The article below is an excerpt from our Q3 2022 commentary.

The most pressing question facing oil markets is why US shale drilling remains so muted despite high prices.

A simple question whose answer is complex.

Investment pundits and oil analysts all have theories, many of which we believe miss the underlying issues.

Our research suggests several complicated factors have come together to keep the industry from increasing activity. The result is that US shale production growth (the only source of non-OPEC supply growth over the last decade) will likely remain muted for longer than most investors expect.

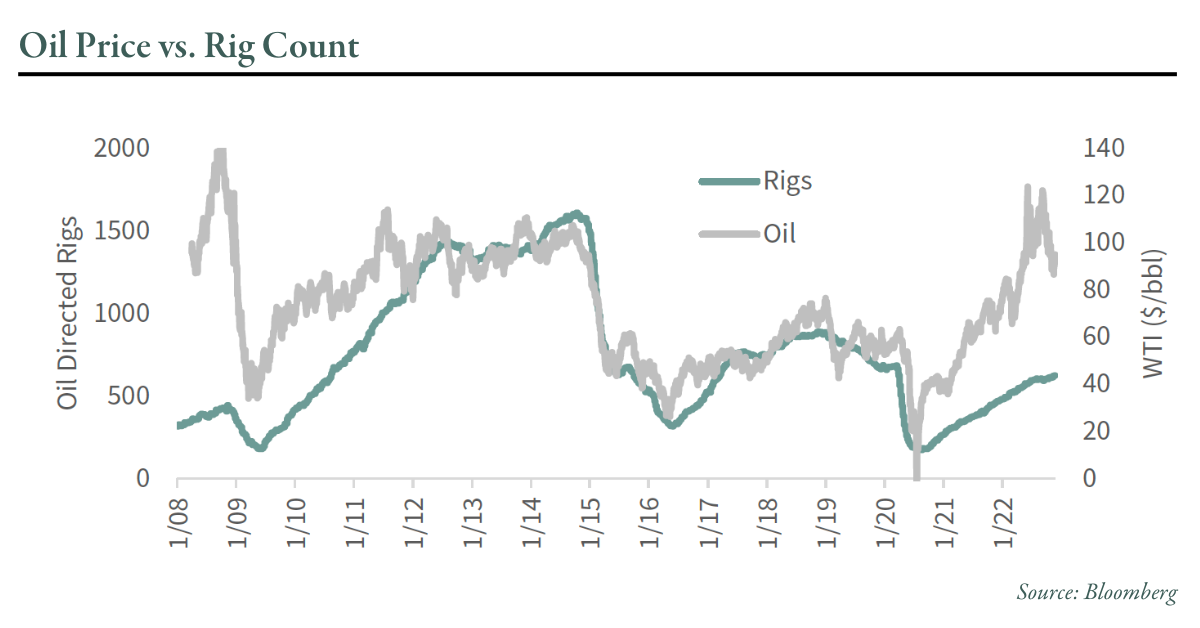

Oil bottomed in April 2020 at an unthinkable -$37 per barrel. The US oil-directed rig count bottomed a few months later, in August 2020 at 172 rigs – the lowest level since 2002. The US oil industry slashed its drilling activity by 80% compared with the pre-COVID level of 900 rigs in 2018 and by 90% from the 2016 high of 1,600 rigs.

Production has been equally volatile over the past three years. Responding to extreme COVID-related uncertainty, US producers stopped drilling new wells and postponed completing their already drilled wells. As a result, the inventory of drilled-but-uncompleted (DUC) wells ballooned. Low prices and concerns that storage would overflow compelled companies to significantly shut in existing production – a first for the industry. Total US crude production fell from 13 m b/d in December 2019 to 9.7 m b/d by May 2020.

Our models told us that resource depletion problems coupled with massive capital curtailment would make widespread shortages highly likely in the coming years. In the lead essay of our 2Q 2020 letter, we warned of an impending energy crisis—a highly unusual conclusion at the time, given that oil markets had turned negative only one month before.

