Contrarian

11/07/2025

In a world captivated by technology and growth narratives, have investors overlooked the real story unfolding beneath their feet?In the latest episode of the W1M Why Invest? podcast, Goehring &...

10/31/2025

Gold, uranium, oil — and the potential for a major global monetary shift.In this episode, Adam Rozencwajg sits down with Erik Townsend and Patrick Ceresna on the MacroVoices podcast to unpack today’s...

10/24/2025

The article below is an excerpt from our Q2 2025 commentary. The world has decided it does not like oil. One would be hard-pressed to find another commodity so roundly scorned, so dismissed as a...

10/17/2025

The article below is an excerpt from our Q2 2025 commentary. In the second quarter, the commodity complex split neatly into two camps. On one side: uranium, platinum group metals, and...

10/10/2025

Gold continues to set new all-time highs, but according to Adam Rozencwajg, Managing Partner of Goehring & Rozencwajg, the story is far from over.In a recent interview with Investing News Network’s...

10/03/2025

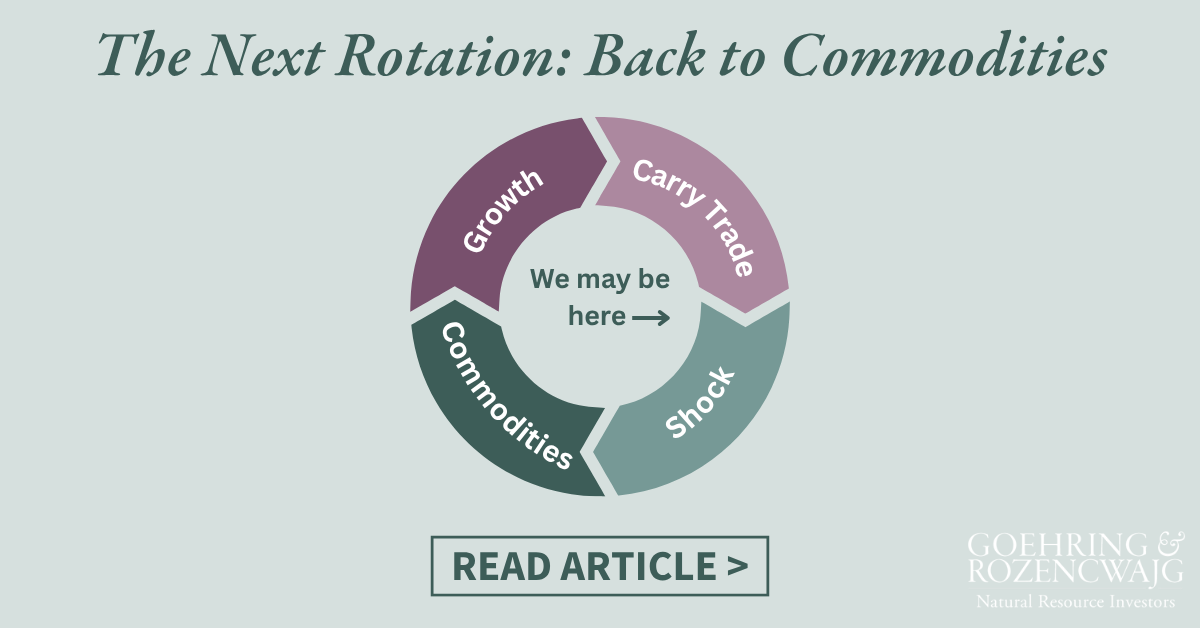

The article below is an excerpt from our Q2 2025 commentary. The financial world, like the social world, has its fashions. At cocktail parties, there are seasons of martinis and seasons of...

09/25/2025

At Goehring & Rozencwajg, we take a contrarian, research-driven approach to natural resources investing. In a recent conversation on Money Life with Chuck Jaffe, Adam Rozencwajg, Managing Partner at...

09/16/2025

Why investors should pay attention now.Leigh Goehring and Adam Rozencwajg have spent decades in the natural resources sector. Right now, they see a setup for gold, uranium, oil, natural gas, and...

09/04/2025

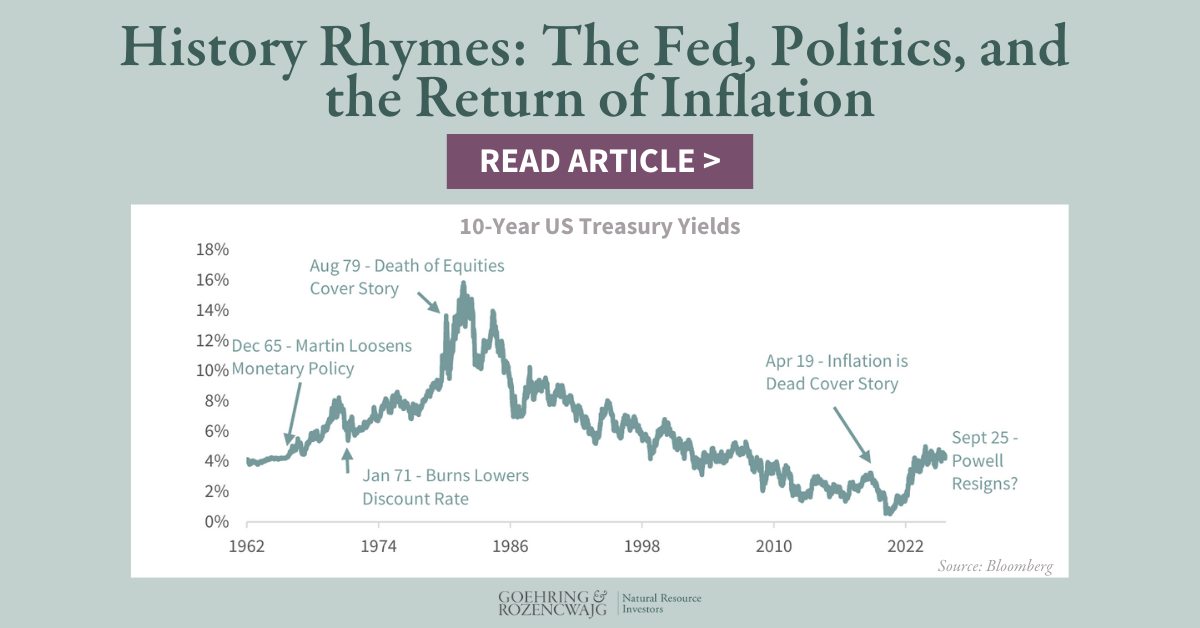

The article below is an excerpt from our Q2 2025 commentary. “Few challenges to the Federal Reserve independence have ever matched the drama of Dec. 5, 1965. Fed Chairman William McChesney Martin...

08/22/2025

The article below is an excerpt from our Q1 2025 commentary. In previous letters, we’ve written at length about our conviction that North American natural gas might well prove to be the...

.png)

.png)