We sincerely appreciate your continued interest and support of our market insights. Below we recap our 3 most popular blog posts of the first half of 2019.

As always, we welcome your comments or questions.

Best wishes,

Goehring & Rozencwajg

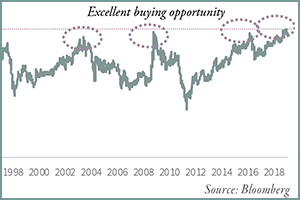

What the Gold-Silver Ratio Can Tell Us About Precious Metals

|

In previous quarterly letters, including Q3 2018 (Into The “Red Zone” We Go), we stated our belief that a huge new bull market would develop in gold that could take the metal to levels significantly higher than today’s price. Using several valuation techniques, we outlined how gold was as cheap as it had ever been. |

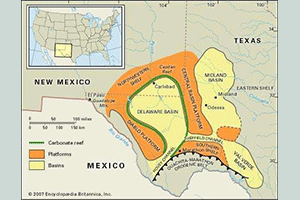

Update on the Permian Basin and Oil Market Outlook

|

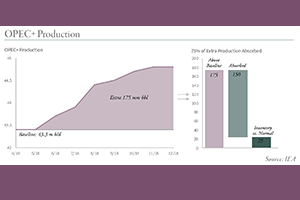

"If we are correct, this would take OECD Inventory levels to 4.2 bn bbl by the end of 2019 or 90 mm bbl below the ten-year average level – a record deficit.”

Data around drilling productivity in the Permian basin continues to be very interesting. We have long argued that the Permian would continue to grow materially over the next several years, but that this growth would be needed to balance strong demand and meet disappointments in production. |

Looking Ahead in 2019: Oil Fundamentals

|

“Based on our models, inventories will now resume their steady draws throughout the rest of the year and prices will resume their advance.”

While the severe weakness over the past several months has been the result of short-term policy errors, it has hidden many long-term bullish underlying fundamental trends currently taking place in global oil markets, all with potentially large consequences. |