The article below is an excerpt from our Q1 2022 commentary.

One of the most frequent questions we get asked regarding this commodity bull market is: “Have I missed it? Is it too late to make an investment in natural resources?”

From our base of younger investors, we frequently get questions such as this: “I have been reading your material for the last two years and I started getting heavily involved in the commodity markets and I have made a lot of money. Is the top near? Should I sell out? Is this commodity bull market over?”

Given the big moves in various commodity markets since the summer of 2020, it is logical to ask these questions. But our response to all these questions is going to be a real shocker. Not only is the commodity bull market not over, it has hardly begun.

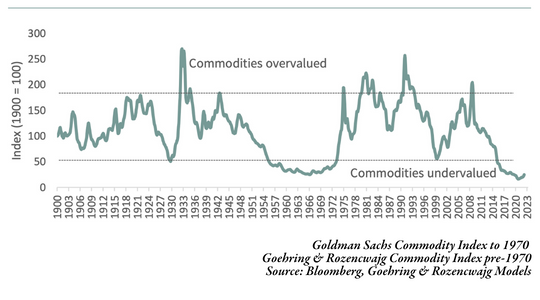

Look carefully at the chart below.

We first ran this chart on the front page of our Q2 2017 letter. This chart shows the returns of the Goldman Sachs commodity index versus the level of the US stock market, as measured by the Dow Jones Industrial Average. Although the Goldman Sachs commodity index was only constructed in 1971, we reconstructed it going all the way back to 1900. As you can see, commodities and financial equities have both traded in long cycles that are usually inversely related. Over the last 130 years, there have been four times when commodity markets became radically undervalued versus the stock market: 1929, the late 1960s, the late 1990s, and today. After each period of radical undervaluation, commodities entered into large bull markets and then proceeded to become radically overvalued. If you had invested in commodities or commodity related equities in any of these three previous periods, the returns on both an absolute and related returns basis were huge -- even in the 1930s.

Constructing a natural resources equity portfolio that consisted of 25% energy, 25% metals and mining, 25% precious metals, and 25% agriculture would have significantly beaten the stock market in each of these cycles.

For example, had you invested in such a natural resource portfolio in 1929, your return would have been 122% by 1940, which doesn’t sound like much, but compared to the Depression ravaged stock market, the returns were almost spectacularly good. Between 1929 and 1940, the stock market fell 50%. Also, the 1930’s was a period of chronic deflation and consumer prices fell over 20% between 1930 and 1940. In real terms, commodity prices (and related equities) offered real returns of almost 180% -- not bad in a period that included one of the greatest bear markets in history and a full-blown banking crisis that required the temporary suspension of the world financial system.

In 1970, a similarly constructed natural resource equities portfolio would have returned 400% by 1980, a return that handily beat the stock market which returned only 80% for the decade. Inflation was a huge problem in the 1970s and consumer prices advanced almost 130% for those 10 years. Natural resources not only provided excellent relative returns versus the stock market, but they provided investors with nominal returns far above the inflation rate as well.

And finally in 2000, a similarly constructed natural resources equity portfolio would have returned 360% between 1999 and 2010, significantly outperforming both the stock market, which returned nothing during that time period, and the inflation rate, which advanced 35% over those 10 years. Even though the 1999-2010 time period saw both the breaking of the “Dot-Com” stock market bubble, the Lehman Brothers financial collapse, and a global banking crisis, commodities again provided excellent returns relative to financial assets, as well as excellent returns relative to inflation.

These three periods couldn’t have been more different: the 1930s were a period of deflation and global depression; the 1970s were a period of severe inflation and worries over currency debasement; and the 2000s were a little bit of everything including a stock market collapse, a global financial panic, and an oil price spike not seen since the 1970s. For those interested in the links joining these three periods together, please read “On the Verge of a Commodity Cycle” that appeared in our Q3 2020 letter. That essay is a reprint of a presentation we made at the August 19, 2020, Finanz and Wirtschaft conference in Zurich, Switzerland. These three great commodity buying opportunities were all characterized not only by cheap commodity prices, but by the recurrence of four other events.

First, prior to each commodity buying opportunity was a decades-long commodity bear market that produced price declines so severe that capital spending in many extractive industries was impaired. Second, each period was characterized by excessive monetary creation. Third, all three periods saw intense financial speculation. And fourth, each period saw a major shift in global monetary regimes. All four conditions are once again present today and, in many instances, they are far greater in magnitude than in any of the previous three cycles.

It is no coincidence that commodity related investments have begun to radically outperform general equity markets. Since January 1, 2021, the natural resource equity portfolio construction above has returned 70%, far outstripping the S&P 500’s 14% return over the same period. Commodity prices remain radically undervalued relative to financial assets, and we have great confidence that we will swing from commodities being radically undervalued to commodities being radically overvalued relative to financial assets at some point in this decade. What will that radically overvalued level be? If the stock market stays at present levels, commodity prices would have to surge 600% to become overvalued relative to the stock market. If the stock market falls 50%, commodity prices would still have to rise 250% for our chart to enter “radially overvalued” territory.

The biggest risk for investors is selling too soon. From the bottom in 2020, the ratio of commodities to the Dow Jones Industrial Average has rallied by 40%. Using history, we can compare this move to past cycles. The ratio bottomed in December 1968 and by November 1970 had advanced by 40% -- commodities by 10% while the market fell by 16%. Many investors may have wanted to sell at that point; however, the rally was just beginning. Over the next nine years, commodities rallied another 156% and commodity stocks rallied another 400%. Had you sold in 1970 after the index advanced 40%, you would have missed 90% of the rally. In 1999, the index bottomed in June and advanced 40% over the next 12 months – commodities advanced by 33% and the market fell by 4%. At that point, oil was $32 on its way to $145, gold was $289 on its way to over $1,000. Over the next 10 years, commodities rallied 150% and resource stocks rallied by 325%. Again, if you had sold in 2000 once the ratio advanced 40%, you would have missed 95% of the rally.

As you can see, commodities still have to surge multiple times in price from here before they become overvalued. Given the huge amount of monetary creation that has taken place over the last 14 years and, given that inflation psychology is about to grip both consumers and investors alike, we have great confidence that we are about to transverse from one side of this chart to the other. The great commodity bull market has only started, and investors should us use any resource market pullback as an opportunity to increase their exposure.

Intrigued? We invite you to revisit our entire Q1 2022 research letter, The Gas Crisis is Coming to America, available below.