The article below is an excerpt from our Q4 2023 commentary.

“Saudi Aramco Abruptly Drops Plans to Expand Oil Production,”

~ The New York Times, January 30, 2024

In an unexpected move, Aramco, the Saudi national oil company, announced the Kingdom had directed it to maintain its “maximum sustainable crude capacity” at 12 m b/d and to abandon its longstanding plan of increasing production to 13 m b/d. The financial press took the announcement to suggest the Kingdom expects oil demand will soon peak. “Saudi Aramco Drops Expansion Plans, Raising Demand Questions” ran a Bloomberg headline, capturing the zeitgeist.

We wonder if perhaps Saudi Arabia canceled their expansion plans because they worry that remaining recoverable reserves are now insufficient to support higher sustained production.

We have keenly followed Saudi Arabia’s oil reserves for decades. We first visited the Ghawar super-major field in January 2004, one year before Matt Simmons wrote his controversial book Twilight in the Desert. We were impressed by the massive focus on drilling (at the time) ultra-long lateral wells targeting the uppermost section of Ghawar’s anticlinal structure. Mr. Simmons would go on to write extensively on the topic. While the technology was impressive, it retrospectively represented Aramco’s concerted effort to maintain Ghawar at 5 mm b/d. It was an early tipoff that Ghawar – the foundation of the country’s oil industry – was entering a long period of decline.

After Mr. Simmons’s book was published in 2005, securing a travel visa or meeting with Aramco became far more complex. Several times, our visas were issued and later revoked, or else our investment banking contacts informed us that efforts to get a visa would be unproductive. Despite our inability to travel to the Kingdom, our interest in recoverable reserve controversy only grew.

The old Saudi Aramco last published an audited reserve estimate in 1976 of 150 bn barrels of proved and probable reserves. Without explanation, in 1988, Aramco increased its recoverable reserve estimate to 260 bn bbl. Since then, Saudi Arabia has reconfirmed annually that its reserves remain unchanged at 260 bn bbl despite pumping over 120 bn bbl since 1988. The Kingdom does not produce an audited reserve report to back up its estimates, but this has not stopped most energy analysts from taking the figure at face value. In their 2023 Statistical Review, BP lists Saudi reserves at 295 bn bbl. In our 3Q18 letter, we wrote an extensive essay on why we firmly believe their reserve figure is far lower – likely no more than 160 bn bbl.

It seemed, for a moment, that the mystery would be solved in late 2018. Aramco announced it would be issuing a London-listed bond offering of $12 bn that would require filing an audited reserve report as part of the prospectus. In January 2019, Aramco released a summary of the report prepared by DeGolyer & MacNaughton, a highly respected Houston-based firm that incidentally oversaw the last published audit in 1979. In the summary, Aramco confirmed that Saudi’s remaining reserves totaled 263 bn bbl.

While the bond prospectus initially appeared to have settled the debate, it raised more questions than answers. First, it does not appear that DeGolyer & MacNaughton arrived at the exact figure reported in the summary. In their certification letter, included as Appendix C of the prospectus and overlooked by many, the authors disclose their audit only covered 162 bn bbl – much closer to our estimate. The remaining 98 bn barrels were never independently evaluated or verified.

Instead, DeGolyer & MacNaughton reported that nearly 45 bn bbl of Aramco’s self-reported reserves were said to be in fields too small or remote to analyze. Furthermore, another 53 bn bbl were not evaluated because they were expected to be produced after 2077 – the expiry date of Aramco’s oil concession. Although the summary strongly suggested that the auditors had independently verified Aramco’s stated 260 bn bbl reserve figure, they had only confirmed 162 bn bbl.

The report begged the question: do the other 100 bn bbl exist? The answer is crucial in assessing Aramco’s future pumping capability.

