As mentioned last week in our blog, Investors Bearish but Demand Has Never Been Stronger, we believe we are entering a prolonged period of strong commodity demand, yet the value of commodities relative to financial assets has grown more and more depressed. In one of our first Goehring & Rozencwajg letters, we printed a chart comparing the price of commodities to the Dow Jones Industrial Average going all the way back to 1917. We recently provided a similar chart dating back to 1970 which you can view here. For those that are interested, we used the Goldman Sachs’ Commodity Index since its inception in 1970 and prior to that we constructed our own commodity price index using a similar methodology. The chart clearly showed that by 2017, commodities were as cheap as they had ever been relative to financial assets. The chart generated intense interest from our readers, and we were frequently asked if we could also analyze commodity-related equites over the same time period.

Although this task might seem relatively easy, it turns out that data on commodity-related equities is difficult to come by prior to 1980 (the exception being gold stocks which were widely followed). We have extensively researched the issue, and as far as we can tell no one has tried to compare the price of commodity-related stocks to the general stock market throughout the whole twentieth-century.

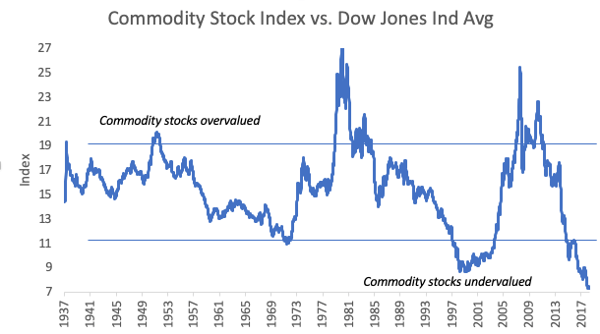

Our ultimate goal is to construct a commodity-related stock index beginning in 1900 and to compare that with the broad market. We used the widely followed S&P North American Natural Resource Stock Index as our starting point and have worked to extend it back as far as possible. As of today, we have collected enough data to compare returns going back to 1937 and hope to reach 1900 within several months.

Source: Bloomberg, Barron's, G&R Models.

The chart shows our Natural Resource Stock Index (which aligns with S&P North American Natural Resource Stock Index since 1997), divided by the Dow Jones Industrial Average. Commodity stocks clearly follow the direction and cyclicality of commodity prices, undergoing huge periods of relative outperformance and underperformance.

From the commodity-cycle lows reached back in both 1970 and 2000, natural resource equities outperformed the broad stock market by five-fold over the following decade. Today, both commodity prices and natural resource-related equities have never been more depressed relative to the broad market.

Considering the world is entering into a “golden age” of strong commodity demand and given the massive amounts of money-printing over the latest decade by Central Banks (which will most likely wind-up debasing global currencies), investors should be looking to resources as an extremely cheap potential hedge. As you can clearly see in the chart above, this certainly is not the case: commodity-related stocks have never been more depressed and out of favor. Commodity-related stocks are being “given away” today.

This blog contains excerpts of our in-depth commentary, The Bell Has Been Rung. If you are interested in this subject, we encourage you to download the full commentary here.