Investors and analysts, as expected, vehemently disagreed with us. Not only were investors obsessed about demand, but they also became convinced that any nascent rally would run into a wall of new drilling. “Once oil hits $40, shale producers will start drilling again,” went the conventional wisdom. Oil did reach $40 in June 2020 but failed to elicit a drilling response. Even with oil at $60 per barrel in March 2021, the oil-directed rig count remained stuck at 300 – the lowest level, apart from the COVID lows, since the 2008-2009 financial crisis.

Following Russia’s invasion of Ukraine, oil prices broke through $100 per barrel for the first time since 2014. Most analysts predicted that triple-digit oil prices – the highest in nearly a decade – would produce a strong response in drilling activity. However, thus far, that response has been muted. Even now, after six months with oil prices greater than $85 per barrel, the US oil-directed rig count remains at 533 – nearly 40% below the 2018 levels despite oil prices having nearly doubled.

As this chart shows, a tight relationship has historically existed between oil prices and drilling activity. Between 2008 and 2018, the oil price alone explained 70% of the variation in drilling activity. Since 2020 however, this relationship has broken down. The industry should be turning 1,000 rigs; instead, they are stuck stubbornly at 533.

This lack of activity has confounded most analysts. Countless agencies and banks have revised their estimates for lower 2022 and 2023 US crude oil production. The US represented the bulk of non-OPEC growth over the past 17 years, making these disappointments impactful. Since June, the US Energy Information Agency (EIA) has revised its estimates lower for 2022 and 2023 US crude production every month. The International Energy Agency (IEA) revised its 2022 US production estimates lower while revising its 2021 figures higher, effectively reducing implied growth by nearly 200,000 b/d. Our models tell us these disappointments would have been even greater had it not been for the accelerated completion of the vast DUC inventory accumulated during COVID. With most of the DUC inventory now gone, the industry must either increase drilling activity or accept further disappointments. As of now, they are choosing the latter.

Indeed, the oil price justifies new drilling. Prices have rallied steadily for the last 30 months and remain at the highest level in nearly a decade while oil inventories continue to plummet. The market has shifted from structural surplus to structural deficit. We estimate that a company with high-quality Permian acreage can generate $38 mm in undiscounted cash flow from a well given $80 WTI, compared with $8 mm in drilling and completion costs. Given more than half of a well’s cash flow is generated in its first two years, the IRR at today’s oil prices is well over 200%.

Given these extremely attractive single-well economics, why are the companies not drilling more? Energy analysts throw vague references to capital discipline or labor shortages around. We don’t want to downplay these observations; however, we believe that other forces are at work.

After studying the issue in depth, we believe oil companies are acting very rationally, even if it seems counterintuitive. By keeping activity low, oil companies are simply responding to the signals sent from their three significant constituencies, all emphatically telling them not to drill. These constituencies are policymakers, investors, and their internal strategy teams.

Policy Makers

Despite calls for more production, policymakers remain highly hostile toward the fossil fuel industry. In the United States, President Biden repeatedly floated the idea of a windfall profit tax that would severely impact E&P profitability. Every proposal by the Biden Administration in response to high energy prices is either outright antagonistic towards the industry or, at best neutral. They have suggested banning crude exports (bad for producers and refiners), reducing gasoline taxes (good for consumers, neutral for producers), implementing windfall profit taxes (bad for producers), banning drilling on federal lands (bad for producers), and increasing subsidies for renewable energy (bad for everyone).

At no point has the administration signaled to the energy industry that its stance might be moving from outright hostility to accommodation. In the first of two congressional hearings in the last 18 months, members of congress criticized the sector for not cutting production faster; in the second, the same members blamed the companies for underinvestment, low production, and high energy prices.

The situation in Canada and Europe is similar. Energy CEOs remain highly concerned that any increase in oil development will be met with outright hostility and increased government scrutiny. No CEO longs to be part of the next congressional hearings. Under these circumstances, it is entirely rational for oil companies to put off increasing drilling activity and development.

Investors

Investors are also signaling oil companies to slow development. This claim might sound odd, given energy stocks have been one of the few bright spots in the market over the last two years. Since January 1st 2021, energy exploration and production companies (as measured by the XOP ETF) are up 182% compared with the S&P 500, which is up a mere 9% on a total return basis. However, as you will see, investors are sending clear no-drill signals to oil companies.

