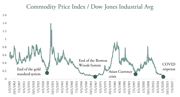

A return of inflation could wreak havoc on many investors’ portfolios, especially those heavy in fixed-income securities. In 2020 we wrote extensively on how the Fed’s actions and the CARES Act may have set the stage for such a resurgence of inflation. Two of our top-three blogs of 2020 hit this subject, while the third examined the historic relationship between gold and oil prices. Explore these popular blogs below.

We Are Entering Into A New Era Of Inflation. Are You Prepared?

Last April, Bloomberg BusinessWeek ran a cover story entitled “Is Inflation Dead?” We immediately thought back to the infamous 1979 BusinessWeek cover “The Death of Equities,” written less than three years before the start of the greatest bull market of all time. We wondered whether this new cover would be equally as prescient in bringing inflation back as the major theme of the coming decade. After the events of last week, the answer appears to be a resounding “yes.”

Last April, Bloomberg BusinessWeek ran a cover story entitled “Is Inflation Dead?” We immediately thought back to the infamous 1979 BusinessWeek cover “The Death of Equities,” written less than three years before the start of the greatest bull market of all time. We wondered whether this new cover would be equally as prescient in bringing inflation back as the major theme of the coming decade. After the events of last week, the answer appears to be a resounding “yes.”

Continue Reading >

Are We Entering a New Paradigm of Inflation?

During a recent client call, this question on inflation was posed to G&R Managing Partner Adam Rozencwajg, CFA:

“Over the past 40 or so years, we've been in a period of declining real interest rates. And part of that has to do with inflation. Can you just talk about your firm's views on inflation, and is there anything that you think needs to change? Is there a change in the mindset or specific catalysts you're seeing to indicate we may be entering a new paradigm of inflation?”

The Gold-Oil Ratio Revisited

As proof we live in interesting times, just consider the gold-oil ratio over the last few months. Because of the impact of COVID-19 on the global economy, the gold-oil ratio has reached the highest levels in history. For example, on April 20th 2020, an ounce of gold purchases over 400 barrels of oil – ten times the previous records reached in the depths of the Great Depression in 1933 and nine times the level reached during the panic lows of early 2016.

As proof we live in interesting times, just consider the gold-oil ratio over the last few months. Because of the impact of COVID-19 on the global economy, the gold-oil ratio has reached the highest levels in history. For example, on April 20th 2020, an ounce of gold purchases over 400 barrels of oil – ten times the previous records reached in the depths of the Great Depression in 1933 and nine times the level reached during the panic lows of early 2016.