What makes us so bullish, especially when everyone else is so bearish?

Often in severe bear markets, obvious bullish data points sit right in front of us and yet no one seems to notice. Our current commodity and natural resource research espouses quite a few reasons along with supporting research for our stance.

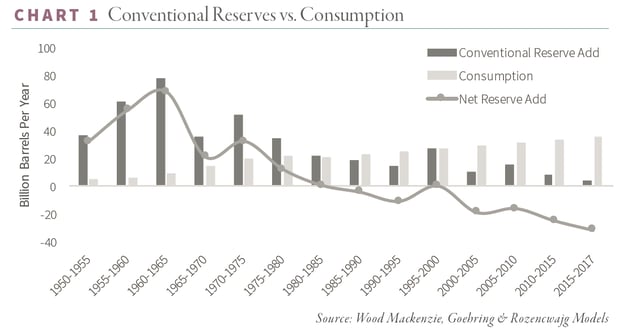

To highlight an example, in a report put out late last year, Rystad Energy (an international oil and gas consulting firm) stated that global conventional oil and gas discoveries reached an all-time low in 2017. We estimate that the global oil and gas industry only found four billion barrels of new conventional oil last year that capped a dismal 20-year stretch for conventional oil discoveries. Since the start of the shale oil revolution in 2007, discoveries of conventional oil (not including shale) have totaled approximately 110bn barrels while consumption has totaled 360bn barrels. Thus between 2007 and today, we have consumed an incredible 250bn more barrels than we have replaced through conventional discoveries -- and this shortfall is accelerating.

As you can see on the chart above, over the last six years, conventional discoveries continue to collapse and the deficit between discoveries and consumption continues to grow. According to our calculations, since 2012, we have consumed almost 210 bn barrels of oil, while conventional discoveries have only totaled 40bn barrels. Over the last six years alone we have consumed 170bn more barrels than we have discovered through conventional oil discoveries.

While the current trend is clearly unsustainable, oil bears remain unpersuaded. They argue that huge discoveries of unconventional oil (i.e. US shales) have made the collapse of conventional discoveries all but irrelevant. Oil shale resources will total in the billions of barrels, say the bears. Discoveries of new conventional oil reserves are therefore no longer necessary in a world where oil shale production is expected to continue its relentless surge.

As readers know, we emphatically disagree with this line of reasoning. As we wrote extensively in our Q3 2016 letter, we have assessed all of the global oil shale basins based on their geological prospectivity (the Middle East is missing from our study due to a lack of published data). Based on our analysis, we concluded that except for three shale basins (the LaLuna shale in Columbia, the Vacua Murte shale in Argentina, and the Bashenov shale in Russia), the shale oil revolution (pioneered here in North America) will not be exportable to the rest of the world.

Also, with the production history now available, we have attempted to estimate how much shale oil reserves will be recovered from the five largest US shale plays. In our last letter, we used a reserve estimating technique called “Hubbert Linearization” to estimate the total recoverable reserves from the most important US shale plays. We determined that consensus opinion had significantly overestimated the ultimate recovery of oil from these fields.

For more data, research and market insights as to why the contrarian value team at G&R sees incredible opportunity in the current market, please read our most recent research on commodities and natural resources. In the spirit of transparency and accessibility the G&R team offers free access to investors, prospects and friends of the firm.

Please share your thoughts or questions on anything related to commodities. We welcome the dialogue!