Despite the rally, energy stocks trade at near-record low valuations. As recently as September, E&P companies traded for 5.6x earnings and 3.4x EBITDA – the weakest readings in over a decade. On average, the stocks have traded for a median value of 22x earnings and 9x EBITDA over the past ten years. Currently, the sector trades for 7x earnings and 4x EBITDA – 68% and 55% below the long-term average, respectively, and only slightly above the September lows.

Low valuations encourage companies to favor returning capital to shareholders over increasing drilling, despite strong single-well returns. Here’s why:

The E&P sector trades at 0.8x its net-debt adjusted PV-10 per share. For those to whom this is unfamiliar, the SEC requires energy companies to publish their PV-10 value (or standard measure) annually in their 10-K. The companies must list their proven reserves and estimate the discounted cash flows using a given oil and gas price. Removing net debt and dividing by the share count yields the so-called “net-debt adjusted PV-10 value per share,” which we will refer to as NAV per share going forward. In the past, investors capitalized an energy company at a multiple of NAV, reflecting the future development potential not yet reflected in their proved reserve figure. The trick was to determine the appropriate multiple given the company’s assets.

We cannot recall a time when the entire industry traded for less than its NAV, and these extremely low valuations have tipped the scales away from drilling and toward dividends and share repurchases.

Consider a hypothetical E&P company trading at 0.8x its net-debt adjusted PV-10 per share. Our hypothetical company has $1 bn of PV-10, 10 mm shares, and $200 mm of net debt. The company’s CEO can choose between spending $100 mm on new drilling or buying back stock.

Assuming they can find and develop energy reserves for $15 per barrel of oil equivalent (boe), the company will book 6.7 mm boe of newly proved developed reserves for the $100 mm investment. At $80 crude and $5 gas, we estimate this investment would generate ~$130 mm in new PV-10. However, because the market capitalizes the company at only 0.8x NAV, the ending stock price would be virtually unchanged.

On the other hand, if the company bought back $100 mm of its stock, its share count would fall by nearly 20%. Adjusting for net debt and dividing by the new lower share count implies the stock would rise by over 5% -- more than by drilling new wells. Therefore, the CEO that choses to return money to shareholders will enjoy a higher stock price and still have his best wells left undrilled. Under these conditions, no rational executive would rush to increase activity. Even though each well drilled would generate an IRR of nearly 80% in our example, the company is better off deferring development. The companies’ extremely low valuations explain this paradox. To summarize Edward Chancellor in “Capital Returns,” high multiples value growth and reward investment, while low multiples discount growth and encourage discipline.

We call this analysis a company’s “signal to drill,” and we believe it explains the industry’s reluctance to increase activity. Looking company by company, we estimate over 50% of the remaining undeveloped reserves in the US are in the hands of companies for whom it is better to return capital than to drill. Those companies with a clear “signal to drill” are growing production by 8%, while those without are shrinking by 4%. Pioneer Natural Resources (PXD) is an example of the former. PXD trades at a 100% premium to their NAV, and the company is growing production by almost 20%. In the latter category, Laredo Petroleum trades at a 70% discount to NAV, and its production is declining by 7%.

In 2018, the industry had a much clearer signal to drill despite lower prices. Oil averaged $51 per barrel in 2017 – 40% lower than today; however, we estimate the industry was valued at 4x NAV compared with 0.8x today. Using the same parameters as in the example above, drilling increases the stock price by 7%, whereas buying back stock at very high valuations would decrease the price by 10%. Even though a single well’s IRR is much better today than it was in late 2017, the difference in valuations back then pushed oil companies to drill. If oil companies traded at 3x NAV, everyone would have a positive “signal to drill,” and a considerable drilling boom would be underway. These same companies today are being told to defer drilling and development because of depressed valuations.

