02/26/2026

Adam Rozencwajg recently joined Chris Martenson on the Peak Prosperity podcast to discuss the evolving macro environment and its potential implications for commodities.The conversation explores: ...

02/19/2026

Leigh Goehring, Managing Partner at G&R, recently joined Jesse Day on the VRIC podcast to discuss why gold and silver may be far more than a strong recent trade—and why they could prove essential in...

01/21/2026

The article below is an excerpt from our Q3 2025 commentary. We have long taken a certain perverse pride in conducting research that is not merely original, but occasionally so unfashionable that...

01/15/2026

The article below is an excerpt from our Q3 2025 commentary. At Goehring & Rozencwajg, we’ve built our approach around a simple but often uncomfortable conviction: the best value in natural resource...

01/08/2026

Much has been written about the Trump administration’s actions in Venezuela and the supposed implications for the global oil market, though at this early stage it is already apparent that the subject...

01/07/2026

Watch our 7-minute video: Q3 2025 Market Commentary.Adam Rozencwajg, Managing Partner of G&R, recaps the latest research letter, highlighting why the era of stable, low-volatility markets—the...

12/19/2025

The article below is an excerpt from our Q3 2025 commentary. We spent the early days of October zig-zagging across New Zealand and Australia, where every meeting seemed to begin—and often end—with...

12/12/2025

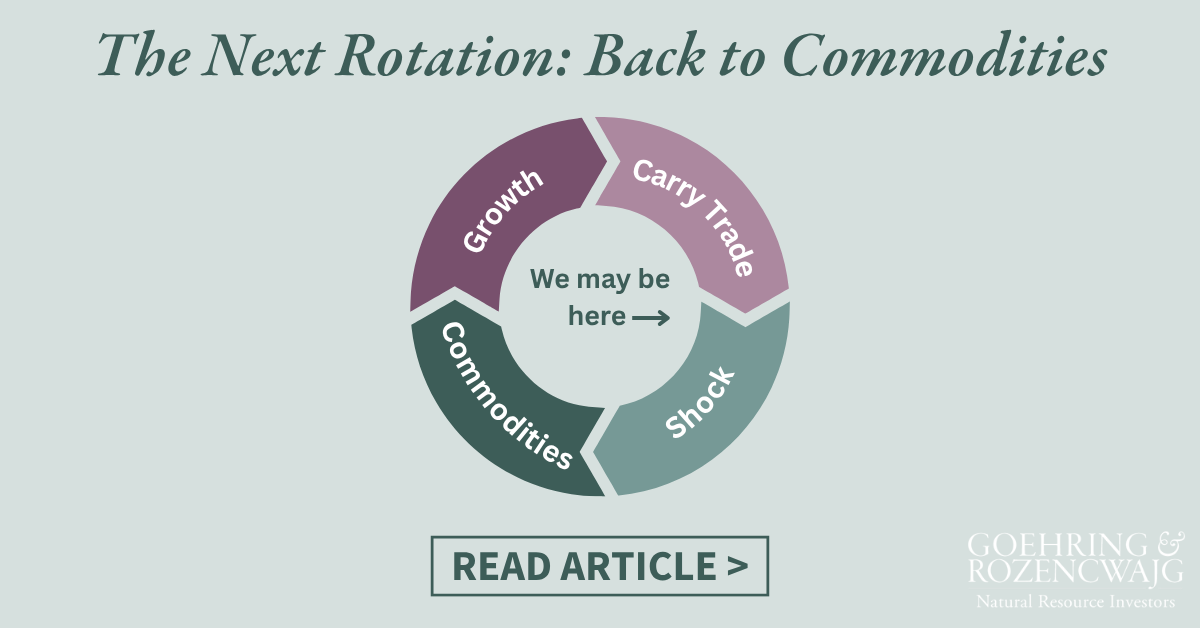

The article below is an excerpt from our Q3 2025 commentary. In our fourth-quarter 2024 letter (click here to view past commentaries), we introduced a framework that has since shaped much of our...

12/11/2025

Adam Rozencwajg joined The Contrarian Capitalist podcast to discuss whether gold is cheap or expensive at the moment.Adam A. Rozencwajg is the Co-Founder and Managing Partner of Goehring & Rozencwajg...

12/05/2025

Power shifts quietly—until the moment it reshapes markets. On the Top Traders Unplugged podcast, Niels Kaastrup-Larsen and Cem Karsan sit down with Adam Rozencwajg, Managing Partner of G&R, to unpack...

11/20/2025

The article below is an excerpt from our Q2 2025 commentary. President Trump’s recent executive action targeting reform at the Nuclear Regulatory Commission (NRC) may well go down as the most...

11/07/2025

In a world captivated by technology and growth narratives, have investors overlooked the real story unfolding beneath their feet?In the latest episode of the W1M Why Invest? podcast, Goehring &...

10/31/2025

Gold, uranium, oil — and the potential for a major global monetary shift.In this episode, Adam Rozencwajg sits down with Erik Townsend and Patrick Ceresna on the MacroVoices podcast to unpack today’s...

10/24/2025

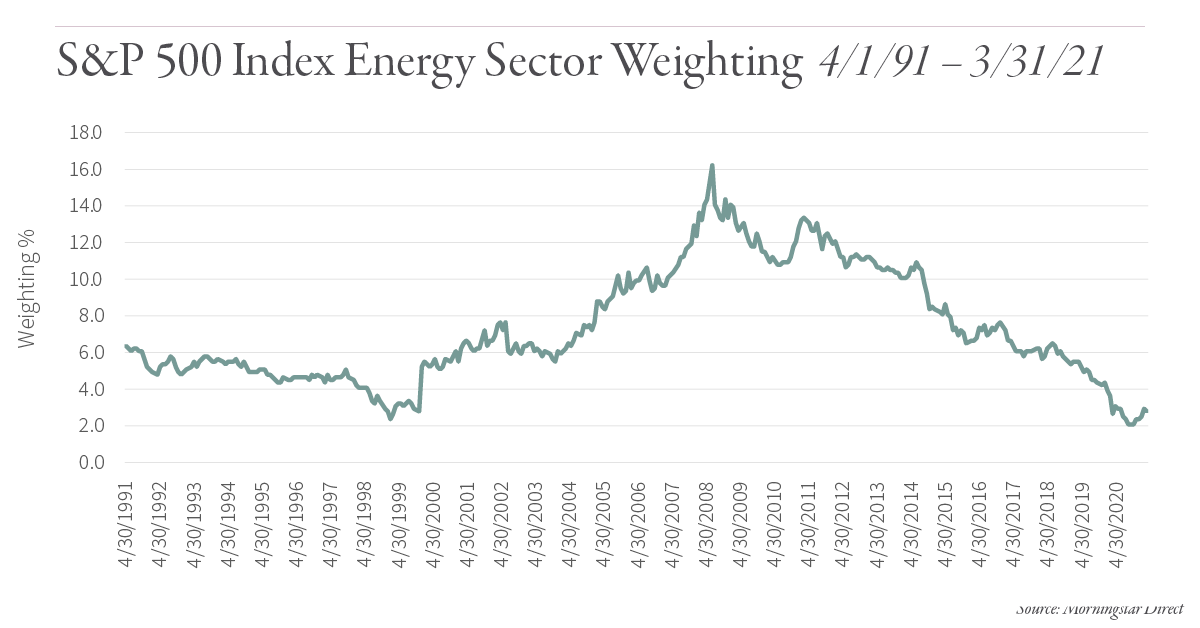

The article below is an excerpt from our Q2 2025 commentary. The world has decided it does not like oil. One would be hard-pressed to find another commodity so roundly scorned, so dismissed as a...

10/17/2025

The article below is an excerpt from our Q2 2025 commentary. In the second quarter, the commodity complex split neatly into two camps. On one side: uranium, platinum group metals, and...

10/10/2025

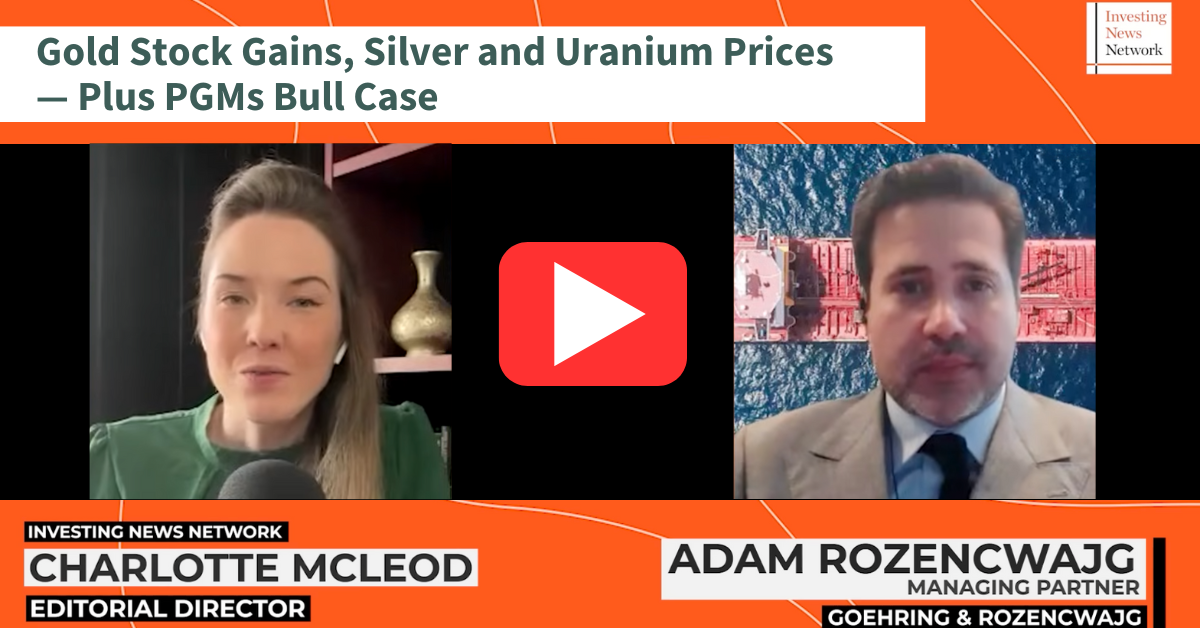

Gold continues to set new all-time highs, but according to Adam Rozencwajg, Managing Partner of Goehring & Rozencwajg, the story is far from over.In a recent interview with Investing News Network’s...

