The article below is an excerpt from our Q4 2022 commentary.

“Egg prices soar due to deadly bird flu outbreak.”

~Times Union 1/18/2023

When commodity markets fall into structural deficit, prices remain muted until a black swan event occurs, last year’s 20-fold surge in global natural gas prices being an excellent example. The recent rise in egg prices provides another.

Will global grain markets become susceptible to a black swan event that causes grain prices to skyrocket?

Although grain and fertilizer prices have corrected over the last nine months, grain markets remain tight. As our readers know, we firmly believe we have entered a global cooling cycle that will bring on much more challenging and adverse crop-growing conditions this decade.

For those who could attend our investor day on November 3rd, we presented how the 40-year global warming cycle has dramatically boosted global grain yields by significantly increasing the growing season. Fewer late spring and early fall frosts, combined with increased precipitation here in the grain-growing belts of North America, have resulted in record harvests year after year.

We stressed that global warming had been the best thing for a world ever more hungry for animal protein and grain. If we are right that a new cooling phase has begun, we should see significant impacts on grain yields brought about by adverse weather conditions with much greater regularity.

In what may be a forerunner of what to expect, adverse weather conditions experienced during the 2022-2023 growing season continue to impact grain balances. In their January World Agricultural Supply and Demand Estimates report (WASDE), the USDA unexpectedly reduced their 2022 estimates for corn acres harvested and soybean yields. Arid weather in parts of the western corn belt damaged the corn crop, so farmers decided against harvesting those acres. In their previous estimate, the USDA reported 80.8 mm acres would be harvested. In their January report, they cut this number to 79.2 mm acres. Because of drought conditions, the USDA spent almost all of the 2022 corn growing season reducing estimates for both acres planted, acres harvested, and yield. In their original May estimates, the USDA reported that 89.5 mm corn acres would be planted, 81.7 mm acres of which would be harvested, with an expected yield of 177 bushels per acre. By January, acres planted had fallen to 88.6 mm acres, acres harvested to 79.2, and realized yields to 173.3. The USDA initially estimated the US corn harvest would reach 14.46 bn bushels. They now estimate it will only be 13.73 bn bushels, a drop of 5%. The US 2022-2023 corn ending stock figures have fallen to 1.24 bn bushels. Corn ending stocks are expected to hit levels seen only twice in the last 45 years. When adjusted for daily consumption, they are at record lows.

In soybeans, extremely hot weather damaged crops more, and the USDA reduced soybean yield by an additional 0.7 bushel per acre in their January report. Like corn, the USDA underestimated dry and hot conditions in the soybean growing belt and overestimated the crop size. In their original projection last May, the USDA estimated 91 mm planted soy acres with 90.1 mm harvested acres and a yield of 51.5 bushels per acre, a new record. In their latest January WASDE report, the USDA estimates that only 87.5 soybean acres were planted, 86.3 were harvested, and yields would reach 49.5 bushels per acre. The original size of the soybean crop was estimated at a record 4.64 bn bushels. The USDA now estimates the soybean crop will only reach 4.28 bn bushels, almost 8% lower. Soybean ending stocks are now estimated to reach 210 mm bushels -- again approaching dangerously low levels.

Weather-related supply disappointments in the United States, Europe, and India, combined with war-related supply disruption in Ukraine that will continue into 2023, mean that global grain markets will remain tight. A black swan event would have a devastating effect.

