“Over the longer-term, ESG-led activist investors have all but ensured non-OPEC production will fall dramatically, leaving OPEC with increased market share and pricing power.”

Over the past 18 months, oil markets experienced their largest dislocation in history. Because of COVID-19 restrictions, demand collapsed, and inventories swelled. Prices fell to a previously unthinkable -$37 per barrel in April 2020 as traders were forced to pay to have crude taken off their hands. At the same time, producers rushed to shut-in production and curtail drilling activity. While investors panicked, we turned to our models and concluded the market would tighten much faster than anyone thought possible. We doubled our oil and gas exposure through 2Q 2020 and have enjoyed the rebound ever since.

Our bullish thesis was based on much stronger-than-consensus demand estimates and ongoing challenges with non-OPEC+ production. We made several predictions – some that were quite radical at the time – and concluded the crude oil market would shift into deficit by summer 2020, causing inventories to normalize as soon as mid-2021.

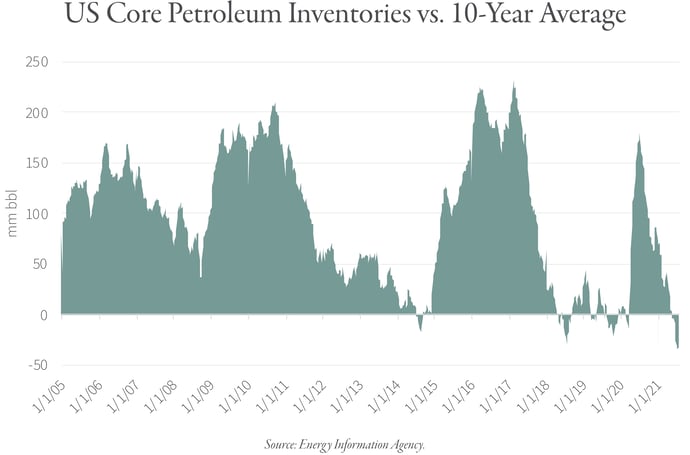

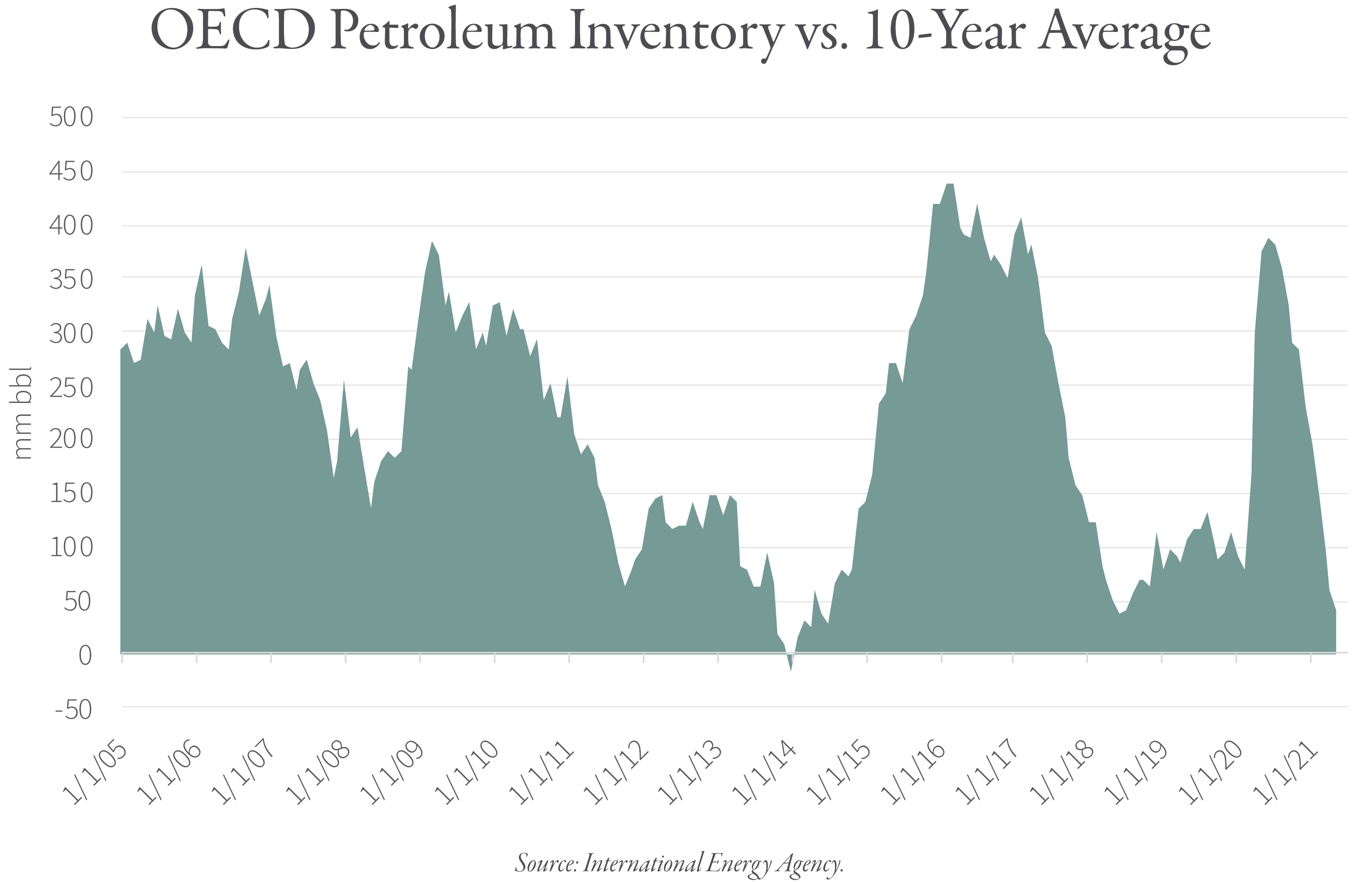

Since we first made our prediction last spring, inventories have indeed fallen at the fastest rate on record. After peaking at 178 mm bbl above 10-year seasonal averages, US core petroleum inventories are now 34 mm bbl below 10-year averages – the lowest reading in nearly two decades. On a global basis, inventories peaked at 388 mm bbl above seasonal averages last June and as of May 2021 are only 40 mm bbl above average. Given recent trends, we believe global inventories are likely turning negative relative to seasonal averages, in line with our original predictions.

Global oil markets are very tight. WTI and Brent both trade for $75 per barrel and the 12-month backwardation (an indication of physical tightness) is approaching its widest reading in years. Oil related equities have been strong performers as well, with the XOP ETF rising nearly 70% over the first half of 2021.

Despite the price action in both oil and oil-related equities, investors remain bearish. Shares outstanding of the XOP (a good proxy for generalist investor fund flows) increased less than 10% during the first half of 2021 despite the strong underlying performance. Investors today are fixated on two things: OPEC+ spare capacity and competition from EVs. While these factors need to be monitored, investors are ignoring how tight oil markets have become and how much tighter they will get as we progress through the rest of 2021 and 2022. Over the longer-term, ESG-led activist investors have all but ensured non-OPEC production will fall dramatically, leaving OPEC with increased market share and pricing power.

To read more on this subject, we encourage you to download the full commentary, available below.