10/03/2025

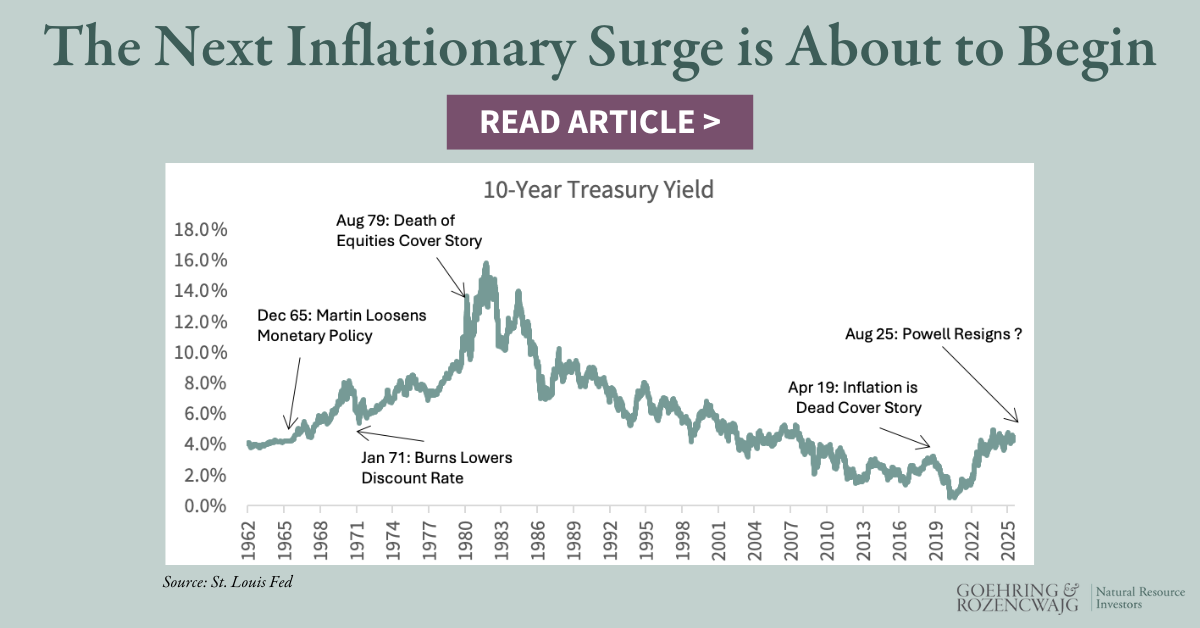

The article below is an excerpt from our Q2 2025 commentary. The financial world, like the social world, has its fashions. At cocktail parties, there are seasons of martinis and seasons of...

09/25/2025

At Goehring & Rozencwajg, we take a contrarian, research-driven approach to natural resources investing. In a recent conversation on Money Life with Chuck Jaffe, Adam Rozencwajg, Managing Partner at...

09/16/2025

Why investors should pay attention now.Leigh Goehring and Adam Rozencwajg have spent decades in the natural resources sector. Right now, they see a setup for gold, uranium, oil, natural gas, and...

09/04/2025

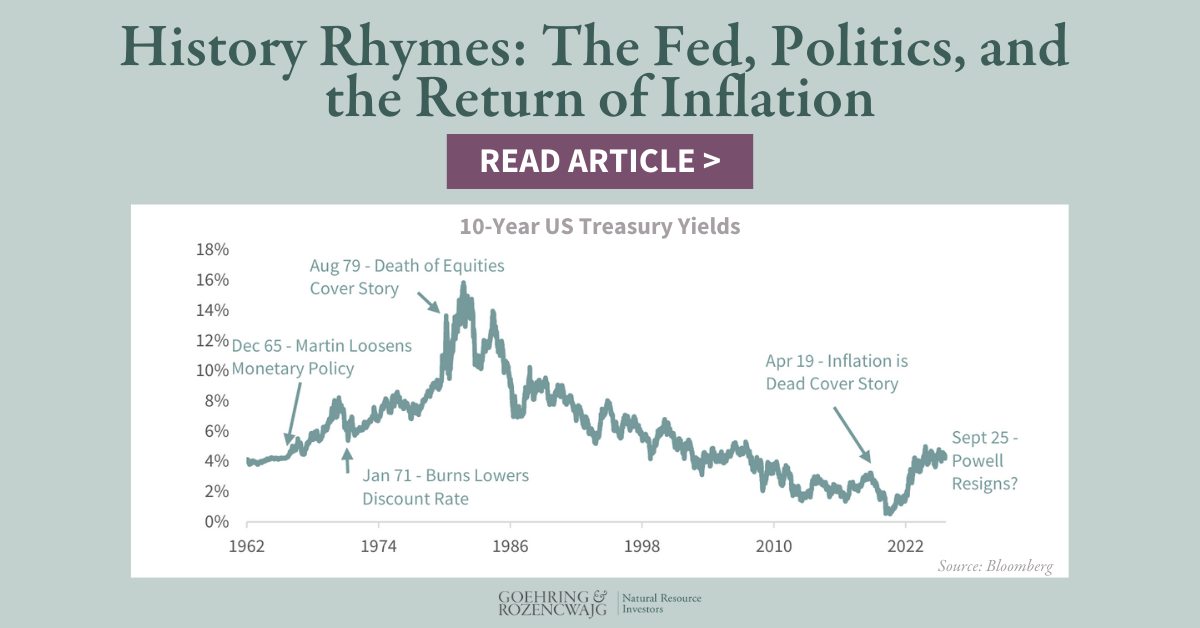

The article below is an excerpt from our Q2 2025 commentary. “Few challenges to the Federal Reserve independence have ever matched the drama of Dec. 5, 1965. Fed Chairman William McChesney Martin...

08/22/2025

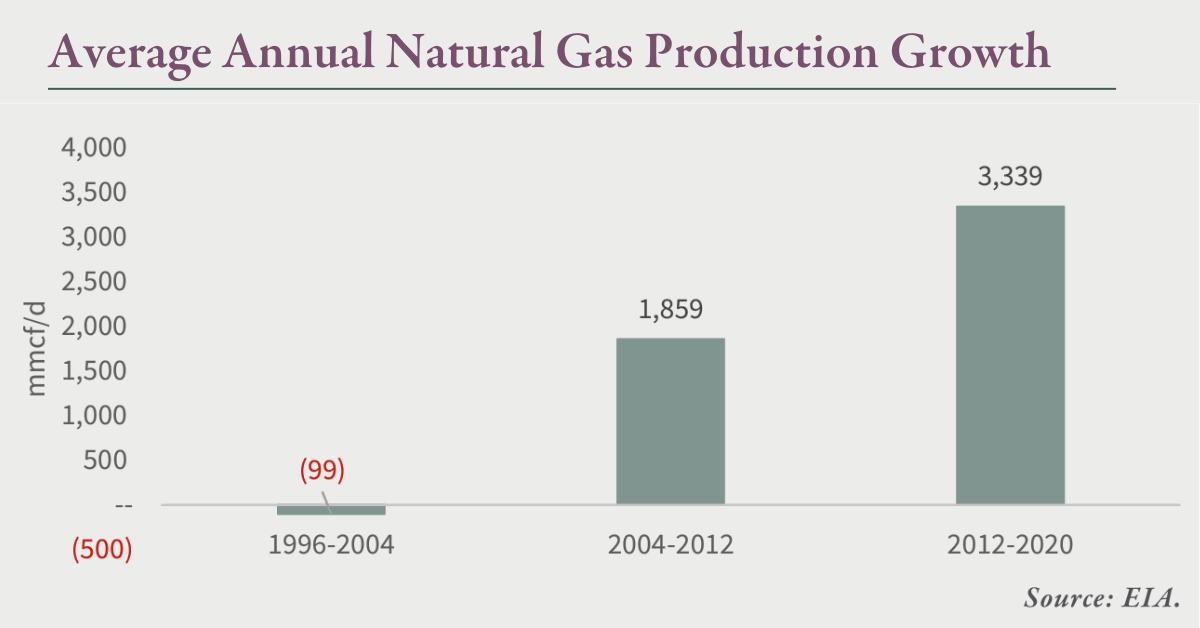

The article below is an excerpt from our Q1 2025 commentary. In previous letters, we’ve written at length about our conviction that North American natural gas might well prove to be the...

08/13/2025

The article below is an excerpt from our Q1 2025 commentary. Back in 2018, we posited that financial players—ever alert to overlooked corners of the commodity world—would emerge as a dominant force...

08/04/2025

“Few challenges to the Federal Reserve independence have ever matched the drama of Dec. 5, 1965. Fed Chaiman William McChesney Martin Jr. had just convinced the Board of Governors to raise the...

08/01/2025

You could say that natural resources run in Leigh Goehring’s blood. The son of two oil and gas engineers, Leigh has spent nearly his entire life studying markets and investments related to...

07/25/2025

Unlocking opportunity in an overlooked sector.Adam Rozencwajg, Managing Partner at Goehring & Rozencwajg, returns to The Value Perspective podcast for a deep dive into commodity investing.He covers:

07/11/2025

Concerns about a global supply glut and an uncertain demand outlook continue to weigh on crude prices. Commodity experts Wasif Latif and Adam Rozencwajg share their insights on MarketWatch on what’s...

07/02/2025

The article below is an excerpt from our Q1 2025 commentary. “In just 15 years, shale companies have increased U.S. oil production by about 8 million barrels of oil a day. The boom reduced the...

06/27/2025

In a recent interview with the Investing News Network, Adam Rozencwajg, Managing Partner at Goehring & Rozencwajg, shared his latest insights into the precious metals and energy markets, including...

06/20/2025

Is the next major commodities cycle already underway? Adam Rozencwajg, Co-Founder and Managing Partner at Goehring & Rozencwajg, joins Ed Coyne of Sprott Radio for a timely conversation on the...

06/13/2025

A Global Market Shake-Up: Why Rozencwajg Says Real Assets Are the FutureIs a new commodities supercycle already underway? According to Adam Rozencwajg, Managing Partner at Goehring & Rozencwajg, the...

06/04/2025

The article below is an excerpt from our Q1 2025 commentary. Has the Great Commodity Bull Market Quietly Begun? It is beginning to look that way. The signs are not yet shouted from the rooftops,...

05/29/2025

The article below is an excerpt from our Q1 2025 commentary. “Platinum Breaking Out on Surging Demand From China” ~Bloomberg, May 20th, 2025“BMW bets on petrol and sees rocky road to...

05/16/2025

We believe a global monetary reset is underway—with gold at the center. In our view, this shift is setting the stage for a commodity supercycle that could far surpass what most investors expect.We...

05/07/2025

Commodities are poised for a significant rise due to macroeconomic shifts, potential monetary regime changes, and the depletion paradox is now patrolling the US shale oil patch. In this insightful...

04/01/2025

The article below is an excerpt from our Q4 2024 commentary. We believe the time to buy natural resource equities has arrived. History, with its characteristic flair for the dramatic, has shown that...

03/21/2025

In a fascinating discussion, Adam Rozencwajg joined host Grant Williams on The Grant Williams Podcast to delve into the intricate world of commodity markets and their far-reaching implications for...

03/11/2025

Adam Rozencwajg joined the Top Traders Unplugged podcast with hosts Niels Kaastrup-Larsen and Cem Karsan to tackle a pressing issue: the potential for an imminent monetary regime shift. The...

02/28/2025

Is gold poised for a breakout? Adam Rozencwajg, CFA, Managing Partner of Goehring & Rozencwajg joined the Investing News Network and shared his insights on where the precious metal stands in its...

