Did you know?

- Over the last year, the S&P500 is up 14.37% while the S&P GSCI is up 30.04%1

- Commodities is only an 8.9% weighting in the S&P5001

- Energy is one of the best performing sectors in the S&P500 up 19.87% over the last year1

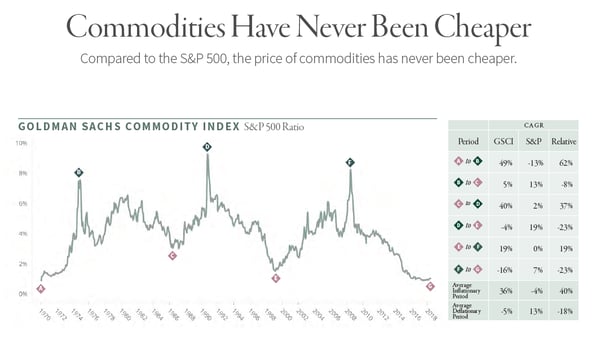

- Commodities have never been cheaper relative to the S&P5001

If you are looking for ways to incorporate commodities/natural resources into your portfolios, schedule time to talk with our team.

We can share how the contrarian value process utilized by G&R since 1992 has generated returns that beat the S&P500 with less than half the correlation2.

1Source: Bloomberg. Data as of 6/30/18

2Source: Goehring & Rozencwajg. Time period: 1/1/92 – 6/30/18. Returns: G&R (net) 9.89% vs S&P500 9.53%, Correlation 0.49