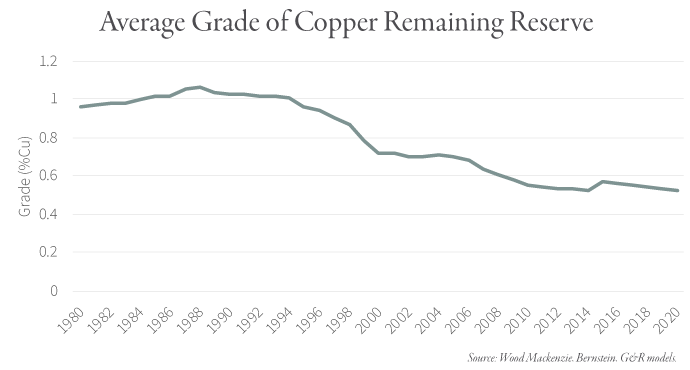

Prior to 2005, few investors paid any attention to issues related to copper depletion. The reason was simple: the average reserve grade and head grade (that is, the quality of the ore being mined) of the copper industry had been trending upwards since the early 1980s. An extremely large number of new high-grade copper mines commenced production, starting in the late 1980s. State control of the Chilean copper industry was relaxed in the mid-1970s, leading to an explosion in exploration spending. Solvent-extraction electro-winnowing (SX/EW) allowed for the processing of oxide copper deposits (previously not possible) in the early 1980s. And there was the discovery and development of the massive, high-grade Grasberg copper-gold project in Indonesia. By the late 1980s, the world was about to be flooded with new copper supply — all of it mined from new high-grade deposits.

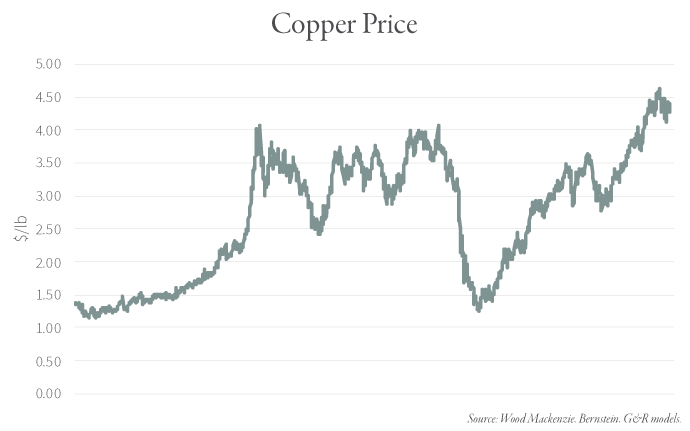

However, by the late 1990s new trends were beginning to take hold. The introduction of new large-scale copper mines slowed dramatically while depletion in the existing, aging mine base slowly began to accelerate. In the summer of 2005, I (Leigh Goehring) had dinner with Richard Adkerson, CEO of Freeport-McMoRan, now the world’s largest copper company. He told me how bullish he was regarding copper prices. At the time, copper had just reached $1.50 per pound and investors had turned universally bearish, believing new supply would soon overwhelm demand. Mr. Adkerson explained that investors did not appreciate the depletion problem quickly taking hold and that copper mine supply growth would disappoint versus expectations. He added that the copper market would remain in deficit and copper prices would continue to move much higher. These were all great calls on Mr. Akderson’s part.

Mr. Adkerson’s comments made a big impression on me, so in the summer of 2005 we decided to undertake a large-scale research project on the subject of copper mine depletion. Prior to 2005, as far as we knew, no one had yet studied the nascent subject of depletion as it pertained to copper mining. We eventually modelled 115 mines representing 80% of global mine supply outside of China and what we found confirmed what Richard Adkerson had told me: after years of steadily rising, copper head grades had started to quietly decline. Incorporating all this new data into our copper mine supply model, we predicted the head grade drop would accelerate and wrote in our 2005 investor letter that mine supply would be “insufficient to close the structural gap between supply and demand [and that] copper prices must remain high.”

Our analysis was correct. In previous high copper price cycles (1988 and 1994 for example), an immediate supply response almost always occurred. The reason: miners still had high-grade copper-rich zones that could be easily accessed and mined. However, by 2005, the creeping depletion problem made short-term supply responses harder to achieve because easily accessible high-grade zones had been mined long ago. Instead of retreating back below $1.00 as everyone expected, copper prices more than doubled over the next six months reaching a then-record $4.10 per pound — more than twice the previous all-time high of $1.65. The bull market lasted another five years before finally peaking at $4.65 per pound in 2011.

To learn how this period of fast-rising copper prices related to the 2020-2021 rally, we encourage you to download the full commentary.