02/21/2025

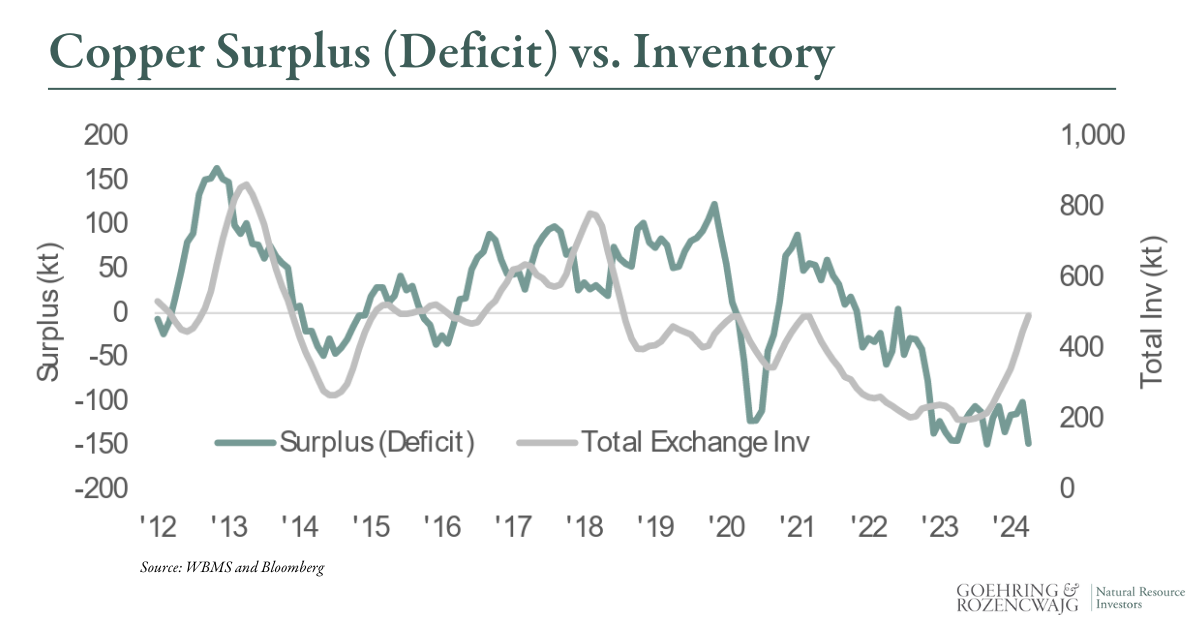

The article below is an excerpt from our Q3 2024 commentary. In last quarter's letter, we outlined a rising tide of bearish signals within the global copper market. Chief among them was the growing...

02/13/2025

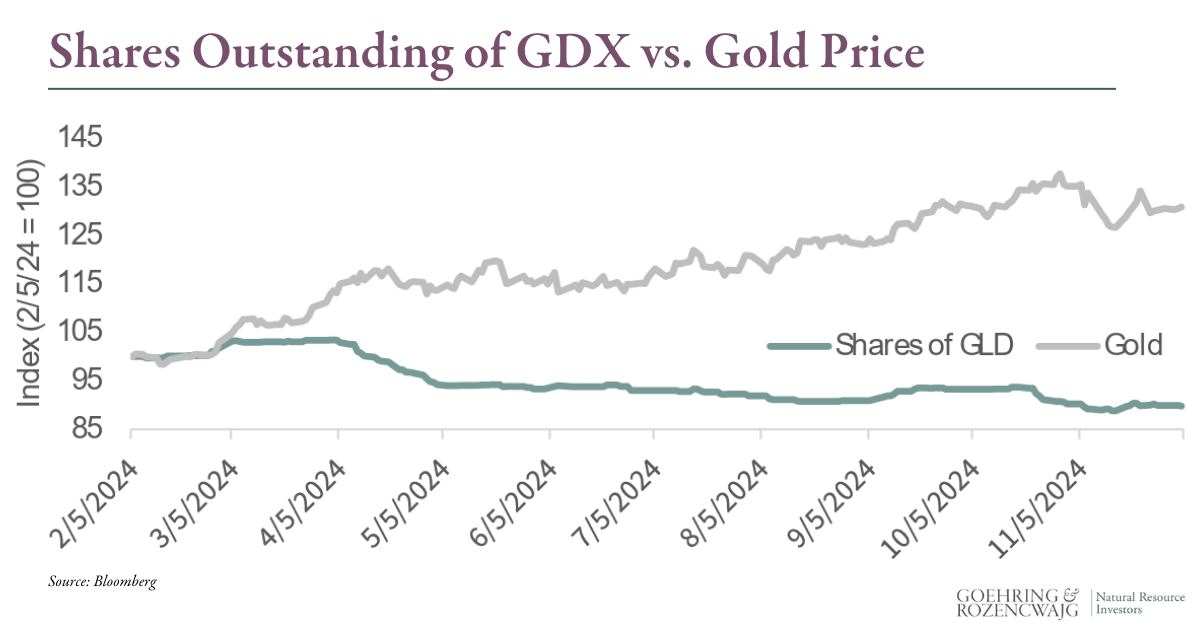

The article below is an excerpt from our Q3 2024 commentary. In the tumult of the global gold market, the past four years have unfolded as a clash of opposing forces. On one side, the steady...

02/04/2025

Adam Rozencwajg, CFA, Managing Partner at Goehring & Rozencwajg, joined the Peak Prosperity podcast, hosted by Dr. Chris Martenson to offer a contrarian investing perspective, showing how spotting...

01/30/2025

Leigh Goehring and Adam Rozencwajg, CFA, joined Jesse Day of VRIC Media and dived deep into the commodities markets, offering insights into key trends and investment opportunities. Key takeaways from...

01/23/2025

Nuclear Power is Back—and Bigger Than Ever! Once a symbol of fear, nuclear energy is now the solution to our climate crisis. Big names like Microsoft, Google, Amazon, and Meta are diving into the...

01/16/2025

Adam Rozencwajg, CFA, joined The Value Perspective Podcast, co-hosted by Juan Torres Rodriguez and Django Davidson from Hosking Partners. Together, they explore G&R’s deep value approach to...

01/09/2025

Q3 2024 natural resources saw volatility: Natural gas inventories fell, oil faced a contrarian opportunity, coal stocks rebounded, precious metals surged, uranium saw supply concerns &...

01/03/2025

As Natural Resource Investors, our goal is to keep you updated on the latest developments in the commodities and natural resources sectors, empowering you to make well-informed investment decisions....

12/19/2024

The article below is an excerpt from our Q3 2024 commentary. The great drama of American shale production may now be nearing its final act. For years, we have anticipated that the relentless growth...

12/13/2024

The article below is an excerpt from our Q4 2023 commentary. “How the world’s biggest offshore wind company was blown off course: Denmark’s Ørsted was once seen as a model for how oil and gas giants...

11/21/2024

Leigh Goehring, Managing Partner at Goehring & Rozencwajg, recently spoke with the Investing News Network about why G&R believes the gold bull market is just starting and shared his insights on the...

11/14/2024

The article below is an excerpt from our Q2 2024 commentary and was first published on August 22, 2024, ahead of Kazatomprom’s announcement on August 23rd. “Uranium Fever Backed by Bill Gates Betting...

11/07/2024

The article below is an excerpt from our Q2 2024 commentary. Natural gas production is plummeting—a condition noted by almost no analysts. Between December 2023 and May 2024, U.S. dry gas supply has...

10/08/2024

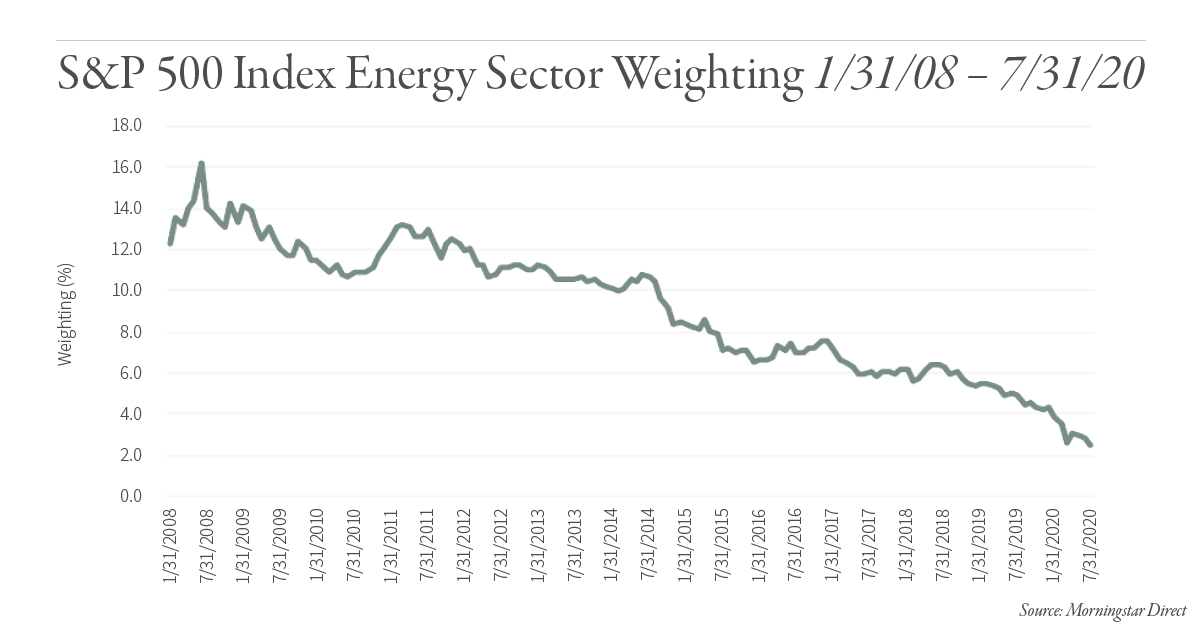

The article below is an excerpt from our Q2 2024 commentary. Investors showed little interest in commodities and natural resource equities in the second quarter. The A.I. frenzy continues to...

09/27/2024

The article below is an excerpt from our Q2 2024 commentary. “Let us pledge that by 1980, under Project Independence, we shall be able to meet America’s energy needs from America’s own energy...

09/13/2024

The article below is an excerpt from our Q2 2024 commentary. As we write, gold has surged past the $2,500 mark for the first time in history, an event that would seem to herald a golden age for gold...

09/05/2024

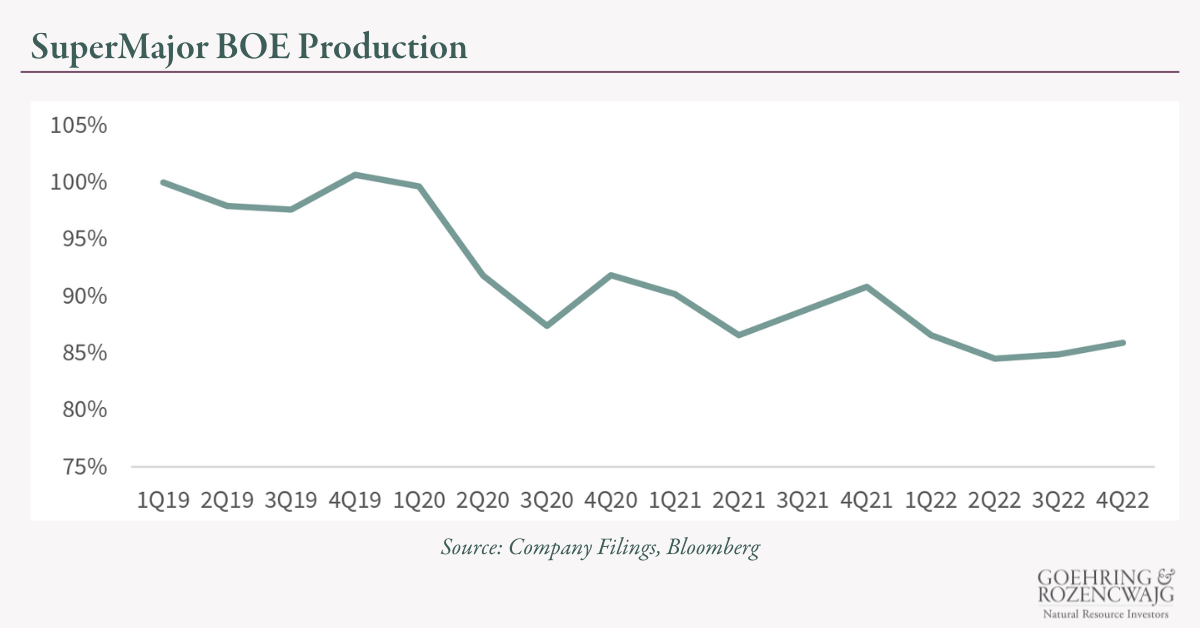

Prefer to listen to this article? Please click the play button above. The article below is an excerpt from our Q2 2024 commentary. We first unveiled this chart (shown below) in our 1Q2019 letter and...