Unless investors start redirecting capital back into the energy industry, valuations will remain depressed. The “signal to drill” will continue to push energy executives away from drilling and towards share buybacks. By deferring drilling, energy executives act entirely rationally and in the best interest of shareholders. Perhaps the most rational is Harold Hamm, Chief Executive Officer of Continental Resources. We estimate that Continental trades for 0.8x NAV, sending management the signal to slow drilling. At the same time, Continental can likely still generate a strong drilling rate of return – although it is suffering from resource exhaustion. Mr. Hamm has decided to break the “signal to drill” constraint by offering to acquire the remaining Continental shares he does not own and to take the company private. In doing so, Mr. Hamm hopes to unlock the latent value that the public markets refuse to acknowledge. He can undertake any drilling activity he deems appropriate since he is the only shareholder.

Strategy Teams

The last group signaling energy companies to keep development muted are their strategy teams: petroleum engineers, rig crews, and project managers. The reason is resource depletion. We have long argued that Eagle Ford and Bakken producers have drilled out most of their best wells, so production would likely plateau and decline. Over the past years, several companies have gotten into serious trouble by running out of high-quality inventory. As recently as 2017, Oasis Petroleum, a sizeable Bakken driller, claimed they retained 20 years of top-quality Tier 1 drilling locations. However, only a few months later, they tacitly acknowledged they were running out by closing a high-priced Permian acquisition to exit the Bakken and forestall future production declines. The strategy did not work, and Oasis declared bankruptcy in September 2020.

Similarly, Whiting Petroleum stated they had a decade of Tier 1 locations before declaring bankruptcy in mid-2020. The most dramatic example is Cabot Oil and Gas. Long a market darling that commanded a premium valuation due to its perceived asset quality, Cabot claimed to have had 20+ years of top Tier 1 drilling inventory in the prized northeast corner of the Marcellus. Our models, however, suggested that Cabot’s tier 1 acreage was not as extensive as claimed, so we have not owned the stock for many years. Cabot began to suffer Tier 1 inventory depletion several years ago, and in 2021 Cabot unexpectedly announced they would merge with Cimarex, a mid-quality Permian company. Based on our research, this merger addressed Cabot’s quickly depleting Tier 1 inventory in the Marcellus. Energy executives are acutely aware of the dangers surrounding Tier 1 inventory exhaustion. After being forced out of their Tier 1 cores, companies will suffer from ever-declining well productivity, production shortfalls, lower profitability, and recurring earnings disappointments. Given such a scenario, even executives with the best remaining acreage are reluctant to increase drilling programs that speed the depletion of their Tier 1 inventory.

As Tier 1 acreage becomes scarcer, Tier 1 inventory management becomes more critical.

