“Looking forward, we still think the IEA is once again far too optimistic regarding its 2019 estimates for non-OPEC production outside of the US and Russia. Instead of growing by 120,000 b/d, our models tell us it may actually decline by 300,000 b/d.”

Last week we touched on the decline of non-OPEC oil production outside of the US and Russia (Read: Looking Ahead in 2019: Oil Fundamentals). Despite the spreading weakness in conventional non-OPEC production, the IEA still expects growth in 2019. Specifically, in their most recent report, the IEA expects non-OPEC production outside of the US and Russia to grow by 120,000 b/d. Our models tell us this will not be possible given the lack of new large-scale projects slated to come online next year (for an in-depth analysis please see our letter from July 2018).

Image source: Reuters.com

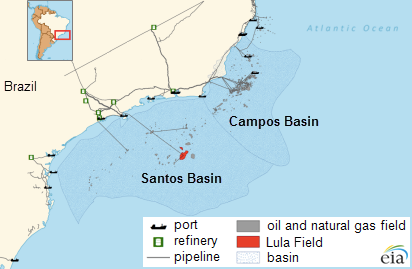

In particular, the IEA expects Brazilian offshore production to solve the complex technical issues that have impaired their production over the last five years. While it is true that five new floating production storage and offloading (FPSO) vessels are scheduled to make their way to Brazilian waters this year, our analysis suggests that geological issues in the Campos and Lula (formerly Tupi) ultra-deep-water fields are largely to blame for the recent production disappointments. In particular, the Campos wells are declining faster than expected while the Lula development is producing considerably higher water-cuts than anticipated.

Image source: Eia.gov

These problems are not easily solved and as a result we expect Brazilian production to once again disappoint in 2019. Similarly, we expect that massive underinvestment in the North Sea and Mexico over the past decade will continue to take its toll on production from these regions.

In the beginning of December, Canadian lawmakers announced Alberta would curtail its oil production by 325,000 b/d for an extended period. These curtailments now add downward pressure on slowing Canadian production— production already impacted by the lack of new expected project startups going forward. Despite these announcements, the IEA is still calling for Canadian production to be flat in 2019. We believe this is impossible.

Last year at this time, the IEA had expected 2018 production would grow by 650,000 b/d, a figure we strongly disagreed with at the time and which has since been revised lower by 67%. Looking forward, we still think the IEA is once again far too optimistic regarding its 2019 estimates for non-OPEC production outside of the US and Russia. Instead of growing by 120,000 b/d, our models tell us it may actually decline by 300,000 b/d.

The other fundamental factor keeping global oil markets tighter than expected during 2018 was very strong demand. The IEA states that 2018 demand averaged 99.3 m b/d, an increase of 1.3 m b/d compared with 2017. However, we believe this needs to be revised materially higher. The reason continues to be the so-called “missing barrels,” which have now averaged over 1.0 m b/d over the last six months. These “missing barrels” represent oil that has been produced but (according to the IEA) neither consumed nor placed in inventory. We have long argued that these missing barrels represent underestimated non-OECD demand (particularly from India and China), based on our emerging market S-Curve demand models. With data now in through November, the IEA estimates that global demand averaged 99.2 m b/d in 2018 while supply averaged 99.9 mm b/d. This would suggest that global inventories should have grown by 700,000 b/d or 240 mm bbl in total throughout the year. Instead, inventories only rose by 70 mm for the year through November. This suggests that global demand was understated by as much as 500,000 b/d and that actual growth averaged an incredibly strong 1.8 mb/d for 2018. Given that these “missing barrels” have been accelerating in recent months, we expect they will continue into 2019, further tightening global oil balances.

This blog contains excerpts of our in-depth commentary “OIL BULL MARKETS PAST & PRESENT, AND YELLOW JACKETS”. If you are interested in this subject, we encourage you to download the full commentary here.