08/21/2024

Prefer to listen to this article? Please click the play button above. "Uranium Fever Backed by Bill Gates Betting on Nuclear Energy"~ Bloomberg 7/09/2024"One of The Last Holdouts, Australia Weighs...

08/15/2024

Prefer to listen to this article? Please click the play button above. The article below is an excerpt from our Q1 2024 commentary. In the wake of the 1929 stock market crash and the Great...

08/08/2024

Prefer to listen to this article? Please click the play button above. The article below is an excerpt from our Q1 2024 commentary. The following is an excerpt from an open letter written by John...

08/01/2024

Prefer to listen to this article? Please click the play button above. The article below is an excerpt from our Q1 2024 commentary. WTI Crude Oil1/1/1970: $3.182/15/1981: $34.301/1/2000: $25.55...

07/26/2024

Exciting developments are unfolding in the global oil and North American natural gas markets, presenting a unique opportunity for investors willing to take a contrarian approach. We believe there is...

07/18/2024

Adam Rozencwajg teamed up with WTFinance podcast host Anthony Fatseas to delve into the looming Monetary System Revolution. In this intriguing episode of the WTFinance podcast, the discussion...

07/10/2024

Prefer to listen to this article? Please click the play button above. The article below is an excerpt from our Q1 2024 commentary. We believe the North American natural gas market has reached a...

06/27/2024

Adam Rozencwajg and Yra Harris joined the Financial Repression Authority to discuss Commodities and Geo-Political Risks. They offer valuable perspectives on the overall economy and financial...

06/20/2024

During his interview with Jeremy Szafron of KITCO News, Adam Rozencwajg, Managing Partner at Goehring & Rozencwajg, delves deep into the intricate dynamics of the precious metals market. By focusing...

05/29/2024

Leigh Goehring, Managing Partner at G&R and a seasoned investor in natural resources, recently shared his wealth of experience on the Commodity Culture podcast. His message is clear: the time to dive...

05/22/2024

Adam Rozencwajg, Managing Partner at G&R, recently joined the MacroVoices podcast, hosted by Erik Townsend and Patrick Ceresna, to provide insightful updates on the energy markets, precious metals...

05/16/2024

Prefer to listen to this article? Please click the play button above. The article below is an excerpt from our Q4 2023 commentary. Over the last sixteen months, weak grain prices have left traders...

05/08/2024

Where does G&R stand on Bitcoin? Does Bitcoin deserve a place in a diversified portfolio along with gold? Adam Rozencwajg, CFA, answers these questions and many more on investing in gold, silver and...

05/03/2024

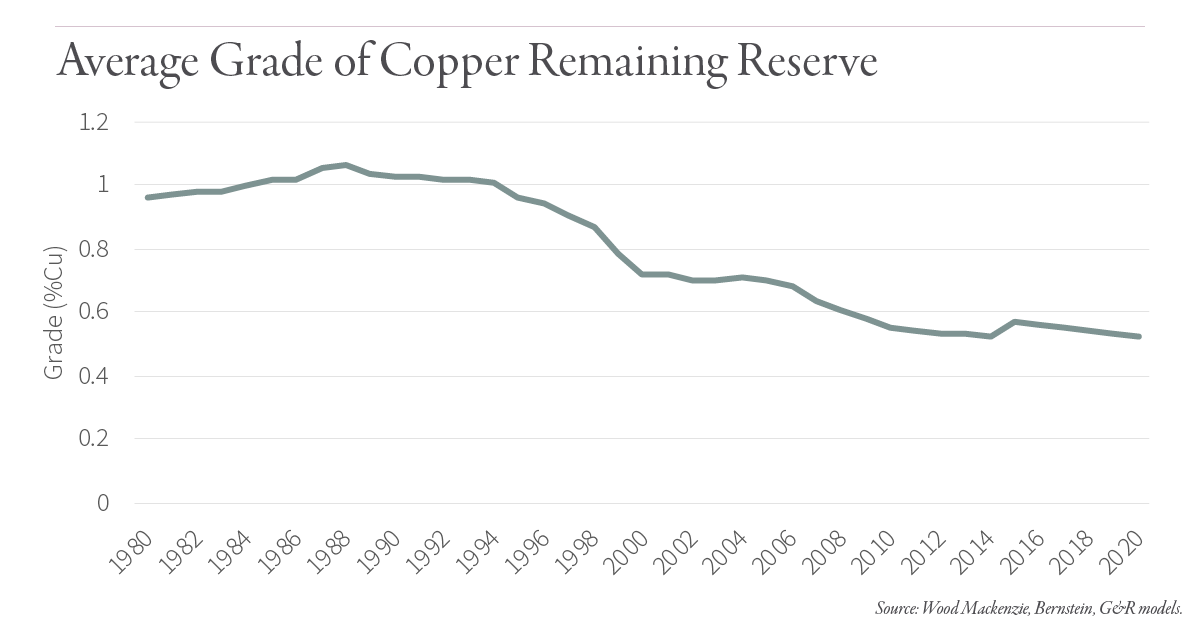

The article below is an excerpt from our Q4 2023 commentary. Copper demand was extremely strong in 2023, growing 7.3% year-on-year over the first ten months, according to the World Bureau of Metal...

04/24/2024

The article below is an excerpt from our Q4 2023 commentary. On January 12th, Kazatomprom, the publicly traded Kazakh national uranium company, shocked the markets by announcing it could not meet...

04/17/2024

Electric vehicles (EVs) have been widely hailed as a key part of the transition to green energy, but are they helping as much as we think they are? Adam Rozencwajg, CFA, spoke with Charlotte McLeod...

04/11/2024

The article below is an excerpt from our Q4 2023 commentary. Five years ago, we became uranium bulls. We explained how the market had quietly slipped into a structural deficit, with reactor demand...

04/03/2024

The article below is an excerpt from our Q4 2023 commentary. The biggest mystery in oil markets surrounds the apparent surge in US production. At the beginning of 2023, we predicted shale growth...

03/27/2024

The article below is an excerpt from our Q4 2023 commentary. “Saudi Aramco Abruptly Drops Plans to Expand Oil Production,” ~ The New York Times, January 30, 2024 In an unexpected move, Aramco, the...

03/21/2024

The article below is an excerpt from our Q4 2023 commentary. Commodities were mixed during the fourth quarter. The Goldman Sachs Commodity Index (GSCI), heavily weighted toward energy, fell by a...

03/07/2024

Challenge Accepted: Convince Me in 15 Minutes That Uranium is in a Bull Market. Joining the engaging podcast, Convince Me in 15 Minutes, Adam Rozencwajg makes a compelling argument for the promising...

02/28/2024

The article below is an excerpt from our Q4 2023 commentary. “Electric vehicles (EVs) are pilling up on lots across the country as the green revolution hits a speed bump, data show.” ~ USA Today,...

02/27/2024

The article below is an excerpt from our Q3 2023 commentary. There are notable similarities between the uranium market twelve months ago and today’s oil market. Almost overnight, uranium went from...

02/16/2024

"Wouldn't a recession and continued economic weakness reduce energy demand and thus be bearish for oil and gas prices?" This is a common question that frequently arises during discussions on the ...

02/09/2024

The Permian shale oil basin is very close to peaking out. When it does, everything changes for the US and the world. "Everyone thought 2019 was the all-time high for Energy and Oil demand and that...

02/02/2024

The article below is an excerpt from our Q3 2023 commentary. Real interest rates and gold have always moved in opposite directions. When real interest rates rise, gold falls, and when real rates...

01/26/2024

Looking at the next 50 years, is the threat of Peak Cheap Oil fact or overblown fear? A month has passed since energy analyst Doomberg released his controversial report titled "Peak Cheap Oil Is A...

01/19/2024

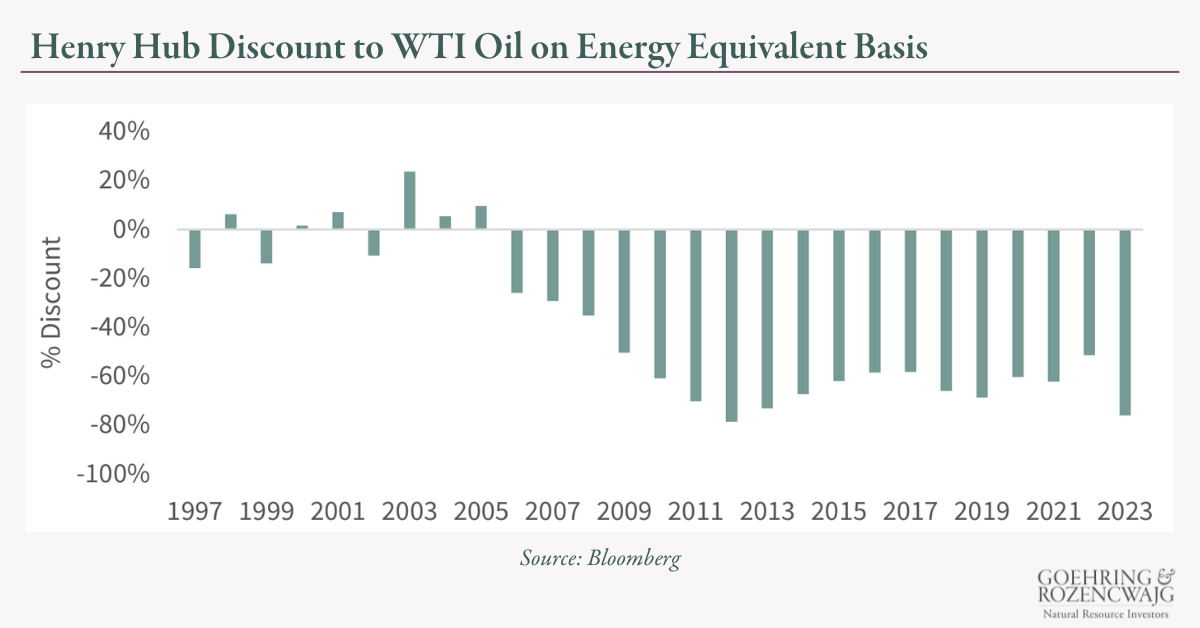

The article below is an excerpt from our Q3 2023 commentary. North American natural gas is the cheapest energy molecule on the planet by as much as 75%. Over the next twelve months, we believe this...