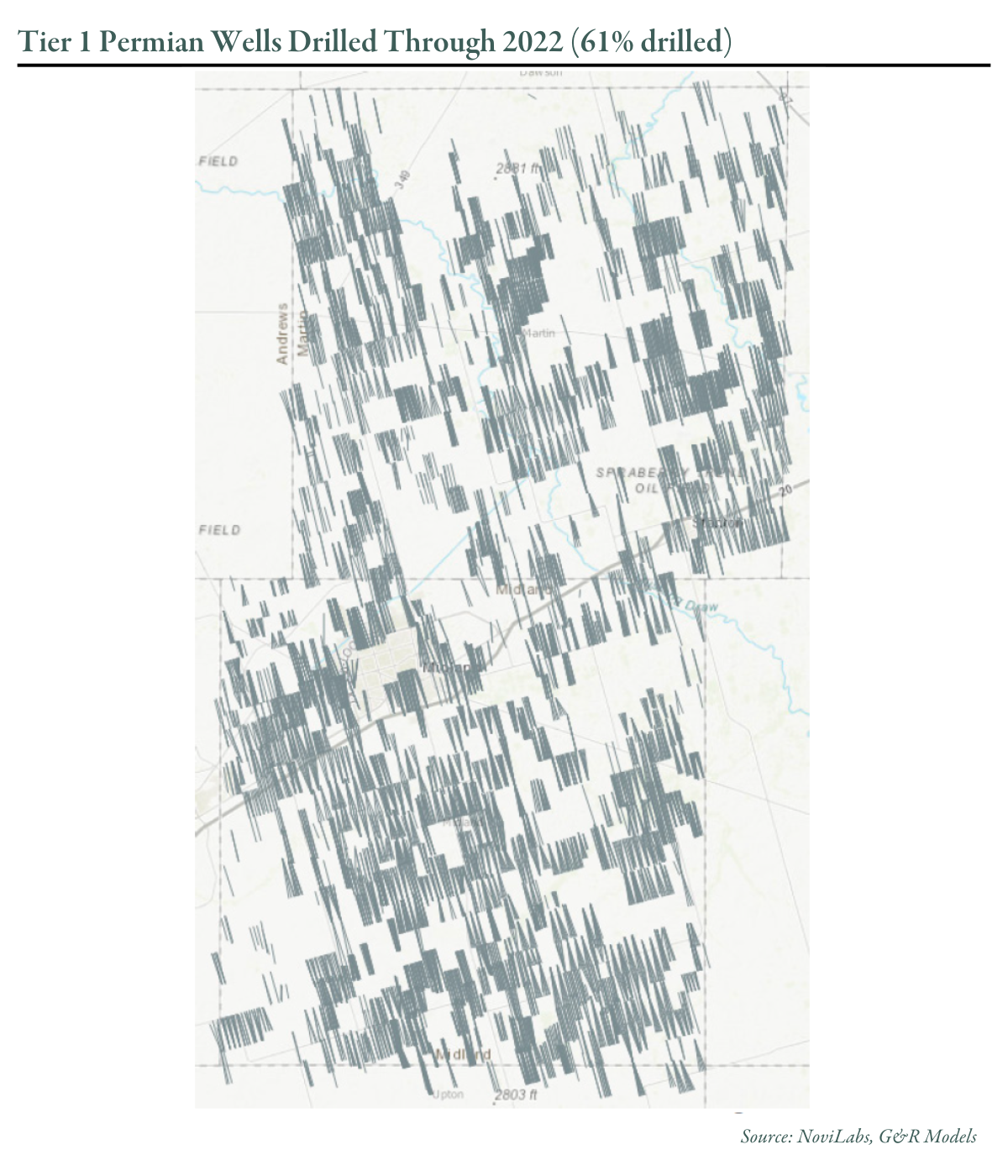

An in-depth study of Tier 1 acreage in the Midland and Marlin Counties in the Permian Basin clearly highlights these companies’ issues. Using our neural network, we can study the best areas of the Permian and estimate the inventory of undrilled locations in both counties. In the map below, you can see Midland and Martin County areas that we estimate have the best Tier 1 drilling locations. We estimate approximately 4,800 undrilled Tier 1 locations, based upon 10,000-foot laterals and 600 feet between wellbores. Operators have recently brought on 50 wells per month. At this rate, the area will be fully developed by 2030.

As recently as 2018, development in this area averaged 110 wells per month. If the companies operating in the play were to double drilling and go back to 100 wells per month, they would fully develop the acreage in only four years. A company with core Midland and Martin acreage would therefore need to start looking immediately to try and reinvent its asset base – a daunting task given the lack of exploration success over the past decade. If they waited, they would risk the fates of Oasis, Whiting, and Cabot.

By maintaining a more muted pace of drilling development, operators across the Permian are choosing to stretch out the life of their Tier 1 inventory, despite strong well economics suggesting accelerating development.

When you think about the challenges now being faced by the industry in these terms, you can easily see why oil company executives would keep the pace of development subdued. On the one hand, you could increase activity, risk attracting the ire of policymakers, have your stock price go down, and deplete your irreplaceable asset. On the other hand, you could return capital to shareholders, stay under the radar of policymakers, have the market reward your capital discipline, and keep your Tier 1 assets for a later time when the market will better value them.

Is it any wonder energy companies are not drilling?

In past cycles, the “signal to drill” has often been determined by the oil and gas price. When oil prices fell from $100 to $27 between 2014 and 2016, the industry laid down rigs because they could not generate a return on drilling. As prices recovered in 2016 and into 2018, the rig count rebounded by 600 rigs. Because of record low valuations, this is the first time we can recall where the “signal to drill” is driven by valuation instead of oil price. As a result, higher prices have not incentivized increased activity. Until investors allocate capital to the space and valuation improves, we expect drilling activity to remain subdued and oil shale supply disappointments to continue.

Intrigued? We invite you to revisit our entire Q3 2022 research letter, Why Won't Energy Companies Drill?, available below.