“What will end the current period of commodity undervaluation? We are more and more convinced that it will once again be related to a shift in the global monetary regime, such as the potential devaluation of the Chinese yuan.”

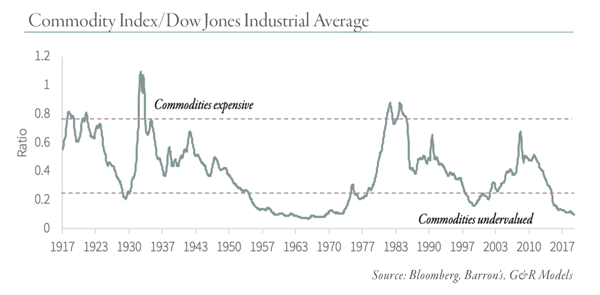

In our previous market insights, we published a chart comparing the price of commodities to the price of the stock market over the past 100 years. We explained how commodities tend to go through long pronounced cycles that often last several decades. During these cycles, commodity prices become extremely depressed relative to the broad stock market and represent excellent investments, while at other times they become radically overvalued and represent poor investments.

In the summer of 2017, we wrote a detailed analysis of each cycle and identified several factors that led to the major commodity market bottoms in 1929, 1969 and 1999. (View Past Commentaries Here). In summary, all three major commodity market bottoms were preceded by huge levels of investor bearishness. Natural resources were thought to represent the “old economy” whose best days were behind it.

Furthermore, at each cycle bottom a new stock market mania had gripped investors. By 1929, it was a broad-based equities bubble that centered around “new economy” media stocks such as RCA. By 1969, it was the conglomerate craze, followed by the “gunslinger” mutual fund craze, and finally the “Nifty Fifty” (a portfolio of 50 stocks, each with a P/E multiple of over 50). In the 1990s, it was the dot-com bubble. Today, we have multiple investment manias occurring simultaneously: FAANG stocks, passive investing, risk parity, cryptocurrencies, and the Canadian cannabis craze, among others.

During each market cycle, these crazes served dual roles. First, they served to broadly bid up the price of equity markets. Second, they reinforced the notion that commodities no longer held any valid place in the “modern” investor’s portfolio. Furthermore, all three historical market bottoms were preceded by very loose monetary policies that helped to propel these trends further than otherwise thought possible.

As you can see above, commodities are as cheap today as they have ever been relative to the broad equity market. In every prior case of radical undervaluation, commodities and the related natural resource equities have been excellent long-term investments and we believe this time will not be any different. Since we published our first report, we have often been asked when the current period of resource undervaluation will finally end. The truth is that no one can say with any certainty, but we will discuss two potential catalysts that could propel commodity and natural resource markets much higher.

First, we will examine some remarkable similarities that signaled the end of each of the previous commodity bear markets.

On the surface, the late 1920s, 1960s, and 1990s appear to be very different eras. Yet, they share one notable similarity: each period experienced a monumental shift in the global monetary order. During World War I, most European countries suspended the convertibility of their currencies into gold to accommodate wartime deficit spending and aggressive money printing. The Bank of England suspended its gold standard in 1914. By 1925, after spending a decade trying to deflate its economy, the UK attempted to re-back the pound with gold.

After extensive debate, Winston Churchill (by that time Chancellor of the Exchequer) decided to put the pound back on a gold standard at its pre-war rate which, in retrospect, was a massive mistake. The pound was now severely overvalued and gold flowed from the UK to the US. To help the situation in the UK, Federal Reserve New York Governor Benjamin Strong kept US interest rates low despite a roaring economy. In his most controversial move, he lowered short-term interest rates in 1927 and admitted that he had given the stock market “un petit coup de whisky.” That small shot of whisky was actually much more potent than originally thought and the stock market began a speculative parabolic blow-off.

After extensive debate, Winston Churchill (by that time Chancellor of the Exchequer) decided to put the pound back on a gold standard at its pre-war rate which, in retrospect, was a massive mistake. The pound was now severely overvalued and gold flowed from the UK to the US. To help the situation in the UK, Federal Reserve New York Governor Benjamin Strong kept US interest rates low despite a roaring economy. In his most controversial move, he lowered short-term interest rates in 1927 and admitted that he had given the stock market “un petit coup de whisky.” That small shot of whisky was actually much more potent than originally thought and the stock market began a speculative parabolic blow-off.