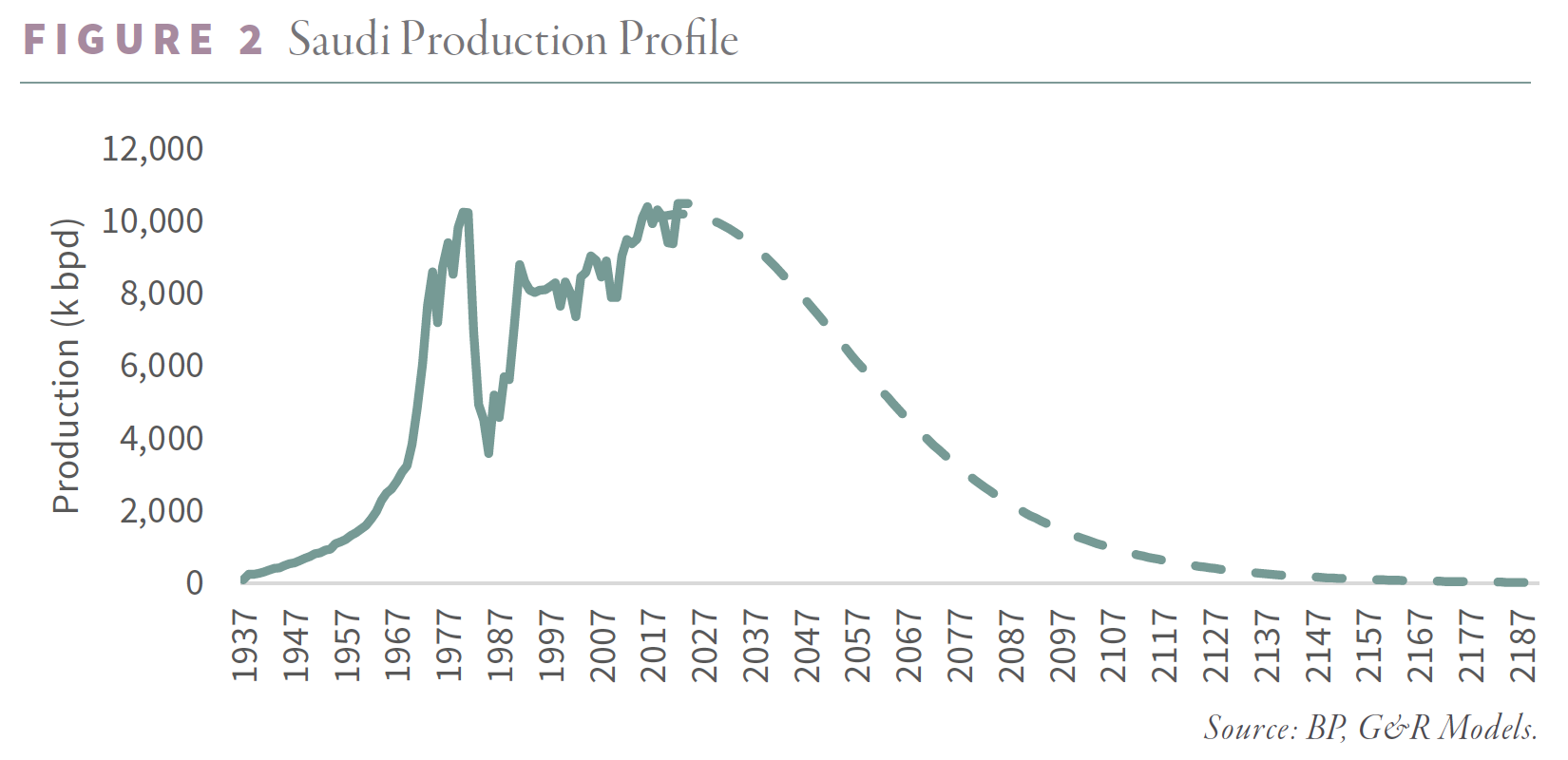

According to King Hubbert, a field’s production will follow a bell-shaped curve: ramping up slowly at first, then faster before eventually plateauing, peaking, and declining in a mirror image of the ramp-up. Peak production corresponds to half the field’s recoverable reserves having been produced. We calculate that Saudi Arabia by 2019 had produced 150 bn bbl since its fields were first developed in the early 1950s.

