The slowing of shale oil production growth has become an accepted fact. However, we believe new forces are now at work that could produce another downward revision to US shale growth assumptions. These new forces are poorly understood and seldom mentioned, and we believe it is important that we bring them to your attention.

In a recent blog, Declining Tier 1 Acreage and Slowing US Shale Oil Production, we outlined how the industry’s high-grading effort positively impacted drilling productivity over the last five years. We also discussed what would happen to future shale oil production growth once “Tier 1” drilling prospects dwindled. But high-grading produces other unintended consequences that few energy analysts mention.

For example, we all understand how high grading significantly improves an E&P company’s drilling productivity when drilling activity increases. You simply put more and more of your rigs to work drilling the best prospects. After years of high-grading however, when a drilling retrenchment cycle forces you to drop rigs, the positive impact of high-grading reverses itself, with significant negative impacts to production growth. We are now over a full year into just such a cycle and we believe the consequences of the last five years’ worth of high-grading is about to become widely felt and understood.

To understand the relationship between drilling retrenchment, high-grading, productivity growth and production, consider an energy company that is forced to cut back its drilling activity in response to falling oil prices and reduced cash flows. It is logical to assume a company will stop drilling its least productive wells first. The remaining drilling activity becomes concentrated in the most productive areas and the average productivity rises. The larger the gap between a company’s least productive rig and its most productive rig, the more this phenomenon positively impacts average productivity and future production.

Between 2008 and 2019, we have experienced four periods of drilling retrenchment in the oil shales. During the 2009 slowdown, the Bakken, Eagle Ford, and Permian lost 60% of their rigs. However, the difference between the most productive and least productive rig was so great that drilling productivity soared by 75% and total production from new drilling activity only fell by 35% -- much less than the fall in the rig count. In 2013, the three basins lost 15% of their rigs. Once again, the material difference between the most and least productive rig caused productivity to jump by 60%. Production from new drilling activity actually accelerated by 35%. In 2016, drilling activity declined by a massive 80% in the three basins. Productivity was able to skyrocket by 200% as companies were still able to lay down a large number of relatively unproductive rigs. Oil production from new drilling activity slowed by only 50%, again much less than the 80% drop in the rig count.

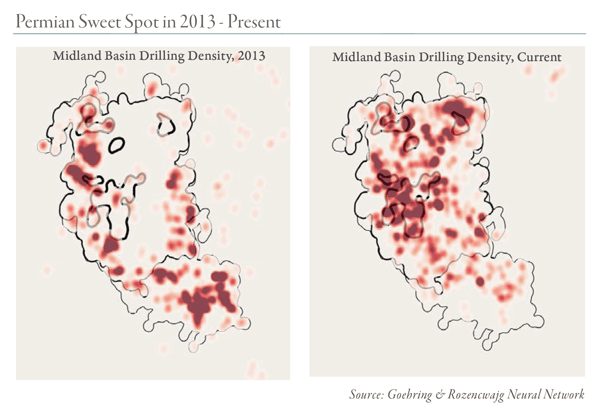

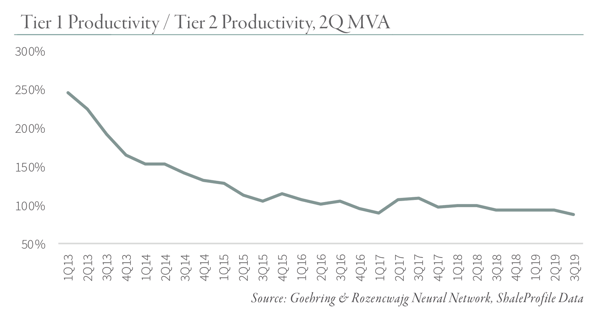

We used our neural network to shed some light on these periods of drilling retrenchment. We divided all of the drilling activity in the three plays into two tiers based upon acreage quality. According to our neural network, in 2009, 50% of all shale activity took place in Tier 1 areas. In 2013 and 2016 Tier 1 drilling still only represented 50% and 60% respectively. Today, that has changed dramatically. We believe that by 2019, Tier 1 activity approached 75% of all drilling. The following map shows the drilling activity on the Midland side of the Permian basin in 2013 and 2018. As you can see, operators have honed in on the best parts of the play and are hardly drilling the less productive areas at all. The same trend is true in the Bakken and Eagle Ford and we invite those that are interested to please reach out for similar drilling activity maps.

We also calculated the spread between the best wells and worst wells drilled during previous downturns. In 2013 we estimate the top half of all shale wells were 200% more productive as the bottom half. By 2019 this spread had collapsed to only 90% more productive. As rigs are laid down, our research tells us that the narrowing in drilling productivity will have a large impact on shale oil production growth. In previous drilling downturns, the E&P industry had the luxury of being able to lay down a significant number of relatively unproductive rigs. Years of high grading has taken this luxury away. Today, far fewer rigs are drilling unproductive wells compared to the downturns of 2009, 2013 and 2016 - a phenomenon clearly shown on the map above.

The rig count has now fallen by 200 rigs or 23% since peaking in late 2018. Because of the high-grading, we believe the impact of this slowdown could affect production much more acutely than analysts expect. Unlike in past cycles, where productivity surged by 75%, 60% and 200%, our models tell us this cycle will be much more muted. In fact, based upon preliminary data, 2019 productivity may have actually declined year-on-year, despite the slowdown in drilling activity.

Shale oil production has already surprised analysts by slowing materially in 2019. However, the bulk of the slowdown occurred earlier in the year before much of the impact of the drilling retrenchment took hold. In our last letter, we explained how the unexpected slowdown in shale oil growth was the result of an acceleration in Permian Basin base declines. In 2018, newly completed Permian wells surged. These younger wells sported first-year decline rates as high as 70%, much greater than the field’s base decline as a whole. Bringing this surge of high decline wells online pushed the Permian base decline from 54% for the first eight months of 2018 to 57% for the same period in 2019. The acceleration in base declines, coupled with a slowdown in shale drilling productivity, slowed production growth by nearly 60% even though the number of completed wells increased by 10% compared with 2018.

However, we believe, new underappreciated forces are now at work in the shales. As we progress through 2020, the retrenchment of drilling activity, combined with the inability for drilling productivity to rise because of “high grading” will produce the potential for a significant disappointment in oil production. If rig counts turn much lower or if productivity continues to disappoint, US shale production growth might even start to turn negative as we reach the end of 2020. Most analysts are still very optimistic about US oil growth in 2020. Estimates range from as low as 1.1 mm b/d to as high as 1.7 mm b/d, but we believe these growth estimates are far too aggressive. Several prominent oil industry veterans are calling for growth as low as 400,000 b/d, which could also turn out to be optimistic.

Download below our full Q4 2019 commentary, THE UNINTENDED CONSEQUENCES OF HIGH GRADING, for our estimates of US shale growth, as well as global oil supply-and-demand balances.