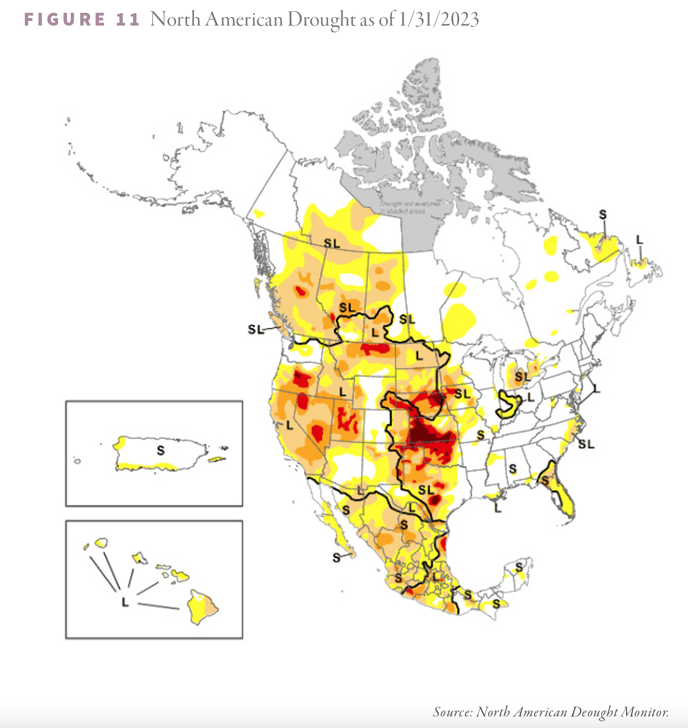

What might this event be? We believe that it will be related to the persistence of today’s La Niña weather pattern. Much of the dryness impacting large swaths of both the central and western US and western Canada can be attributed to the La Niña in force in the Pacific Ocean since the summer of 2020. Late last year, weather models strongly suggested that the La Niña would shift into an El Niño once 2023 was over. If this happened, the drought that has gripped a large swath of the US and Canada’s central and western sections would most likely ease, with highly positive implications for crop-growing conditions in both countries. However, it now looks like the weather models have flipped and strongly indicate that the present La Niña should extend through 2023. Dry and potentially severe drought conditions may continue to grip the midsection of the US and Canada this coming year.

North American dry weather this year and next could be worsened by the upcoming Gleissberg solar cycle, a phenomenon named after the German scientist Wolfgang Gleissberg. Gleissberg noticed how variations in the sun’s magnetic fields repeated every 90 years or every nine solar cycles. The last Gleissberg cycle occurred in the early 1930s, coinciding with the infamous Dust Bowl; the next is expected in 2023-2024. For those interested in sunspot activity and the potential impact on weather, please refer to our Q1 2019 essay, “What Sunspots Mean for Global Growing Conditions,” which gives a broad overview.

Sunspot scientists believe the Gleissberg cycle contributed significantly to the extreme drought conditions in the 1930s. While vigorous debate surrounds the Gleissberg cycle, significant evidence shows that record droughts have coincided with the cycle throughout history.

Given the projected persistence of La Niña into 2023 and the Gleissberg sunspot cycle, we run the risk of severe drought conditions here in North America over the next two years and another considerable run-up in grain prices at some point in 2023, as adverse growing conditions have the potential to impact supply significantly.

Intrigued? We invite you to download or revisit our entire Q4 2022 research letter, available below.

Registration with the SEC should not be construed as an endorsement or an indicator of investment skill, acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal. Historical performance is not indicative of any specific investment or future results. Investment process, strategies, philosophies, portfolio composition and allocations, security selection criteria and other parameters are current as of the date indicated and are subject to change without prior notice. This communication is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Nothing in this communication is intended to be or should be construed as individualized investment advice. All content is of a general nature and solely for educational, informational and illustrative purposes. This communication may include opinions and forward-looking statements. All statements other than statements of historical fact are opinions and/or forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such beliefs and expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements. All expressions of opinion are subject to change. You are cautioned not to place undue reliance on these forward-looking statements. Any dated information is published as of its date only. Dated and forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any dated or forward-looking statements. Any references to outside data, opinions or content are listed for informational purposes only and have not been independently verified for accuracy by the Adviser. Third-party views, opinions or forecasts do not necessarily reflect those of the Adviser or its employees. Unless stated otherwise, any mention of specific securities or investments is for illustrative purposes only. Adviser’s clients may or may not hold the securities discussed in their portfolios. Adviser makes no representations that any of the securities discussed have been or will be profitable. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.