Assuming Saudi Arabia did have 260 bn bbl of remaining reserves, by 2018 it had already produced 40% of its total recoverable reserves. If Saudi Arabia continued pumping between 9 and 10 mm b/d, by 2031, it would reach its halfway point, at which point production would decline. Under this 2018 scenario, Aramco could increase output to 13 m b/d and still have a decade until declines took hold.

Instead, if the 45 bn bbl contained in fields too small or remote to evaluate were not recoverable (which we believe), then production would peak in only six years. Under this scenario, Saudi production should be in the plateau phase and incremental production gains would likely be short-lived. Since 2015, Aramco has, in fact, unexpectedly throttled back production several times. While the stated reason has been to balance the market, it may have more to do with geological depletion than is commonly believed.

A third scenario must also be seriously considered. If the post-2077 reserves do not exist, the Kingdom has already produced half of its total recoverable reserves. Under this scenario, increasing production for anything other than the briefest period would be very challenging. DeGolyer & MacNaughton did not attempt to verify the 53 bn bbl contained in this category. In our 2Q19 letter, we tried to determine whether these reserves seemed reasonable using indirect statistical methods. Our conclusion: they likely do not exist.

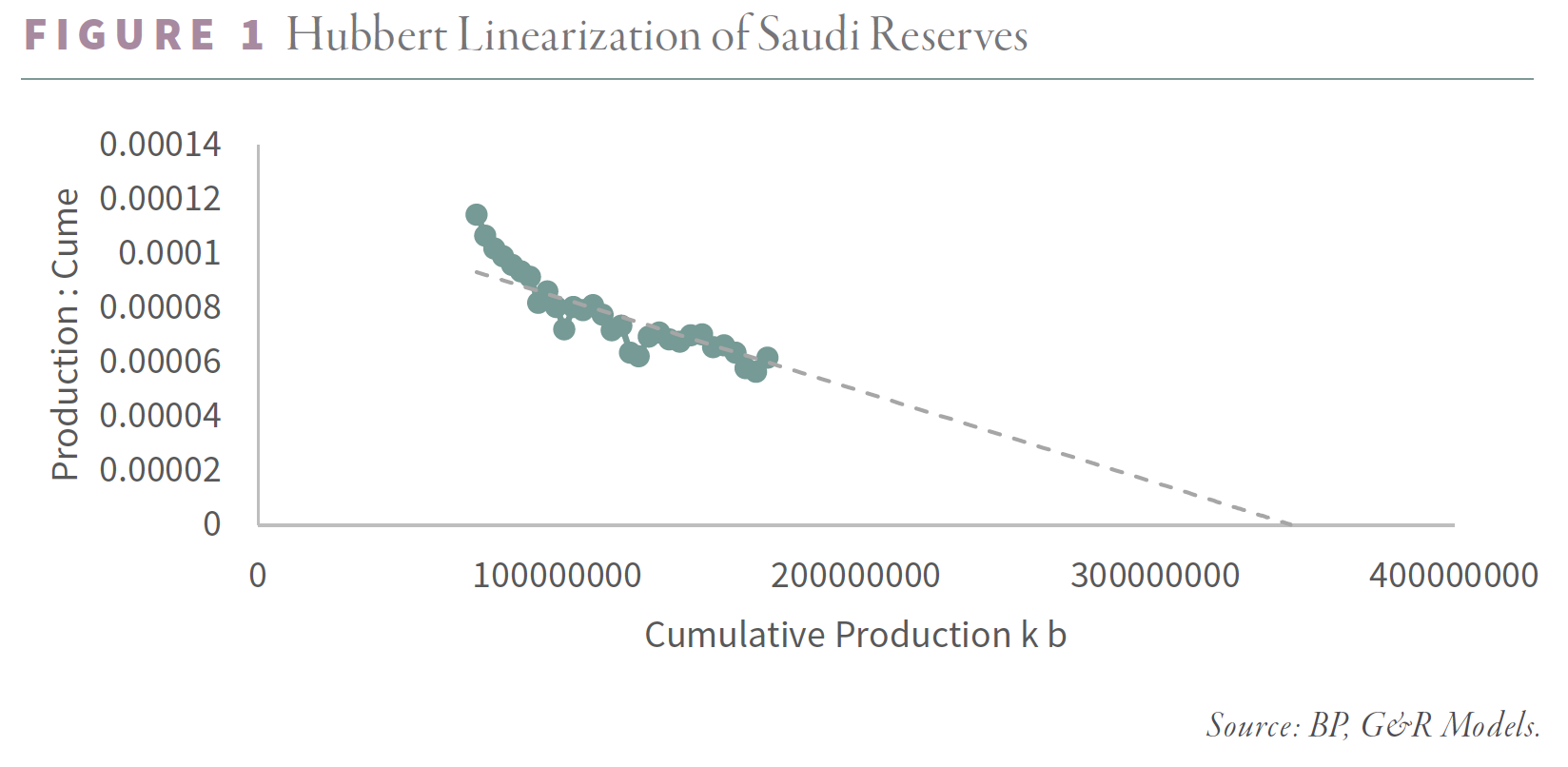

We performed a Hubbert Linearization, in which we studied the relationship between current production and current to cumulative production ratio. This was a technique advanced by King Hubbert to try and estimate a field’s ultimate recoverable reserves. After an initial period of instability, the relationship between the two settles into a straight line that can be extrapolated to estimate reserves.

We next computed an expected production profile for Saudi Arabia based on the Linearization. This profile suggests that between 2018 and 2077, Saudi Arabia will produce 158 bn bbl – very much in line with the DeGolyer & MacNaughton audited figure. By 2077, the model predicts production will have fallen from 9 mm b/d today to only 3.1 mm b/d, with declines of 4% per annum. Aramco claims that post-2077, Saudi reserves will still total 53 bn bbl. However, we believe this is mathematically impossible. If 2077 production stands at 3.1 m b/d, and it declines by 4% per year, as suggested by our Hubert Linearization, then cumulative production from 2077 forward would never exceed 28 bn bbl.

Assuming the “too small, too remote” fields do not exist, and total reserves post-2077 total 28 bn and not 53 bn bbl (as reported in the summary), then Saudi’s ultimate recoverable reserves are 340 bn bbl, of which 52 % have been produced as of 2024. The Saudis are now past their halfway point in producing their recoverable reserves. Under this scenario, production cannot grow from here, and outright declines should be expected at any time.