After Strong died in 1928, his expansive monetary policies were reversed and many scholars agree that this precipitated the stock market crash of 1929, the banking panic of 1932, and the Great Depression. As the stock market was peaking, the value of commodities relative to the broad market made its first massive bottom in September 1929. Over the next three years, the Dow Jones Industrial Average fell by nearly 90% while commodity prices declined by only 15%.

By early 1933, Roosevelt suspended the gold exchange standard except for foreign exchange and by 1934 he passed the Gold Reserve Act increasing the statutory price of gold from $20.67 to $35 per ounce. The commodity bull market had begun and by 1947 commodity prices had advanced by 50%. At that point, commodity prices were 30% above their pre-Depression highs while the Dow Jones Industrial Average was 50% lower. In retrospect, the end of the decades-long commodity undervaluation coincided perfectly with the dismantling of the traditional global monetary system that had existed for nearly 100 years.

By the end of the 1960s, the situation had completely reversed itself. Between 1947 and 1969 the stock market advanced by 500% while the commodity index fell by 15%, taking the ratio of the two even lower than it was in 1929. While the absolute price of commodities bottomed in the mid-1960s, the recovery was lackluster, particularly compared to the huge surge in broad equity markets (very similar to today). Just like in the late 1920s, this period of commodity undervaluation ended in perfect conjunction with a major monetary upheaval. Throughout the 1960s, the US ran increasing budget deficits as Great Society programs and the Vietnam War took their toll. The US dollar became extremely overvalued relative to gold. Under the Bretton Woods exchange standard, all global currencies were pegged to the US dollar which in turn was pegged to gold at the rate of $35 per ounce.

By 1968, a two-tied gold pricing system was introduced. Monetary authorities would continue conducting transactions at $35 per ounce, but other transactions could be conducted at fluctuating prices. Gold prices in London began to consistently trade above the official rate of $35 per ounce. The result was massive gold outflows from the US. In 1971, President Nixon suspended convertibility of the dollar into gold, in effect ending the Bretton Woods exchange standard. For the first time since Alexander Hamilton was treasury secretary (except for the 16-year “Greenback” era during and after the Civil War), the US dollar had no metal backing. Once again, the period of commodity undervaluation ended exactly as one global monetary regime was ending and a new one was beginning. From 1968 (when President Johnson first introduced the dual price system) to 1980, commodity prices surged nine-fold while the stock market was range bound.

The price of commodities relative to the stock market again bottomed in 1999 at levels comparable with their 1929 low. While initially we had not identified a major monetary shift that occurred in conjunction with this market bottom, Professor Russell Napier informed the audience at the Grant’s Interest Rate Observer spring conference that just such a shift had indeed taken place. In an article in the Financial Times that mirrors his presentation, Professor Napier wrote: “[Today’s monetary system] is a system patched together in the embers of the Asian economic crisis, when many countries intervened in the foreign exchange markets to prevent the appreciation of their currencies.” Professor Napier goes on to explain how this resulted in a $10 trillion rise in world foreign exchange holdings between 1999 and 2014, the majority of which were US Treasuries. In China, this had the effect of rapidly increasing the monetary base which in turn accelerated growth. In other words, what Professor Napier calls his “no-name system” replaced the post-Bretton Woods fiat system at exactly the moment the 1980-1999 period of commodity undervaluation ended. From 1999 until 2011, the commodity index increased by over five-fold while the Dow Jones Industrial Average advanced by less than 40%.

What will end the current period of commodity undervaluation? We are more and more convinced that it will once again be related to a shift in the global monetary regime. It may spring from the US adopting a version of Modern Monetary Theory or potentially from a large devaluation in the renminbi (Chinese yuan). Chinese monetarists face a difficult decision today. In order to maintain the current exchange rate, they must either deplete their foreign reserve holdings or else grow their broad money supply more slowly than they would like. A third option, of course, would be to devalue the renminbi which in our estimation is looking more and more likely. Prudent long-term investors need to consider a natural resources allocation to protect themselves against such a shock.

This blog contains excerpts of our in-depth commentary, "The Gold Bull Market is Here". If you are interested in this subject, we encourage you to download the full commentary here.