01/12/2024

The article below is an excerpt from our Q3 2023 commentary. In 2018, uranium assets were widely considered to be stranded assets. Following the 2011 Japanese earthquake and tsunami, utilities...

01/05/2024

As Natural Resource Investors, we aim to keep investors informed of what is happening in the commodities and natural resources sectors so that you can make informed investment decisions. In 2023, a...

12/22/2023

The article below is an excerpt from our Q3 2023 commentary. In late 2021, we made a bold and deeply contrarian call: we predicted massive capital flows into renewable energy could potentially...

12/14/2023

The article below is an excerpt from our Q3 2023 commentary. “It is a confusion of ideas to suppose that the economical use of fuel is equivalent to diminished consumption. The very contrary is the...

12/08/2023

Adam Rozencwajg, CFA, Managing Partner at Goehring & Rozencwajg, joined "Money Life with Chuck Jaffee" to discuss investing in natural resources and commodities in today's market. We invite you to...

11/21/2023

The article below is an excerpt from our Q2 2023 commentary. Driven by concerns of an impending global recession, copper sentiment remained bearish during the second quarter. On the other hand,...

11/17/2023

What is happening in the energy markets? Why is there an underinvestment in energy over the past decade? What is the risk of price fluctuations? What does this mean for prices? Adam Rozencwajg, CFA,...

11/09/2023

In 2023, renewables are grappling with rising costs and higher interest rates. The perception of nuclear power in the energy transition is shifting. Is this a long-term change? Natural gas remains a...

11/01/2023

In this episode of The Super Terrific Happy Hour podcast, Stephanie Pomboy and Grant Williams are joined by a panel of guests to discuss the macro environment as it pertains to inflation and how each...

10/24/2023

"I think that it's entirely plausible to see uranium at US$300 in a spike," ~Adam Rozencwajg, Managing Partner, Goehring & Rozencwajg Adam Rozencwajg joined Charlotte McLeod of the Investing News...

10/05/2023

The article below is an excerpt from our Q2 2023 commentary. In our view, natural gas prices are reaching a turning point. Gas spiked to decade highs last spring following Russia’s invasion of...

09/29/2023

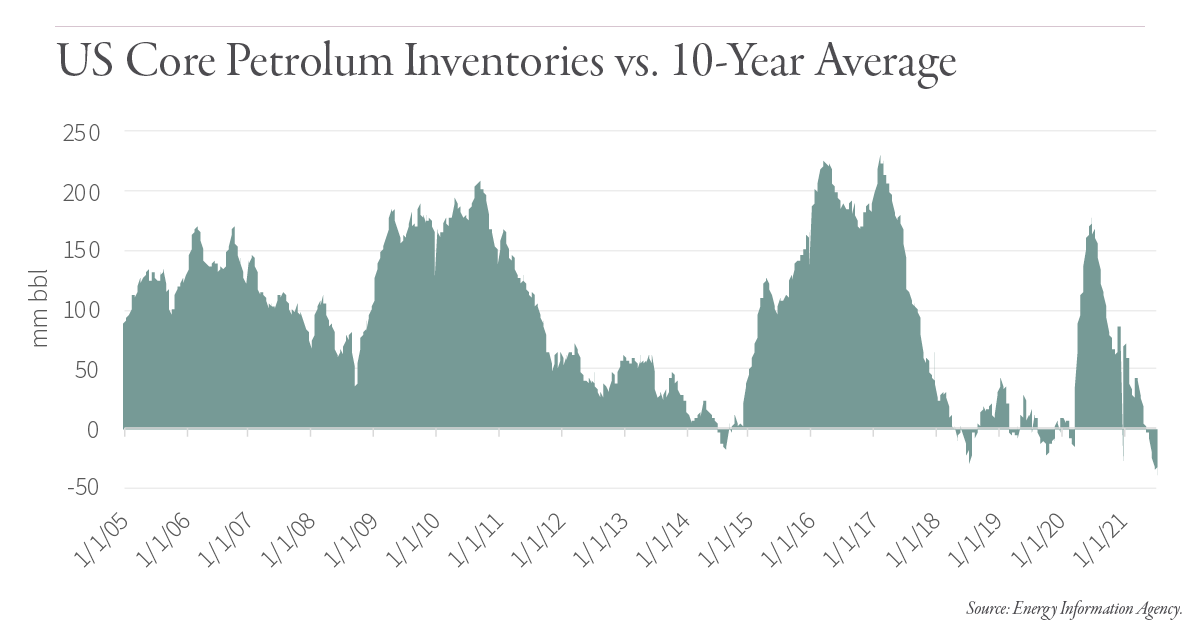

The article below is an excerpt from our Q2 2023 commentary. We believe oil is on the verge of a sharp rally. As we write this, West Texas Intermediate and Brent trade for $84 and $87 per barrel,...

09/22/2023

In this episode, Adam Rozencwajg joined Jacob Shapiro of the Lykeion Channel for an inaugural episode of "The Geopolitics of Commodities".Adam and Jacob discuss a wide range of topics including...

09/14/2023

The article below is an excerpt from our Q2 2023 commentary. Why has uranium rallied while every other energy commodity has collapsed? Over the past twelve months, spot uranium advanced 12% while...

09/07/2023

The article below is an excerpt from our Q2 2023 commentary. Commodities and related natural resource markets were broadly weak in the second quarter. Investors remained concerned about a global...

08/31/2023

The article below is an excerpt from our Q2 2023 commentary. Gold is no different than any other asset class: it becomes popular, rises in price, is overvalued, and ultimately represents a poor...

08/24/2023

The article below is an excerpt from our Q2 2023 commentary.Picture it, if you will: December of 2029. In a dimly lit private dining room, the sound of cutlery clinking blends with spirited...

08/10/2023

The article below is an excerpt from our Q1 2023 commentary.We are using the 1970s as an analog for precious metals this decade. So far, it is proving to be prescient. By 1974, silver had...

08/03/2023

Are we in a commodity supercycle? In this episode, Adam Rozencwajg, Managing Partner at G&R, joined UBS's Paul Stefansson to explore the future of the commodity market and how the energy transition...

07/27/2023

Leigh Goehring, Managing Partner at G&R, recently joined the MacroVoices podcast, hosted by Erik Townsend and Patrick Ceresna, to provide an insightful update on the global food crisis. This crisis...

