Tightness in the US natural gas market is beginning to manifest itself in low inventory levels. After having started the year at a 200 bcf surplus to the five-year seasonal average, US inventories now stand at nearly a 200 bcf deficit. Given the current trajectory, our models suggest we could end the injection season at 3.2 tcf of gas representing a 400 bcf deficit, or 700 bn cubic feet lower than the same time last year. If we are correct, inventories run the risk of starting the withdrawal season at the second lowest level in fifteen years. At that point, any bout of cold weather this coming winter would likely lead to a price spike.

Prices have been firming and currently stand at $3.60 per mmcf – over 40% higher than the start of the year and more than double this time last year. In fact, Henry Hub natural gas, which normally experiences price spikes in the winter due to heating demand, is at its highest seasonal level since 2014. Despite the rally, there has been little in the way of a drilling response. According to the Baker Hughes rig count, only 30 rigs have been put back to work since bottoming at 68 in July 2020. As of today, 100 rigs are drilling for gas compared with 200 as recently as 2019.

Since their initial development in the early 2000s, the US shale gas fields have completely overwhelmed US gas markets. Between 2007 and 2020, shale production grew by an incredible 68 bcf/d on a starting base of 50 bcf/d. Over that time, the shales represented 150% of total US production growth, with conventional supply declining steadily. Notably, the Marcellus (in Pennsylvania) and associated gas from the Permian (in Texas) were responsible for nearly 70% of that increase. In 2019, our neural network indicated that both plays were in the early stages of resource exhaustion. We predicted both basins would have a hard time growing at the same rate as in prior years and may actually begin to decline.

Our models appear to be correct. Between December 2019 and June 2021, the Marcellus has been flat while the Permian has added only 1.1 bcf/d. To put these figures into perspective, over the eighteen months between June 2018 and December 2019, the Marcellus added 6.5 bcf/d while the Permian added 5.5 bcf/d. In other words, Marcellus growth declined by 98% while Permian growth fell by 80%. While COVID certainly impacted drilling activity, recent production trends have not improved. Year to date, production from the Marcellus and Permian combined is down 250 mmcf/d.

If the shales stop growing, total US production would decline quite quickly. For example, total US dry gas production peaked in December 2019 at 97 bcf/d. As of April (the most recent month with complete data), US supply was down 4.5 bcf/d or nearly 5% to 92.5 bcf/d. Given that preliminary data suggests the shales declined between April and June, it seems almost certain total US dry gas production has continued to decline as well.

We now have another set of anecdotal data points suggesting the Marcellus is suffering the early stages of resource exhaustion. Two major Marcellus gas producers made significant acquisitions outside the basin during Q2. It is our belief they did so to bolster their quickly eroding inventory of remaining high quality drilling locations. On May 24th, 2021, Cabot Oil and Gas, long believed to be the best Marcellus operator, diversified into the Permian by merging with Cimarex Energy for $9 bn including debt. Our models have always suggested that, while Cabot had the best acreage in the gassier portion of the northeast Marcellus, its drilling inventory was not as extensive as most investors believed. Our neural network confirmed this view. We found it extremely telling when Cabot announced their unexpected merger despite never having discussed diversifying outside of the basin.

On June 2nd 2021, Southwestern Energy acquired private Haynesville operator Indigo Natural Resources for $2.7 bn. Just as with Cabot, the market was not expecting a material acquisition that diversified exposure away from the Marcellus. What is interesting about Southwestern is that they were the first mover in the Fayetteville shale in Arkansas in the early 2000s and an early pioneer in shale gas overall. They diversified basins by acquiring Marcellus assets from Chesapeake in 2014, making them one of the few operators to have fully developed a basin and then successfully reoriented into a new play. Perhaps they sense similarities between the Marcellus today and the Fayetteville in 2014.

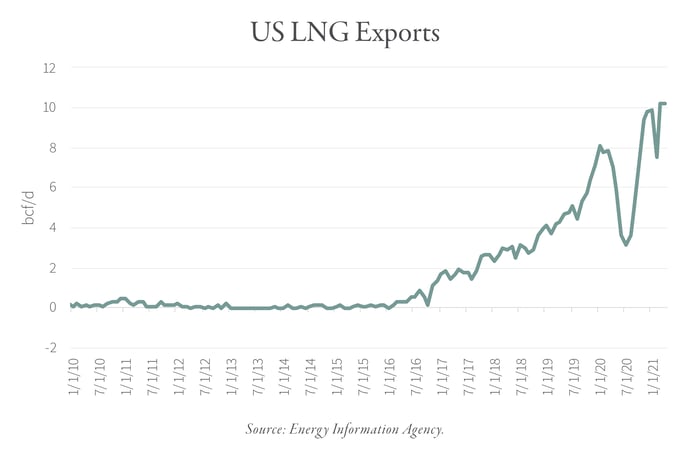

While supply has been challenged, demand remains extremely strong. Global demand for LNG is robust as weather events and strong economic demand from China and others has led to surging prices and tight markets. Notably, high temperatures across Asia have led to strong demand for electricity to power air conditioning in Bangladesh and India (a sign of the S-Curve). At the same time, Brazilian drought conditions have resulted in lower-than-normal hydro availability. Global spot LNG prices averaged $14 per mmbtu, the highest levels since 2013 and above oil-linked parity. Exported US LNG has clearly had no problem being absorbed in the global market, despite having grown from nothing as recently as 2017 to an incredible 10 bcf/d today — up 3 bcf/d in the past year alone. We have long argued that global demand for LNG was much greater than anyone believed possible. As emerging countries become wealthier, they seek cleaner forms of power of which natural gas is the most effective. Gas bears have long argued that excess natural gas supply will eventually break the linkage between global LNG prices and oil prices that has long been central to long-term LNG contracts. The fact that spot LNG today trades above its oil-linked parity suggests to us the market remains very tight. We continue to believe that the global seaborn gas market will continue to absorb new capacity from the US going forward.

The main challenge faced by US natural gas has been the unrelenting growth of the Marcellus and Permian. If we are correct and both plays are entering the early stages of exhaustion, then a new gas bull market has likely started. Production data seems to suggest we are correct and now anecdotal evidence among the producers points that way as well. Inventories are now beginning to get tight relative to seasonal averages and the US will likely enter the withdrawal season vulnerable to any bout of colder-than-normal weather. The great bull market in natural gas has begun.

To read more on this subject, we encourage you to download the full commentary, available below.