“A Trend Will Continue Until It Can No Longer.” This saying ultimately has two related meanings. First, a trend may persist far longer than reason or logic would dictate. Second, the trend will finally reverse when it can’t be pushed any further. The recent trend that has pushed commodity prices down to relative levels not seen in nearly a century has certainly gone on longer and further than we believe reason dictates. The question is whether it has now gone as far as it can go.

We believe the recent period of commodity valuation is only one half of a broader trend. The other half represents a surge of capital into various asset classes and strategies. For example, huge capital flows into passive strategies, FAANG stocks, and bonds represent the flip side of the capital flow out of commodities and natural resource-related investments. Over the last 12 months alone, we estimate that natural resource-related mutual funds have lost nearly 10% of their assets via net outflows. At the same time, we are nearing the point where more assets are held in passive vehicles than active ones.

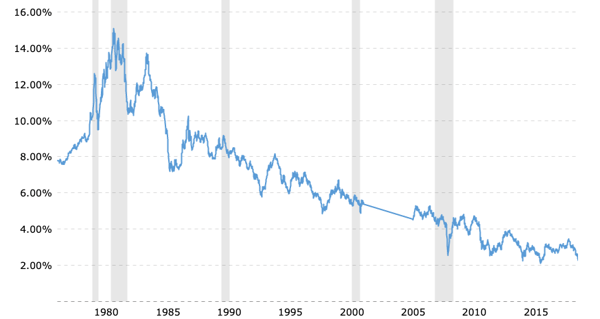

The now 39-year-old bond bull market is perhaps the most impressive of all and the inflows into bond ETFs continue to surge. Since peaking in the summer of 1981 (the US 30-year Treasury bond reached 15.3% yields), government bond yields have fallen relentlessly.

30-year U.S. Treasury Yield

Source: Macrotrends.net

Source: Macrotrends.net

While a sensible investor might think that the zero bound represented a reasonable limit for bond prices, that clearly did not stop bonds from rising further and pushing yields negative. As we write, $13 trillion of sovereign credit around the world carries negative interest rates. Clearly the trend has persisted much further than reason would dictate.

With that in mind, we found it incredibly interesting to read Ray Dalio’s comments from several weeks ago. Bridgewater Associates pioneered the risk parity strategy that recommends (among other things) maintaining a levered exposure to fixed income. As such, we believe he is a bellwether when it comes to the bull market in bonds. In his article he outlines two key investment philosophies.

- First, he believes it is important to identify the trend in place and invest in such a way as to profit from it.

- Second, it is critical to identify the inflection point marking a change in trend.

Ray Dalio, founder of investment firm Bridgewater Associates, speaking at the WEF in Davos, Switzerland on January 22, 2019.

Image Source: CNBC.com

Mr. Dalio goes on to explain how today’s bond market has been bid up to the point where it can no longer deliver the returns that most investors expect. While we agree with Mr. Dalio’s comments, the same argument could have been made any time over the last several years. Why now?

The bond bellwether is telling you that he believes the inflection point in the nearly four-decade-long bond trend is now upon us. Mr. Dalio has been incredibly prescient in recognizing this trend and in understanding just how far it can go. The fact that he believes it has now been pushed too far is extremely telling. If he is correct, then the massive unwinding of several related investment manias will likely follow.

We have written extensively about the significance of the recent Bloomberg BusinessWeek’s cover story “Is Inflation Dead?” Combining the investment significance of the Bloomberg BusinessWeek cover story with Mr. Dalio’s comments gives us additional conviction that a massive shift in capital flows is about to take place.

All of these trends in capital flows have helped push the price of various assets to unsustainable levels. On the other side of the trade, commodities and natural resources have been pushed far too low. The combination of these trends helped push the valuation of commodities relative to the broad market to levels nearly as low as they have been in 100 years. A massive shift in capital flow is about to take place into an asset class where no one has any exposure. The profits for investors in the natural resource and commodity-related investments are going to be large.

This blog contains excerpts of our in-depth commentary, "The Gold Bull Market is Here". If you are interested in this subject, we encourage you to download the full commentary here.