The short answer to this question is: more than index levels of 2-3%.

While many institutional investors and financial advisors divide their equity exposure by market cap, style and geographic region, fewer seek dedicated allocations to specific sectors.

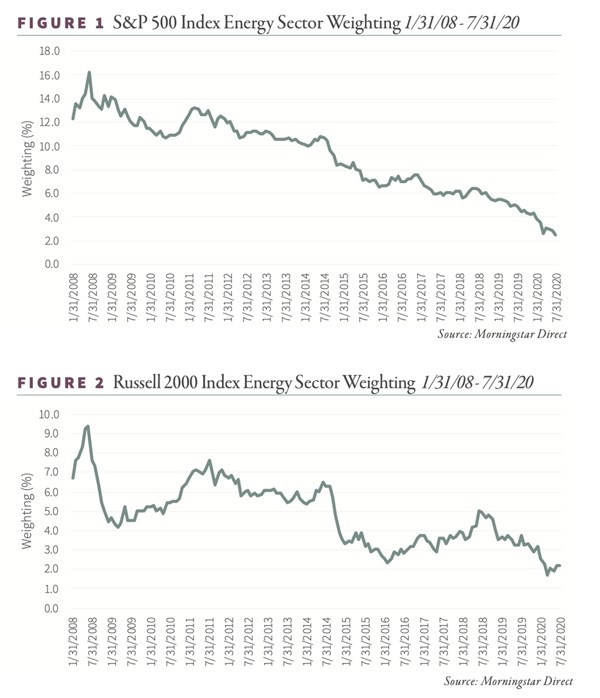

We believe the markets have changed so dramatically over the past five years that investors need to revisit this traditional approach to diversification. Observe how the energy sector’s weighting in the S&P 500 Index and Russell 2000 Index has fallen dramatically since 2008:

At current levels, even if the companies comprising the sector were to double in market cap, investors simply don’t have enough “skin in the game” to make a material difference in performance.

Further, most portfolios are likely over-allocated to the technology sector, whose growth is largely responsible for displacing other sectors, including energy, within domestic equity indices. The market caps of Microsoft, Apple or Amazon are each larger than the entire energy sector’s weighting within the S&P500.

Increasing exposure or achieving a dedicated exposure to an unloved asset class like natural resources simply makes sense from a diversification standpoint.

If you are interested in reading more about this topic, please download our white paper below, Top Reasons to Consider Oil-Related Equities.