Happy New Year!

While we are at the end of one year and the beginning of another, we'd like to take a moment to reflect on our writings.

Below we recap our 3 most popular blog posts of 2019. We sincerely appreciate your continued support and interest in our market insights.

Best wishes always,

Goehring & Rozencwajg

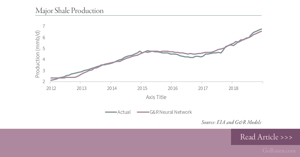

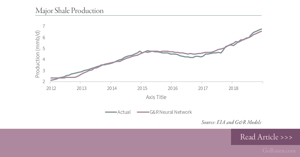

Shale Oil: A Startling Prediction Using the Latest Statistical Techniques

|

|

Developments in the US shale basins have never been more important for global crude fundamentals. Over the past decade, the US has represented more than 100% of total non-OPEC growth and this growth has come exclusively from the shales. Had it not been for the US shales, the global oil market would have been in serious deficit.

Continue Reading >

|

Oil: A Market Divorced from Reality

|

|

In the thirty years we have been investing in global natural resource markets, we cannot remember seeing greater value than we do today in the global oil markets. With both crude and oil-related securities, the price action appears to have completely divorced itself from underlying fundamentals.

Continue Reading >

|

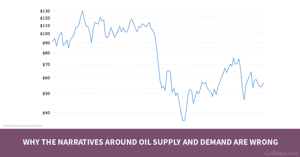

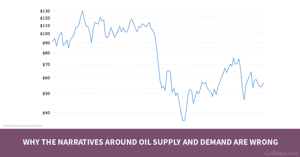

Why the Narratives around Oil Supply and Demand are Wrong

|

|

Often at the bottom of intense, grinding bear markets or the top of bull markets, investors will create a narrative to help explain the extreme price action. Today, the prevailing consensus view is that oil market fundamentals are bad and getting worse. Most analysts believe the market is currently in surplus and that this surplus will accelerate as weak demand is met by ever-growing shale production.

Continue Reading >

|