“We have seen an extraordinary increase in global energy demand in 2018, growing at its fastest pace this decade.” Dr. Fatih Birol, Executive Director of the International Energy Agency (IEA)

“Together, China, the United States, and India accounted for nearly 70 of the rise in energy demand around the world.” IEA Press Release 3/26/2019

Consensus opinion believes global energy consumption is in the process of slowing dramatically. Between 2003 and 2007, global energy consumption grew by an extremely strong 3.7% per year driven by surging Chinese growth. In comparison, for the five-year period ending in 2017, global energy consumption growth slowed dramatically, averaging only 1.4% per year. Most investors believe downward pressure on all forms of energy consumption will continue as we progress into the coming decade. Fears of slowing Chinese economic growth coupled with increased energy efficiency will impair the future growth in energy demand. Given this backdrop, it came as a shock for many when the International Energy Agency (IEA) released its 2018 world energy consumption figures a few weeks ago, showing a large unexpected increase of 2.3%. This marked the biggest increase in 10 years and eclipsed the 1.4% average increase over the last five years. As shocking as this headline figure was, we believe it will be revised higher.

Our readers know we disagree with the prevailing view that global energy growth is slowing. Instead, we believe 2018’s strong energy consumption figure will be repeated over and over again in the coming decade. Based upon our research, all forms of energy consumption with the possible exception of coal will experience robust demand growth far exceeding consensus estimates.

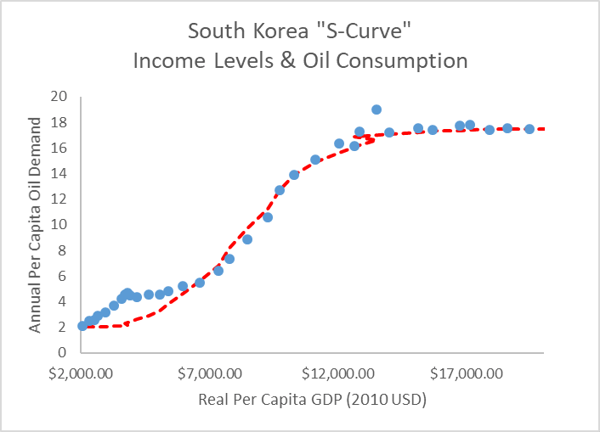

Ten years ago, we put forth our demand thesis and concluded we would soon enter into “a golden age” of energy demand growth. Based upon what we like to call the “S-Curve,” we discussed how rising income levels in many emerging markets had reached important “tipping points,” where total energy consumption begins to accelerate materially. This observable phenomenon has occurred repeatedly in many emerging markets in the post-World War II period. The most famous example of the “S-Curve” is oil consumption in South Korea between 1980 and 1997.

Source: BP Statistical Review. World Bank.

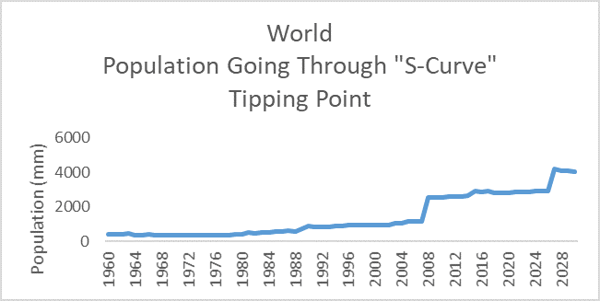

During these 17 years, South Korean oil consumption grew 50% faster than real per capita GDP. The South Korean experience is now being experienced and replicated by a huge segment of the world’s population. As you can see from the chart below, the population entering their period of increased commodity consumption (approximately $2,000 per capita in today’s dollars) held relatively steady between 1960 and 2000. During this time, approximately 500 to 700 mm people were in their period of accelerated commodity consumption at any given moment. However, beginning in the early 2000s, the number of people entering their period of rapidly accelerating commodity consumption exploded.

Source: World Bank

China passed its “tipping point” back in the early 2000s and has since been joined by Malaysia, Thailand, Indonesia, the Philippines, and Vietnam. And now, as we extensively wrote in our letters last year, India has joined this group as well. In just 20 years, the number of people going through their “S-Curve” period of intense commodity demand growth has jumped from 700 mm to over four billion. Never in history have so many people all gone through their “S-Curve Tipping Point” simultaneously. The result is that global demand for raw materials such as oil, natural gas, copper, and proteins will continue to surprise to the upside.

Want to keep reading?

Download our in-depth commentary, The Bell Has Been Rung.