“Headlines all strongly suggested DeGolyer & MacNaughton independently verified 260 bn bbl of Saudi Arabian oil reserves, in truth they only verified 162 bn (or 60%) of that amount.”

Picking up where we left off last week, Aramco’s bond prospectus confirmed that Saudi Arabia’s reserves are concentrated in a very small number of (mostly aging) mega-fields. Five fields (Ghawar, Shaybah, Khurais, Safaniyah, and Zuluf) make up 65% of total liquids reserves. Moreover, three of these fields (Ghawar, Safaniyah, and Zuluf ) have been producing for more than 72, 62, and 45 years, respectively. This makes Aramco’s reserve base extremely concentrated and vulnerable to technical issues in any of these five fields.

The report also raises as many questions as it answers. For example, under the heading “Responsible and Sustainable Stewardship of Unique Fields,” Aramco claims that only 10% of their reserves are more than 60% depleted. As we discussed last week, Ghawar is approximately 60% depleted and that field alone accounts for over 22% of Aramco’s reserves.

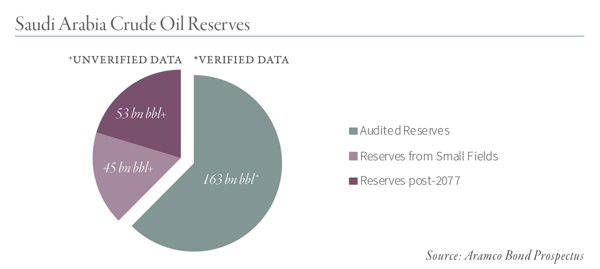

The most glaring anomaly in the Aramco prospectus revolves around the DeGolyer & MacNaughton audit itself. Back in January, Aramco announced that the Kingdom’s crude oil reserves were in excess of 260 bn bbl and that this figure had been independently verified by DeGolyer & MacNaughton. In the bond prospectus, the Kingdom’s proved crude reserves were in line with this figure at 257 bn bbl for the year ending 2017. However, the DeGolyer & MacNaughton Certification Letter reveals that their independent evaluation only covered 162 bn bbl of Aramco’s crude reserves. Two factors explain the difference between the 162 bn bbl of independently-evaluated reserves and the widely-published 260 bn bbl figure.

The first factor is DeGolyer & MacNaughton’s acknowledgment that 20% of Aramco’s reserves are from fields too small and remote to be evaluated in less than several years. The second factor revolves around the “concession period.” Aramco’s concessions extend through 2077, and as a result, DeGolyer & MacNaughton neither included nor independently verified any reserves expected to be produced after the concession expires. According to Aramco, at the end of 2017 the company’s crude reserves (i.e., within the concession period) totaled 202 bn bbl while the Kingdom’s crude reserves (i.e., total reserves) total 258 bn bbl. Therefore, while the headlines all strongly suggested DeGolyer & MacNaughton independently verified 260 bn bbl of Saudi Arabian oil reserves, in truth they only verified 162 bn (or 60%) of that amount. An additional 55 bn bbl of reserves are expected (but never verified) to be produced after the concession ends in 2077, while the remaining 45 bn bbl of reserves are contained in fields too small to be independently verified according to disclosures in the Aramco bond prospectus.

Even if we included all of the reserves post-2077, total “Kingdom” reserves only add up to 215 bn bbl, not 260 bn bbl. Why is this difference so important? Saudi Arabia has cumulatively produced 150 bn bbl of crude to date. If we assume the Kingdom has 260 bn bbl of remaining crude reserves, then total reserves would equal 410 bn bbl, of which 36% have already been produced. Therefore, if Saudi Arabia continues to produce ~10 m b/d they will reach 50% depletion (and peak production) by 2034.

However, if we exclude the reserves contained in fields so small and remote they cannot even be counted (let alone developed and produced), then Saudi Arabia’s ultimate recoverable reserves are only 365 bn bbl instead of 410 bn bbl. As a result, reserves are 41% produced instead of 36%. Using the same production forecast (10 mm b/d), Saudi Arabia will have produced half of their reserves and experience declining production in less than nine years. (If we remove all of the unverified post-concession reserves, then Saudi Arabia will have produced half of its reserves and see production peak in two years.)

It is important to remember that, according to Hubbert, production follows a bell-shaped curve. As a field approaches the halfway mark, production begins to flatten long before entering its period of outright decline. Given that Saudi Arabia is likely less than a decade away from having produced half of its reserves, we would not expect to see production increase dramatically from here. While we may see periodic production boosts from Saudi Arabia, any such episode will likely be immediately followed by a sharp curtailment to rest the aging fields, similar to both 2016 and 2018. We have long argued that Saudi Arabia was exhausting their massive reserve base. With release of the Aramco bond prospectus, we now have several data points that confirm our view.

This blog contains excerpts of our in-depth commentary, The Bell Has Been Rung. If you are interested in this subject, we encourage you to download the full commentary here.