Below is an excerpt from our Q4 2019 Commentary. However, we still believe today this information is valuable and wanted to share it with you in case this topic is of interest to you.

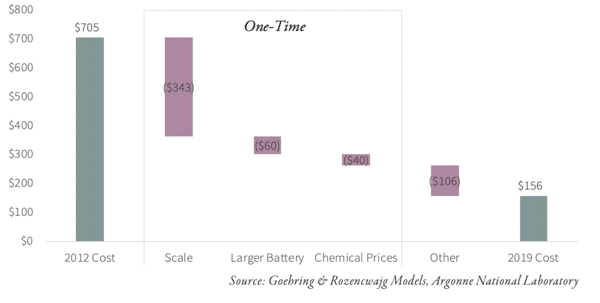

In a previous blog, we discussed the common belief that EVs will reach cost parity with internal combustion vehicles once lithium-ion batteries can be produced at $100 per kwh. In Q4 2019, Bloomberg New Energy Finance estimated these costs sat at approximately $156 per kwh, down an impressive 80% since 2012. Four main factors explain the fall in battery costs over the past decade: increased plant utilization, increased battery size, chemical prices and battery chemistry improvements.

Beginning in 2008, the battery industry built a large amount of lithium-ion manufacturing capacity to meet the expected surge in demand. While the demand projections ultimately proved correct, the timing was initially far too optimistic and by 2010 the average battery plant only operated at 10% utilization. The low level of throughput resulted in substantial operational inefficiencies and artificially high unit costs. Argonne National Laboratory released a version of its model in late 2011 and we used this as a starting point for our analysis. The Argonne model assumes a 100,000 pack per year facility that operates at full capacity. The first thing we did was adjust the model to reflect a plant that only operated at 10% utilization. The result was a cost of $705 per kwh – within 5% of the battery cost reported by the battery industry for 2012.

Using this as a baseline, we adjusted the plant utilization to 100% – the base case used in the Argonne model. Immediately the costs collapsed by 50% from $705 per kwh to $360. These results have profound consequences: nearly 60% of the total cost savings of the past decade came from simply ramping up underutilized facilities. The cost savings is the result of the fixed or semi-fixed costs (such as capital equipment, land and labor) being amortized over a greater quantity of batteries. Battery manufacturing plants today are operating near full utilization. Going forward, additional demand will be met by building new plants and not by increasing utilization. As a result, the largest driver of cost reduction over the last decade is unrepeatable.

The second source of cost reduction is the size of the battery itself. In 2012 the average lithium-ion battery had much less capacity than today. For example, the benchmark battery from the 2011 Argonne model only had capacity of 11 kwh compared with 65 kwh in the most recent edition. In any battery pack there are significant costs that are incurred only once per battery. These costs include module terminals, gas release valves, bus bars, and pack jackets as well as various integration costs. By increasing the capacity of the battery five-fold, these one-time costs are spread over more kilowatt hours. In a typical 2012-vintage battery, these costs made up as much as 20% of the total battery cost. As the capacity increased materially, we estimate these costs came down from $80 to $20 per kwh--a reduction of 75%.

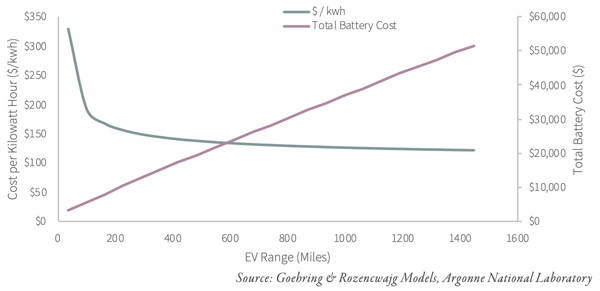

Again, we believe these cost reductions will not be repeated going forward. There is clearly a tradeoff between capacity, unit cost, and total cost. For example, a 2019-vintage battery has a capacity of 65 kwh equating to an EV range of 220 miles. Such a battery is estimated to cost $156 per kwh or $10,170 per battery. If you increased the capacity six-fold (similar to the increase between 2012 and today), the resulting battery would have a range of nearly 1,000 miles and a total cost of $50,000. While its cost per kwh would indeed have come down from $156 to $120, we doubt any consumer would be willing to incur these extra costs for such a ridiculously long range. Clearly there is a right-sizing of the battery that dictates capacity and we believe current EVs are close to optimal. The chart below graphs the relationship between capacity, cost per kwh, and total battery cost for a current-generation lithium-ion battery.

Battery Cost Tradeoff

The third driver of cost reduction over the last several years has been chemical prices. A battery’s “chemistry” typically refers to the active material used in the battery’s cathode. For example, Tesla utilizes a so-called LCA battery where the cathode consists of a compound made of lithium, cobalt, nickel, and aluminum. This compound is purchased from a specialty chemical company which charges a price based upon the cost of the underlying materials and the cost of manufacturing. Over the last several years, the compound price has fallen by nearly 50% as manufacturing costs have declined materially. Our models suggest these cost savings have a limit as the raw material cost becomes a larger and larger percent of the total. For example, we estimate raw material costs made up 40% of chemical price in 2011. By 2018 this had flipped and the raw materials made up 60% of the total chemical price. Moreover, as battery demand picks up, we believe metal demand risks exceeding supply in cobalt and nickel. This will put upward pressure on the specialty chemical price.

Battery insiders admit metal prices could be a problem going forward. In January 2019, Tesla announced a cobalt offtake agreement with Glencore in an effort to secure long-term supply. These cost pressures are unlikely to be offset by lower manufacturing costs, given they now make up less and less of the total. Overall, we estimate chemical prices have lowered battery costs by $40 per kwh between 2011 and 2019.The remaining cost savings have come from improvements to the underlying battery itself and the manufacturing process. After accounting for cost inputs mentioned above, we believe these additional improvements have resulted in $100 in savings or less than 20% of the total.

Our analysis suggests a full 80% of the cost savings of the last several years have come from one-time sources that cannot be repeated. Battery bulls extrapolate the 20% annual cost savings that took prices from $705 to $157 over the last several years. Instead, we believe it is more appropriate to first back-out the one-time cost savings in order to isolate the sustainable cost savings going forward. Instead of falling $550, we believe battery prices fell by less than $100 per kwh over the last seven years, after adjusting for plant utilization, pack size, and chemical cost reduction.

Battery Cost Driver

Late last year the Wall Street Journal reported a spat between Tesla and Panasonic regarding their Gigafactory joint venture. The issue revolved around price with Panasonic claiming it could not operate profitably at current levels. The Gigafactory is the largest battery manufacturing facility in the world, operates at near full utilization, and produces very high capacity batteries. This strongly suggests its costs should be among the lowest in the world – and yet they still are not low enough. If our analysis is correct, it will become harder and harder for battery manufacturers to continue to lower costs. Perhaps the Panasonic headlines are just the start.

If this topic is of interest to you, please download our Q4 2019 commentary, THE UNINTENDED CONSEQUENCES OF HIGH GRADING, where we explore this subject and many others.