07/24/2023

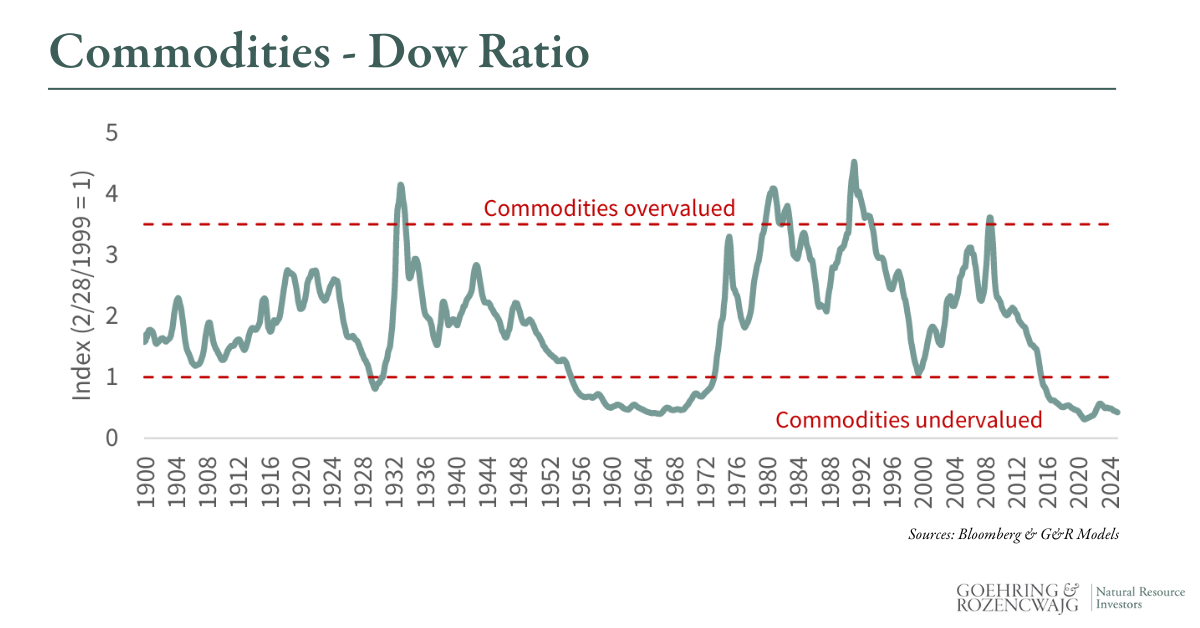

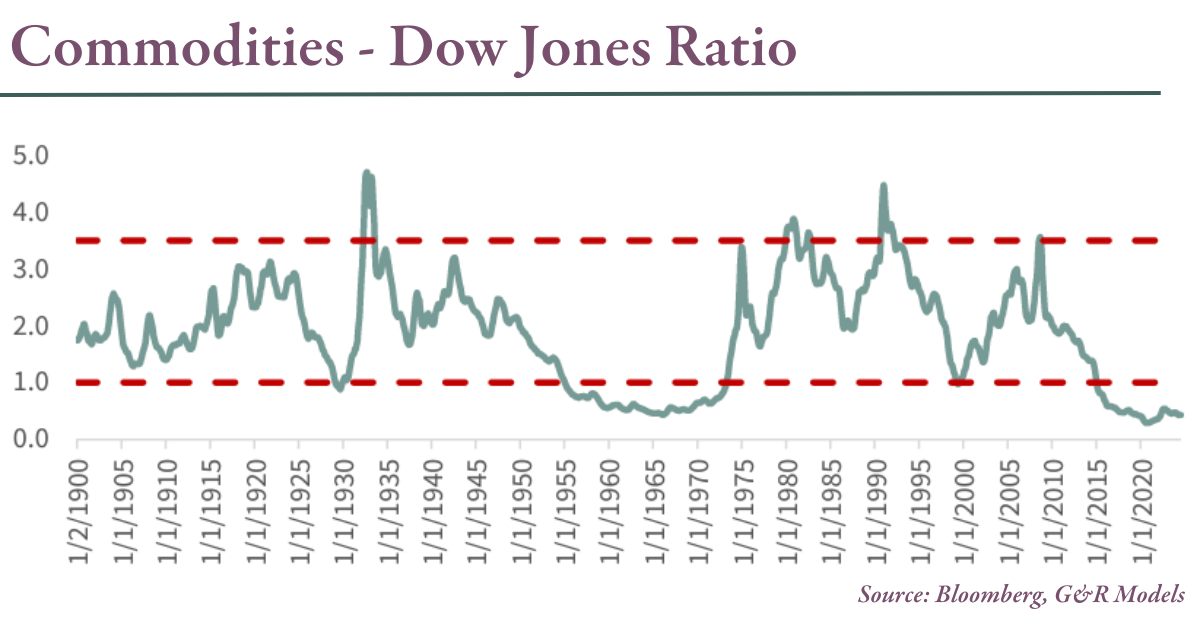

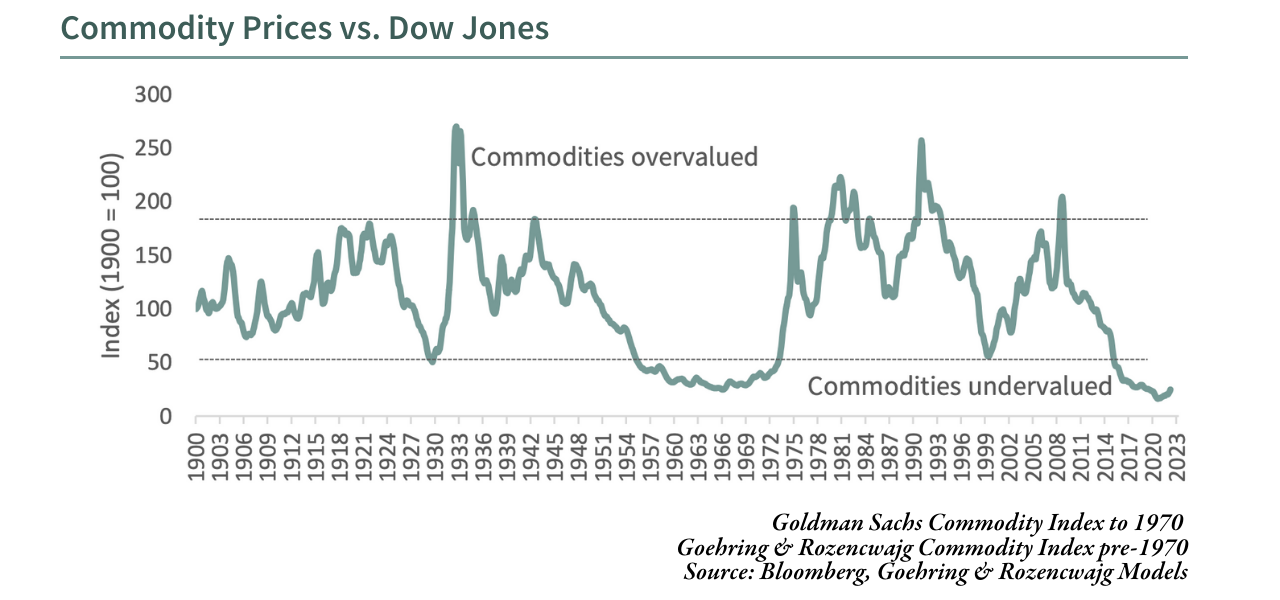

The article below is an excerpt from our Q1 2023 commentary.In 2016, we published the following chart comparing commodities to the Dow Jones Industrial Average. Mr. Gundlach of DoubleLine had issued...

07/14/2023

"From a supply perspective (regarding the energy market) I think we are at a very dangerous and important inflection point right now -- and that's because the shale basins which heretofore have been...

07/10/2023

We're halfway through the year, so we thought it would be a perfect time for us to pause and reflect on our written works. Below are the three most viewed blog posts for the year 2023 so far. Thank...

06/30/2023

The article below is an excerpt from our Q1 2023 commentary.The most crucial development in global oil markets is depletion in the Permian basin. We first warned about this in 2018, predicting the...

06/23/2023

"We think that gold has entered into a new phase of this bull market," said Adam Rozencwajg of Goehring & Rozencwajg (G&R).G&R has been bullish on gold for quite some time, but we have been mostly...

06/15/2023

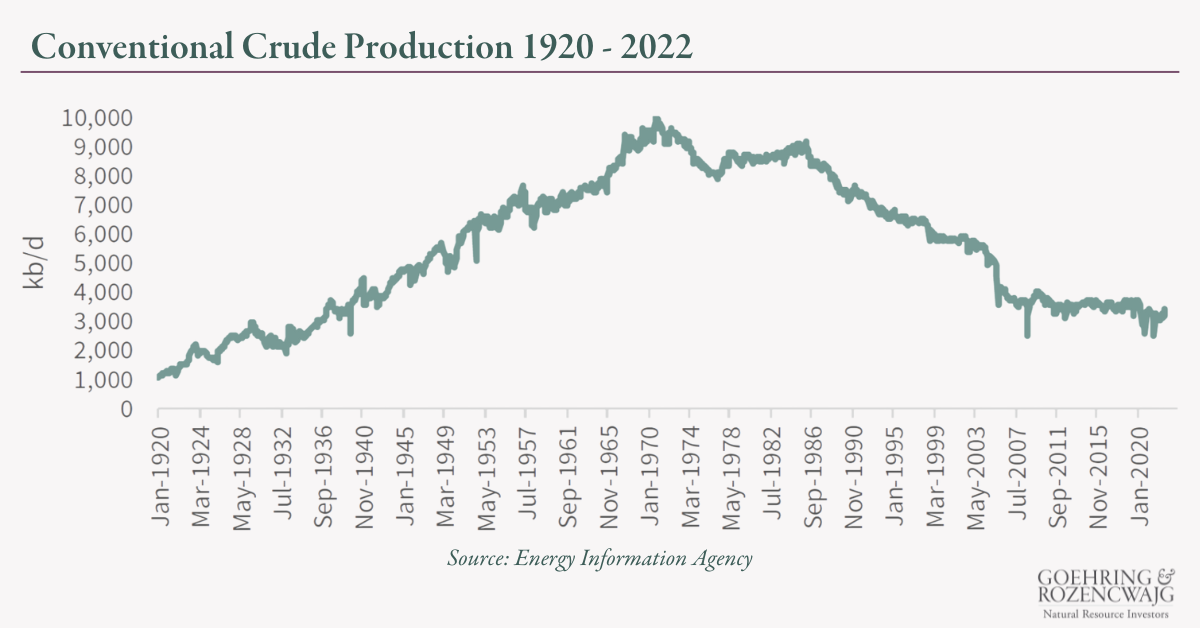

The article below is an excerpt from our Q1 2023 commentary.Conventional oil production has now unequivocally rolled over. Unconventional production, the only source of growth in global oil supply...

06/08/2023

Curious about the state of natural resources in today's market?Then this podcast episode is for you.Adam Rozencwajg, CFA, Managing Partner of Goehring & Rozencwajg, recently joined the Top Traders...

05/25/2023

What are the impacts of rising interest rates on commodities? Where are rates headed? What does it mean for prices, traders, producers, investment and the energy transition? HC Insider Podcast hosts...

05/18/2023

The article below is an excerpt from our Q4 2022 commentary. “Egg prices soar due to deadly bird flu outbreak.” ~Times Union 1/18/2023 When commodity markets fall into structural deficit, prices...

05/12/2023

The article below is an excerpt from our Q4 2022 commentary. “Codelco Production Slump Shows Copper’s ‘Tremendous Challenge’” ~Bloomberg 1/24/2023 Copper demand remains strong. According to the...

05/05/2023

The article below is an excerpt from our Q4 2022 commentary.On December 13th, 2022, the U.S. Department of Energy (DOE) announced a nuclear fusion breakthrough. For the first time in history,...

04/28/2023

The article below is an excerpt from our Q4 2022 commentary.Analysts constantly state that renewable energy competes favorably against natural gas and coal-fired electricity generation on an...

04/21/2023

The article below is an excerpt from our Q4 2022 commentary.“The Decade of Shortages” was the unofficial theme for our investor day, held on November 3rd, 2022. Our audience heard presentations from...

04/14/2023

Adam Rozencwajg, CFA, Managing Partner at Goehring & Rozencwajg, recently joined MacroVoices host Erik Townsend to discuss the energy, gold, copper, and uranium markets. This recent discussion...

04/05/2023

The article below is an excerpt from our Q4 2022 commentary.Our Q1 2022 letter explained why North American natural gas prices would surge. After making a 25-year low of $1.48 per mmcf in June 2020,...

03/31/2023

The article below is an excerpt from our Q4 2022 commentary.We believe investors are being far too complacent about oil markets.After making a 14-year high of $130 per barrel in March, prices have...

03/27/2023

Managing Partner Adam Rozencwajg, CFA, was recently interviewed by Paul Chapman of HC Insider Podcast - Conversations in Commodities.During their conversation, they discuss how decarbonization is...

03/24/2023

The article below is an excerpt from our Q4 2022 commentary.Commodity prices rebounded in Q4. Natural resource-related equities were firm.Investors came back into commodity-related markets, hoping...

03/20/2023

Managing Partner Leigh Goehring was recently interviewed by Decouple Media.In this interview, they deep dive into fracking and shale, the energy source that put Peak Oil concerns on the back burner...

03/15/2023

The article below is an excerpt from our Q4 2022 commentary. “BP’s CEO Plays Down Renewables Push and Returns Lag” “Mr. Looney [(BP’s CEO)] has said he is disappointed in the returns from some of the...

03/09/2023

The article below is an excerpt from our Q4 2022 commentary.Crude oil fundamentals are very tight and risk getting considerably tighter. Investors continue to starve energy companies of much-needed...

02/23/2023

Several state treasurers have withdrawn billions of dollars worth of investment assets from managers over ESG concerns in recent months. The treasurers felt that firms like BlackRock were too focused...

02/16/2023

Managing Partner Adam Rozencwajg, CFA was recently interviewed on TD Ameritrade Network. During this 6-minute conversation, Adam touched based on: Why investors need to watch oil prices - (2023 is...

01/05/2023

Over the past 30 months, energy prices went from an all-time record low (negative oil prices) to all-time record highs as strong demand and disappointing supply were complicated by the war in Ukraine.

12/20/2022

The article below is an excerpt from our Q3 2022 commentary.Inflation continued to surprise to the upside in Q3. Aggressive central bank tightening and ongoing worries over China’s “COVID-zero”...

12/07/2022

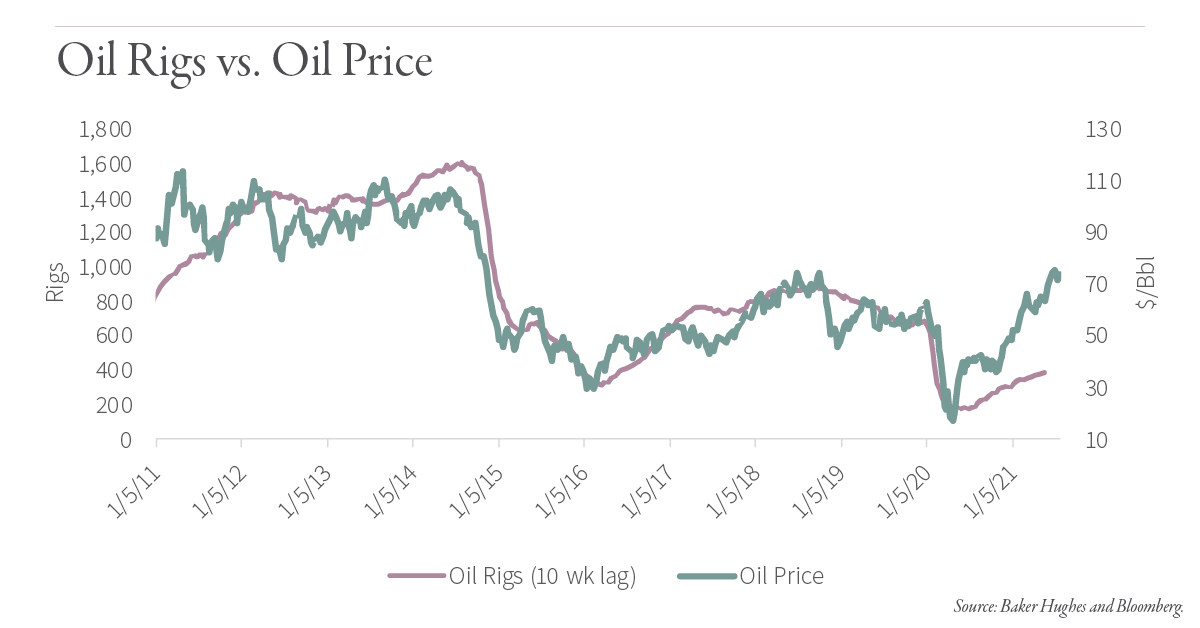

The article below is an excerpt from our Q3 2022 commentary.The most pressing question facing oil markets is why US shale drilling remains so muted despite high prices. A simple question whose answer...

