The article below is an excerpt from our Q3 2023 commentary.

There are notable similarities between the uranium market twelve months ago and today’s oil market. Almost overnight, uranium went from uninvestible to must own, and we believe oil is about to do the same. Uranium slipped into structural deficit for the first time in its history; however, a temporary secondary supply source obscured the shortage. Crude oil, too, has fallen into a structural deficit for the first time ever. Throughout the two oil crises of the 1970s, OPEC maintained ample spare capacity. Similarly, during the bull market from 1999 to 2008, the market was temporarily tight but never in structural deficit.

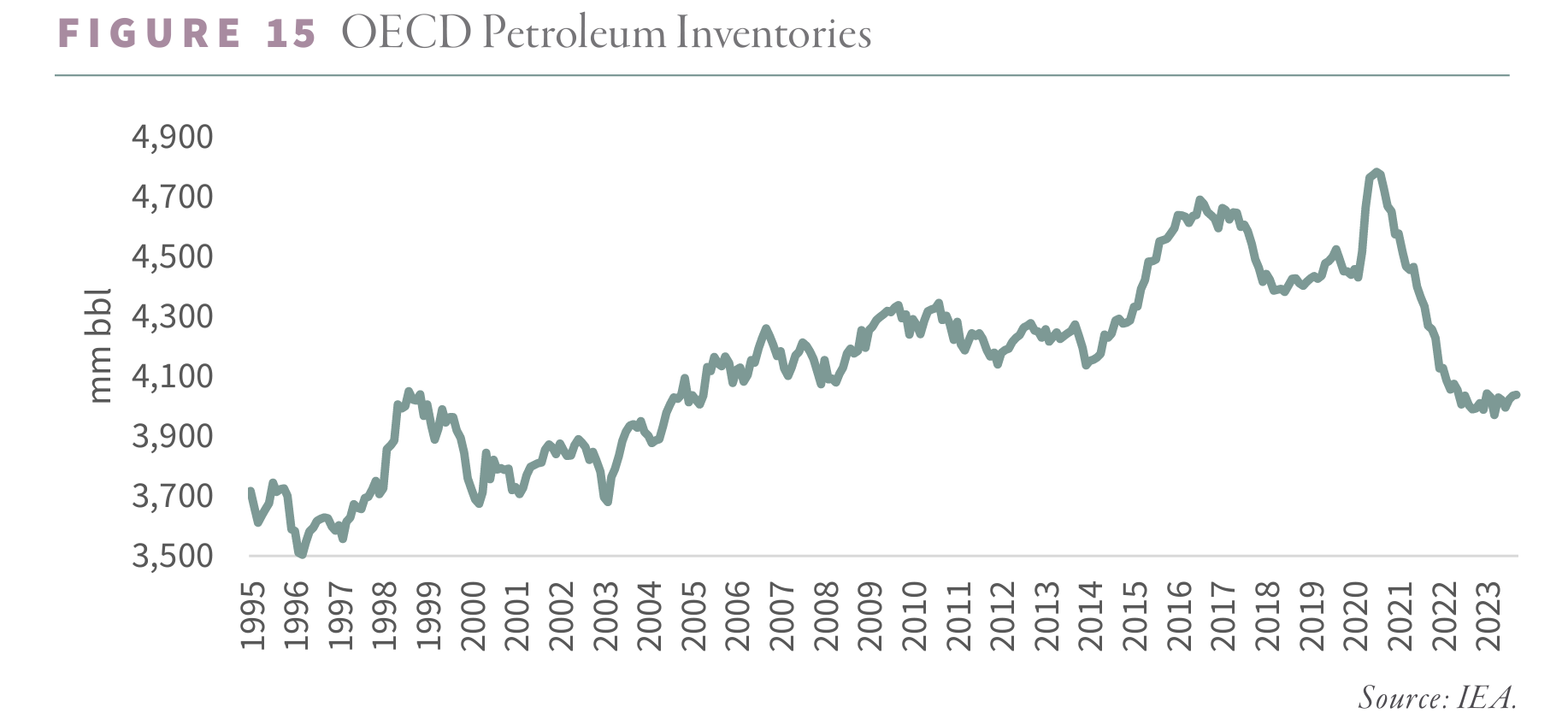

With uranium, a sizeable commercial stockpile accumulated following the 2011 Japanese earthquake and tsunami hid the reality that reactor demand exceeded mine supply beginning in 2019. Earlier this year, the buffer was exhausted, the latent tightness became apparent and prices surged. Crude demand exceeded production as early as 2021; however, massive releases from government strategic reserves masked the deficit throughout 2022 and the first half of 2023. Over that period, global SPRs released nearly 300 mm bbl, equating to a massive 500,000 b/d – the most significant release in history. The US stopped releasing its SPR in the last week of June, and oil rallied from $67 to $90 per barrel. Although it has recently pulled back to $75, we believe it is a temporary correction in an otherwise strong bull market.

Adjusting for SPR releases, inventories have fallen by 800 mm bbl over the last three years – or by 750,000 b/d, representing the sharpest decline in oil market history.

Several news outlets declared oil assets worthless less than two years ago. EV demand supposedly meant peak demand was imminent, while potential forthcoming environmental liabilities left valuations worthless. Analysts often spoke of “stranded assets.” The IEA pronounced energy companies must not invest one more dollar in hydrocarbon assets. In our 3Q20 essay, “Investing in the Uninvestible,” we pushed back, predicting that oil assets would soon be the “must-own” asset class of the decade. Today, our prediction is starting to happen everywhere except in the public equities. We believe this mispricing creates current investment opportunities.

Mineral and royalty ownership is a distinctly American phenomenon. In the United States, individuals can privately own the mineral rights underlying the surface real estate. In most countries, mineral rights are owned by the government. When oil companies drill for oil or gas, they lease the subsurface mineral rights in exchange for an upfront payment and an ongoing royalty (typically 1/8th of all production). The operator