Although a flurry of interest surrounded Mr. Simmons’s book nearly twenty years ago, few energy analysts pay attention to the Kingdom’s geological issues today. Although most analysts incorrectly interpreted the Saudi news as proof of “peak demand,” we take a different view: Matt Simmons was not wrong, merely early. We believe the recent announcement to abandon its growth targets is the first sign our analysis was correct, as outlined in 2019 in three essays—3rd Q 2018, 1st Q 2019, and 2nd Q 2019--, and that sustained Saudi Aramco production declines are much closer than anyone anticipates.

Intrigued? We invite you to download or revisit our entire Q4 2023 research letter, available below.

Registration with the SEC should not be construed as an endorsement or an indicator of investment skill, acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal. Historical performance is not indicative of any specific investment or future results. Investment process, strategies, philosophies, portfolio composition and allocations, security selection criteria and other parameters are current as of the date indicated and are subject to change without prior notice. This communication is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Nothing in this communication is intended to be or should be construed as individualized investment advice. All content is of a general nature and solely for educational, informational and illustrative purposes. This communication may include opinions and forward-looking statements. All statements other than statements of historical fact are opinions and/or forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such beliefs and expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements. All expressions of opinion are subject to change. You are cautioned not to place undue reliance on these forward-looking statements. Any dated information is published as of its date only. Dated and forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any dated or forward-looking statements. Any references to outside data, opinions or content are listed for informational purposes only and have not been independently verified for accuracy by the Adviser. Third-party views, opinions or forecasts do not necessarily reflect those of the Adviser or its employees. Unless stated otherwise, any mention of specific securities or investments is for illustrative purposes only. Adviser’s clients may or may not hold the securities discussed in their portfolios. Adviser makes no representations that any of the securities discussed have been or will be profitable. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.