11/18/2022

Goehring & Rozencwajg hosted afascinating one-day live eventto discusshow to prepare for the coming decade of shortages in everything from energy to materials and agriculture,on Thursday,...

11/09/2022

“I do think that things have really fundamentally changed here, and I think the next number of years will be a little bit different. I think we have to let the dust settle to really understand the...

10/27/2022

The article below is an excerpt from our Q2 2022 commentary.Ever since silver staged a furious catch-up rally back in the summer of 2020 -- something that has always signaled a long corrective phase...

10/20/2022

The article below is an excerpt from our Q2 2022 commentary. "The Kingdom has announced an increase in its production capacity level to 13 million bpd, after which the Kingdom will not have any...

10/14/2022

The article below is an excerpt from our Q2 2022 commentary.Our Q4 2021 commentary was entitled “The Distortions of Cheap Energy.” In our lead essay, we explained how extremely low energy prices...

10/04/2022

The article below is an excerpt from our Q2 2022 commentary.The global natural gas crisis has entered its most dangerous phase yet. We just returned from the UK, Switzerland, and Germany and the mood...

09/30/2022

“We have an energy crisis, we don’t have enough energy today. And yet people are saying that the answer is that we have to get away from oil and gas and invest more in renewables. It will only make...

09/16/2022

The article below is an excerpt from our Q2 2022 commentary.“Are you embarrassed as an American company that your production is going up while the European counterparts are going down…. Would you...

09/09/2022

The article below is an excerpt from our Q2 2022 commentary. The pendulum continued to swing in favor of nuclear power during Q2. The Russian invasion of Ukraine has put national energy security...

08/11/2022

Adam Rozencwajg, CFA, Managing Partner at Goehring & Rozencwajg, joined MacroVoices hosts Erik Townsend and Patrick Ceresna to discuss how the world has entered the early stages of a global energy...

08/05/2022

Goehring & Rozencwajg are pleased to invite all Institutional Investors, Advisors and friends of the firm to 2022 Investor Day on Thursday, November 3, in New York City.

07/28/2022

"A reader lives a thousand lives before he dies."~George R. R. Martin Summer is a time to relax, reflect and if you are like us, continue to do more reading. As Natural Resource Investors, our...

07/21/2022

The article below is an excerpt from our Q1 2022 commentary. Uranium prices surged during Q1. Spot uranium advanced 26% from $42 to $53 per pound while the quoted term price rose 19% from $42 to $50...

07/13/2022

The article below is an excerpt from our Q1 2022 commentary. “World Bank warns of ‘human catastrophe’ food crisis.” - BBC News, April 20, 2022“Farmers are seeing prices for fertilizers skyrocket....

07/07/2022

While we are at the midpoint of the year, we'd like to take a moment to reflect on our writings. Below you will find our top 3 most viewed blog posts of 2022 to date.We sincerely appreciate your...

06/30/2022

The article below is an excerpt from our Q1 2022 commentary. Between 2010 and 2020 the world grew accustomed to cheap, abundant conventional energy. Global energy markets were so well supplied for so...

06/22/2022

The article below is an excerpt from our Q1 2022 commentary. On April 20th, 2019, Bloomberg/BusinessWeek magazine published an issue entitled “Is Inflation Dead?” with a dead dinosaur prominently...

06/16/2022

The article below is an excerpt from our Q1 2022 commentary. One of the most frequent questions we get asked regarding this commodity bull market is: “Have I missed it? Is it too late to make an...

06/09/2022

Charts of the Quarter Top Chart: Not only is the commodity bull market not over, it has hardly begun. This chart shows the returns of the Goldman Sachs commodity index versus the level of the US...

05/13/2022

Adam Rozencwajg, CFA, Managing Partner at Goehring & Rozencwajg, joined the "Top Traders Unplugged" podcast as part of their Global Macro series. In this episode, The Dark Side of Renewable Energy,...

04/21/2022

A sudden and unexpected event is about to take place: the global natural gas crisis, now gripping large swaths of the world, is about to engulf North America as well.Asian and European natural gas...

04/13/2022

Tensions between Russia and Ukraine have thrown oil and gas prices into focus, but an energy crisis has been brewing for much longer than the war has been going on.In an interview with Investing News...

04/05/2022

Massive price spikes are occurring in a number of critical commodities after Russia's invasion of Ukraine.In this Financial Sense Newshour Podcast (recorded March 8, 2022), Adam Rozencwajg shares an...

03/31/2022

The article below is an excerpt from our Q4 2021 commentary. Without US liquefied natural gas (LNG), Europe may well have frozen literally to death this winter. We believe what is happening with...

03/24/2022

The article below is an excerpt from our Q4 2021 commentary. “The world has already passed ‘peak oil’ demand, according to Carbon Brief analysis of the latest energy outlook from oil major BP.” ...

03/18/2022

Managing Partners Leigh Goehring and Adam Rozencwajg recently hosted a video webinar that was viewed live by over 1,300 people.

03/03/2022

We rarely republish old essays but given its importance we felt the need to do so in this case. In April 2019, BusinessWeek published a cover story asking “Is Inflation Dead” with a picture of a dead...

02/14/2022

Inflation is now running at 40-year highs. Natural resource stocks were top performers in 2021 and their leadership has continued into 2022.Could the 40-year bull market in bonds be coming to an end?

02/03/2022

The US CPI grew at 7.1% in the fourth quarter of 2021 signaling the highest inflation in 40 years. Nearly three years ago, Bloomberg Businessweek proclaimed the “Death of Inflation” on its cover –...

01/21/2022

“Chevron Girds for Activist Challenge After Exxon’s Proxy Battle Defeat” Wall Street Journal, September 3, 2021“Exxon Debates Abandoning Some of Its Biggest Oil and Gas Projects” Wall Street Journal,...

01/14/2022

We are currently in Riyadh, Saudi Arabia attending the inaugural Future Minerals Forum. This is our first dedicated research trip since COVID-19 and it has not disappointed. While most investors...

01/06/2022

“Europe’s Energy Crunch Sparks Panic in Asia and Dash to Buy Fuel” Bloomberg, September 16, 2021“Europe’s Energy Crisis Is Coming for the Rest of the World, Too” Bloomberg, September 27, 2021...

12/28/2021

Over the past 18 months energy prices went from an all time record low (negative oil prices) to an all time record high ($40 per mmbtu European natural gas). The energy crisis we had predicted is now...

12/17/2021

With gas headed toward $2/Litre, can an electric future really balance the scales? On December 8, 2021, Adam Rozencwajg was one of the featured experts at the Driving into the Future virtual auto...

12/10/2021

“Food Supply Chains Are Buckling as World Runs Short of Workers” Bloomberg, September 2, 2021“Ruined Brazil Harvest Sparks Food Inflation Everywhere” Bloomberg, September 28, 2021 First appeared in...

12/06/2021

We are excited to be one of the featured experts at the Driving into the Future virtual auto event brought to you by TOYOTA.

11/19/2021

First appeared in Q3 2021 commentary Global oil markets could not have looked grimmer than back in the summer of 2020. COVID cases were increasing again and further global economic lockdowns were...

11/04/2021

Few people think of energy at all and even fewer think about its history. We are on the verge of a new chapter in the History of Energy and few people realize the implications.

10/29/2021

First appeared in Q2 2021 letter Last summer, we predicted global oil demand would quickly regain its pre-COVID peak as travel restrictions were lifted. Clearly, in retrospect, we were too...

10/21/2021

First appeared in Q2 2021 letter Oil production growth outside of OPEC+ and the US shales has been extremely difficult to achieve — even before the recent ESG pressures. Over the last 20 years, oil...

10/08/2021

First appeared in Q2 2021 letter The foundation for the upcoming oil crisis is now firmly set in place. Despite recent hiccups related to the delta variant, the world is re-opening and global oil...

10/01/2021

First appeared in Q2 2021 letter Uranium stocks sold off in mid-June as news outlets reported a possible leak at the Taishan Chinese reactor, a joint venture with Électricité de France (EDF). The...

09/24/2021

First appeared in Q2 2021 letter Copper made a new all-time high during the quarter. After bottoming in January 2016 at $1.94 per pound, copper rallied 150% to reach $4.77 on May 11th 2021. Although...

09/10/2021

First appeared in Q2 2021 letter While we believe a huge precious metals bull market lies in front of us, we must also be aware that challenges remain over the medium term. Since the beginning of...

09/09/2021

Many of the most popular solutions being proposed to solve our planet’s CO2 problem will be difficult, if not impossible, to accomplish. In this video, managing partners Leigh Goehring and Adam...

08/31/2021

Tightness in the US natural gas market is beginning to manifest itself in low inventory levels. After having started the year at a 200 bcf surplus to the five-year seasonal average, US inventories...

08/27/2021

First appeared in 2Q letter August 5, 2021 2021 shale production has held up better than we expected. At the end of last year, we predicted shale production would experience sustained sequential...

08/18/2021

“Over the longer-term, ESG-led activist investors have all but ensured non-OPEC production will fall dramatically, leaving OPEC with increased market share and pricing power.” Over the past 18...

08/11/2021

“With Earnings Soaring, Banks See Boom Ahead” The New York Times, 4/14/2021. A vigorous debate has emerged surrounding inflation as money supply growth dramatically accelerates, deficit spending...

07/23/2021

In our Q4 2020 letter, we discussed how China had emerged seemingly overnight as one of the world’s largest corn importers. While China had become a large importer of soybeans 20 years ago, its corn...

07/08/2021

Given low ending stocks, both corn and soy are extremely susceptible to any disappointments in plantings, harvest, or weather. As the 2021–2022 season gets underway, problems have already developed....

06/30/2021

Non-OPEC+ production outside of the US is facing challenges similar to the situation with the US shales. In their most recent report, the IEA reports that non-OPEC+ production outside of the US was...

06/24/2021

Managing Partners Leigh Goehring and Adam Rozencwajg recently hosted a video conference call along with Stacy Havener, CEO and Founder of Havener Capital Partners. During the event, they discussed...

06/17/2021

Managing partner Adam Rozencwajg was recently featured on Financial Sense Wealth Management’s popular podcast to discuss the supply and demand backdrop for copper, and why we’ll likely see higher...