has a period to drill a well, after which the royalty exists so long as the well remains in production. Over time, surface and mineral rights are often separated and can change hands repeatedly. The robust, albeit often inefficient, mineral and royalty market is dominated by oil veterans. Royalty interests, in general, have appreciated dramatically. While prime Permian acreage could be had for $5,000 per net royalty acre a few years ago, the average price has since surged to closer to $25-30,000. What was once uninvestible has quickly become must own.

Oil corporate buyers have also changed their tune. In recent weeks, Exxon announced it will purchase Pioneer Natural Resources (our largest oil holding). Chevron will buy Hess, with both transactions totaling $120 bn – the most significant period of industry consolidation in memory.

What do the royalty buyers and corporate oil executives know that the public market is missing? Perhaps that prime undrilled acreage is quickly running out. Pioneer holds, by far, the best undeveloped Permian acreage, according to our neural network. While most companies have, at best, three to five years of Tier 1 drilling inventory, Pioneer’s has nearly doubled. We have always believed that Pioneer would eventually be acquired for its irreplaceable acreage position. Chevron’s motivation for buying Hess has more to do with offshore potential in Guyana. We have long argued that offshore assets would see a development boom as the absence of high-quality shale potential became apparent and have held approximately 10% of our portfolio in offshore-related names.

We believe these transactions signal an essential shift in the oil industry. First, only a few years ago, Engine Number 1 would have blocked Exxon from making any hydrocarbon-focused acquisition. Despite owning a mere 0.03% of the common stock, the climate-activist investor gained three Exxon board seats after several firms representing vast amounts of passive index ETF capital backed the effort. No longer. While Engine Number 1 retains its three board seats, something in the board room psychology has changed. Second, the acquisition attests to just how little undrilled acreage remains. In 2017, Exxon famously purchased the Bass brothers’ nearly 300,000 acreage position in the Permian for $6.6 billion. At the time, it was thought Exxon would boost production to 2 mm b/d within a few years. Chevron, similarly, acquired a vast non-operated acreage position in the Permian, hoping to increase production. Six years on, neither transaction worked out as planned, leaving both companies needing multi-billion dollar acquisitions to help offset declines in their legacy assets.

We believe the difference between Tier 1 and Tier 2 locations was underappreciated in both instances.

