“If global commodity demand was falling sharply today, we would expect to

see the Baltic Exchange Dry Index plummeting. Instead, just the

opposite is happening.”

For nearly 30 years, we have been studying long, drawn-out bear markets. As we have discussed in two of our recent blogs, one of our observations has been that distinct anomalies develop at or near the bottom of these protracted periods of investor negativity.

RECENT BLOGS: Global Resource Anomaly: Commodities versus Commodity Stocks and Global Resource Anomaly: Oil Market Term Structure

One common refrain we hear is that global real asset demand has been negatively impacted by trade wars with China. While we admit that a protracted trade war could certainly have negative effects, we should point out that most analysts believe global demand has already been adversely impacted today.

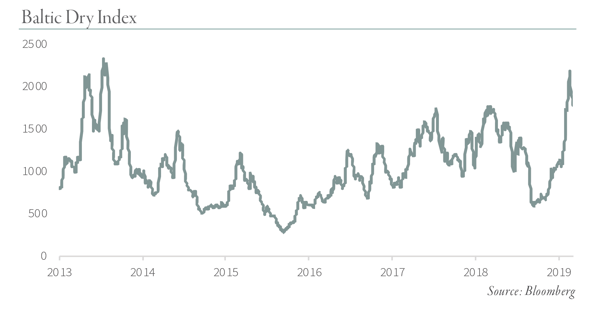

One interesting measure of global commodity demand is the BDI Baltic Exchange Dry Index (BDIY). This index represents the price to ship dry bulk goods and is a composite of Capesize, Panamax and Handysize vessel day rates. While other factors, including the supply of new vessels, can certainly impact this index, it is often used as a real-time barometer of global commodity demand. For example, during the global financial crisis, the BDIY fell by 94% between May and December 2008 and broke a full two months before the top in the Goldman Sachs Commodity Index (GSCI).

If global commodity demand was falling sharply today, we would expect to see the BDIY plummeting. Instead, just the opposite is happening. After bottoming in February, the Index surged nearly four-fold to reach 2,191 by July 22nd. Instead of falling dramatically (as you would expect if global demand were slowing), the BDIY is growing at the second-fastest rate ever. The only time it surged faster was immediately following the 95% decline during the global financial crisis. Today, the Baltic Dry Index is the highest it has been in five and a half years.

The recent surge has been attributed to several iron ore mine restarts in Brazil, but nevertheless we cannot reconcile the idea that global commodity demand is slowing at the same time as the cost to ship that demand is surging at the second-fastest rate ever.

While none of these anomalies on their own prove that we are nearing a turning point, we do believe they point to a natural resource equity market that has been gripped by fear and panic. Natural resource equities continue to underperform the general market, but if the recent Bloomberg BusinessWeek cover story performs it fated function, we believe that strong relative outperformance for natural resource equities will emerge and will last for years.

For many investors, last fall was the final straw and we keep hearing of clients who swear never to re-enter the natural resource markets again. As contrarian value investors, these are precisely the markets we like to get involved with. We believe these anomalies are indications that equity investors are not acting rationally, but rather are extrapolating a never-ending trend. The indications are stacking up that this bear market is living on borrowed time and that a turning point is fast approaching.

This blog contains excerpts of our in-depth commentary, "The Gold Bull Market is Here". If you are interested in this subject, we encourage you to download the full commentary here.