06/15/2021

Exactly one year after West Texas Intermediate crude reached its historic -$37 per barrel low, the damage inflicted on global oil markets from the COVID-19 economic lockdowns has been largely...

06/03/2021

“Jefferies published a research note entitled “Are EVs as ‘Green’ as They Appear?” in which they conclude an electric vehicle must be driven 200,000 km (or 124,000 miles) before its “whole of life”...

05/19/2021

Prior to 2005, few investors paid any attention to issues related to copper depletion. The reason was simple: the average reserve grade and head grade (that is, the quality of the ore being mined) of...

04/21/2021

Investor euphoria has exploded across all types of asset classes and is bordering on mania for a select few. Market participants talk of bubbles everywhere.Well, here is the anti-bubble. As value...

03/31/2021

“According to our models, an aggressive push toward nuclear and gas would allow total global energy demand to grow by 35% over the next two decades while still cutting carbon emissions by nearly...

03/24/2021

Recently, Jesse Felder, former hedge fund manager and host of the popular podcast Superinvestors and the Art of Worldly Wisdom, interviewed our very own Adam Rozencwajg to discuss the bubbles in both...

03/18/2021

“Given the huge upfront energy needs of wind, solar and batteries, any performance disappointment could mean the difference between moderate carbon savings and net increases in carbon.” Few people...

03/12/2021

Electric vehicles will likely not deliver the necessary carbon reduction many people are expecting. In Norway, electric vehicle sales have gone from zero to nearly 60% penetration between 2010 and...

03/03/2021

Valuations for nearly any stock tied to renewable energy themes became quite stretched in 2020, and reports from reputable agencies predicting an acceleration in renewable adoption have only added to...

02/24/2021

In our latest quarterly commentary, we took a close look at an investment theme that has much — we’d say too much —momentum behind it: Green energy. The full commentary is worth a read for anyone...

01/27/2021

We believe we are on the cusp of a global energy crisis. Like most crises, the fundamental causes for this crisis have been brewing for several years but have lacked a catalyst to bring them to the...

01/13/2021

“Given silver’s huge move in the last six months, gold and precious metals could now go through a potential correction phase within a larger bull market.” In gold bull markets over the last 50...

01/06/2021

A return of inflation could wreak havoc on many investors’ portfolios, especially those heavy in fixed-income securities. In 2020 we wrote extensively on how the Fed’s actions and the CARES Act may...

12/04/2020

The Archives from Real Vision recently re-released this classic interview from 2018 featuring Leigh Goehring and legendary financial writer Jim Grant. Their conversation revolves around the turning...

11/23/2020

Back in 2Q 2020, amid rapidly slowing drilling activity, a significant historical development occurred in the US shale patch. In previous drilling cycles, sharp slowdowns in activity produced large...

10/29/2020

The short answer to this question is: more than index levels of 2-3%.While many institutional investors and financial advisors divide their equity exposure by market cap, style and geographic region,...

10/22/2020

Managing Partner Adam Rozencwajg was recently interviewed on Mining Stock Education, a website and podcast dedicated to natural resources and precious metals education and investing. During this...

.png)

.png)

.png)

.png)

.png)

.png)

![[Interview] Leigh Goehring: Gold’s Bull Market Begins; Uranium & Copper Outlook](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.11%20G%26R%20Blog%20%23417%20-%20Investing%20News%20Network%20Interview%20-%20Leigh%20Goehring%20(1).png)

![[Interview] Leigh Goehring On The Present State of The Energy Markets](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.07%20G%26R%20Blog%20%23407%20-%20Leigh%20interview%20.png)

![[Interview] Monetary System Revolution on The Horizon with Adam Rozencwajg and WTFinance](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.07%20GR%20Blog%20%23405-%20WTFinance%20Podcast%20(1).png)

![[Interview] Commodities and Geo-Political Risks with Rozencwajg and Yra Harris](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.04%20GR%20Blog%20%23404-Financial%20Repression%20Authority%20-%20Twitter%20(3)-1.png)

![[Interview] Gold's Bull Run: Just Getting Started?](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.06%20KITCO%20News%20Interview%20-%20Adam%20Rozencwajg%20-%20Golds%20Bull%20Run.png)

![[Interview] Commodities Have 'Never, Ever' Been More Undervalued Than Today](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.05%20G%26R%20Blog%20%23402-%20Commodity%20Culture%20interview%20with%20Leigh%20Goehring.png)

![[Podcast] MacroVoices - AI Demand, Energy & Precious Metals](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.05%20GR%20Blog%20%23401-%20MacroVoices%20-%20LinkedIn.png)

![[Interview] Valuable Insights on Investing in Gold, Silver & Bitcoin](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.05%20G%26R%20Blog%20%23399%20Grizzle%20Live%20Conference%20Interview%20-%20Adam%20Rozencwajg%20.png)

![[Interview] Will EVs Succeed? Efficiency, Emissions and a Potential Catalyst](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.04%20Investing%20News%20Network%20Interview%20-%20Adam%20Rozencwajg%20-%20EVs.png)

![[Podcast] Convince Me in 15 Minutes... That Uranium is in a Bull Market.](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.03%20GR%20Blog%20%23391-%20Convince%20Me%20in%2015%20Min%20-%20Twitter.png)

![[Podcast] Energy Demand is Massively Misunderstood, Here's Why We're Bullish](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.02%20GR%20Blog%20%23388-Commodity%20Culture%20Podcast%20-%20Twitter.png)

![[Podcast] Peak Oil is Closer Than You Think](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.02%20GR%20Blog%20%23387-%20Off%20the%20Cuff%20Podcast%20-%20Twitter.png)

![[Podcast] Adam Rozencwajg joins Money Life with Chuck Jaffe](https://blog.gorozen.com/hubfs/Blog/2023%20Blogs/2023.12%20GR%20Blog%20%23377-%20Money%20Life%20Podcast%20-%20Twitter.png)

![[Podcast] What is Happening in the Energy Markets?](https://blog.gorozen.com/hubfs/Blog/2023%20Blogs/2023.11%20GR%20Blog%20%23375-%20WTFinance%20Podcast.png)

![[HC Insider Podcast] Renewables, Natural Gas and Nukes](https://blog.gorozen.com/hubfs/Blog/2023%20Blogs/2023.11%20GR%20Blog%20%23374-%20HC%20Insider%20Podcast%20-%20Twitter.png)

![[Podcast] How Do You Solve A Problem Like Inflation?](https://blog.gorozen.com/hubfs/Blog/2023%20Blogs/2023.11%20GR%20Blog%20%23373-%20Grant%20Williams%20Podcast.png)

![[INTERVIEW] Uranium at Inflection Point, Will Get Completely Out of Hand](https://blog.gorozen.com/hubfs/Blog/2023%20Blogs/2023.10%20G%26R%20Blog%20%23372%20-%20Uranium%20Stock%20Market%20(1).png)

![[INTERVIEW] Geopolitical Risk within Natural Resources Markets](https://blog.gorozen.com/hubfs/Blog/2023%20Blogs/2023.09%20G%26R%20Blog%20%23369-%20Lykeion%20interview%20.png)

![[INTERVIEW] The Next Opportunity: Are We in a Commodity Supercycle?](https://blog.gorozen.com/hubfs/Blog/2023%20Blogs/2023.08%20G%26R%20Blog%20%23363%20-%20UBS%20%20Interview%20-%20Adam%20Rozencwajg.png)

![[Podcast] MacroVoices - Global Food Crisis Update ft. Leigh Goehring](https://blog.gorozen.com/hubfs/Blog/2023%20Blogs/2023.07%20GR%20Blog%20%23362%20-%20Leigh%20Goehring%20Interview%20MacroVoices.png)

![[Podcast] The Impacts of Rising Interest Rates on Commodities](https://blog.gorozen.com/hubfs/Blog/2023%20Blogs/2023.05%20GR%20Blog%20%23353-%20HC%20Insider%20Podcast%20-%20Twitter%20(1).png)

![[Podcast] MacroVoices: A discussion around Energy, Gold, Copper and Uranium](https://blog.gorozen.com/hubfs/Blog/2023%20Blogs/2023.04%20GR%20Blog%20%23348%20-%20MacroVoices%20-%20LinkedIn.png)

![[REPLAY] 2022 Investor Day - The Coming Decade of Shortages](https://blog.gorozen.com/hubfs/Calls,%20Webinars%20and%20Investor%20Day/2022.11%20Investor%20Day%202022/2022.11%20Investor%20Day%202022%20-%20Access%20Replay.png)

![[PODCAST] Out with the FED Put & In with the OIL Put ft. Adam Rozencwajg](https://blog.gorozen.com/hubfs/Blog/2022.11%20GR%20Blog%20%23335%20-%20Podcast%20%20-%20LinkedIn.png)

![[Podcast] The Real Reason Behind the Current Energy Crisis ft. Adam Rozencwajg](https://blog.gorozen.com/hubfs/Blog/2022.09%20GR%20Blog%20%23331%20-%20Podcast%20Top%20Traders%20Unplugged%20-%20LinkedIn.png)

![[Podcast] MacroVoices: Understanding the Global Energy Crisis ft. Adam Rozencwajg](https://blog.gorozen.com/hubfs/Blog/2022.08%20GR%20Blog%20%23325%20-%20MacroVoices%20-%20LinkedIn.png)

%20and%20Webinars/2022.11%20Investor%20Day%202022/2022.11%20Investor%20Day%202022.png)

![[Podcast] The Dark Side of Renewable Energy ft. Adam Rozencwajg](https://blog.gorozen.com/hubfs/Blog/2022.05%20GR%20Blog%20%23315%20-%20LinkedIn.png)

![[Podcast] Financial Sense: Adam Rozencwajg on the Post-Invasion Outlook for Energy and Commodities](https://blog.gorozen.com/hubfs/Blog/Meet%20the%20Team/2022.04%20GR%20Blog%20%23312%20-%20Financial%20Sense%20Podcast%20-%20LinkedIn.png)

![[Webinar Replay] G&R's Outlook on Energy and Inflation](https://blog.gorozen.com/hubfs/Calls%20(Live)%20and%20Webinars/2022.03%20Webinar%20Live/2022.03%20Replay%20-%20Webinar%20.png)

![[Video] Rising Gas Prices vs Battery Costs](https://blog.gorozen.com/hubfs/Blog/2021.12%20GR%20Bog%20%23303%20-%20Video%20Replay%20-%20Rising%20Gas%20Prices%20vs%20Battery%20Costs%20-%20LinkedIn.png)

![[Podcast with Financial Sense] Copper Has Years Left to Run](https://blog.gorozen.com/hubfs/Blog/2021.06%20GR%20Blog%20238%20LinkedIn.png)

![[Podcast with Jesse Felder] The Speculative Mania in Green Energy Stocks](https://blog.gorozen.com/hubfs/Blog%20Images/2021.03%20GR%20Blog%20230%20LinkedIn.png)

![[Video with Real Vision] Interview with Leigh Goehring and Jim Grant](https://blog.gorozen.com/hubfs/Blog%20Images/2020.11%20GR%20Blog%20221%20LinkedIn.png)

![[New Mining Podcast] Oil to Outperform Gold Over the Next Six Months](https://blog.gorozen.com/hubfs/Blog%20Images/2020.10%20GR218%20Podcast%20Grapihc%20600x342.jpg)