Our neural network has informed our views on shale production for several years. We became acutely aware of the importance of high-quality shale acreage and dwindling supply of undrilled locations. In 2018, the industry was busy telling investors it had improved at drilling shale wells. While productivity per well had surged between 2015 and 2017, our neural network told us the improvement was primarily driven by where companies were drilling wells (high-grading their Tier 1 prospects) and less by advances in their drilling and completion techniques. The industry was not turning Tier 2 into Tier 1 – as widely claimed – but instead was hollowing out the best Tier 1 areas. We concluded the Bakken and Eagle Ford had produced half of their reserves and were at risk of plateauing, while the Permian had several years of growth ahead, albeit at slower rates.

All three major shale oil basins declined during COVID-19 as oil prices turned negative. Just as we predicted, the Bakken and Eagle Ford have been unable to regain their previous highs. Aside from the Permian, production in all of the shales has now fallen by nearly 1 mm b/d or 25% from the pre-COVID high.

The Permian has made a new all-time high (just as we predicted); however, this is starting to slow dramatically. According to the Energy Information Agency (EIA), the Permian has only grown by 17,000 b/d over the last six months, 90% below its long-term average six-month growth rate of 250,000 b/d. We now calculate the Permian has also produced half of its reserves and expect sequential growth to turn negative within the next few months. With a growing degree of confidence, we expect 2024 will be the peak in Permian production. Over the last fifteen years, the US shales have represented all non-OPEC growth. In the previous five years, the Permian has dominated US shales. If correct, we are entering an unprecedented period of tightness in global oil markets.

There is a remarkable parallel between Exxon’s purchase of Pioneer and XTO Energy in 2009. Exxon purchased XTO for its best-in-class Barnett acreage – the most productive shale gas basin. Despite their best due diligence, the Barnett peaked less than eighteen months after the acquisition and has since fallen by 65%. We believe they are purchasing Pioneer at a similar moment – within months of the Permian peaking. However, in one notable way, the Pioneer acquisition could not be more different than XTO. Exxon acquired XTO during a strong energy bull market. Energy shares represented nearly 15% of the S&P 500; commodities were as expensive relative to financial assets as in decades. As a result, Exxon had to pay nearly four times XTO’s SEC PV-10 value (a standard measure of discounted future cash flows that every energy company has to publish in its 10K). Today, we are near the bottom of a grinding energy bear market. Instead of 15%, energy stocks make up less than 5% of the S&P 500. Compared with financial assets, commodities are as cheap as ever. In today’s market, Exxon had to pay less than 1.7x Pioneer’s SEC PV-10. At the top of the cycle, a marquee transaction was more than twice as expensive as it is today. As a result, while we believe the Permian will underperform Exxon’s expectations, much like the Barnett 15 years ago, they are unlikely to require a $20 bn impairment as they did with XTO.

True industry insiders are all telling you to buy oil assets. The public market remains paralyzed with fear. Investing in the uninvestible requires a contrarian outlook and a strong stomach. However, we believe the benefits are well worth the risk.

Intrigued? We invite you to download or revisit our entire Q3 2023 research letter, available below.

Registration with the SEC should not be construed as an endorsement or an indicator of investment skill, acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal. Historical performance is not indicative of any specific investment or future results. Investment process, strategies, philosophies, portfolio composition and allocations, security selection criteria and other parameters are current as of the date indicated and are subject to change without prior notice. This communication is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Nothing in this communication is intended to be or should be construed as individualized investment advice. All content is of a general nature and solely for educational, informational and illustrative purposes. This communication may include opinions and forward-looking statements. All statements other than statements of historical fact are opinions and/or forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such beliefs and expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements. All expressions of opinion are subject to change. You are cautioned not to place undue reliance on these forward-looking statements. Any dated information is published as of its date only. Dated and forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any dated or forward-looking statements. Any references to outside data, opinions or content are listed for informational purposes only and have not been independently verified for accuracy by the Adviser. Third-party views, opinions or forecasts do not necessarily reflect those of the Adviser or its employees. Unless stated otherwise, any mention of specific securities or investments is for illustrative purposes only. Adviser’s clients may or may not hold the securities discussed in their portfolios. Adviser makes no representations that any of the securities discussed have been or will be profitable. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.