Over the past 30 months, energy prices went from an all-time record low (negative oil prices) to all-time record highs as strong demand and disappointing supply were complicated by the war in Ukraine.

And we kept you informed through it all.

In 2022 we published several articles. Which insights proved the most popular? Let's revisit our three most popular blog posts of 2022.

The Global Natural Gas Crisis is coming to North America

A sudden and unexpected event is about to take place: the global natural gas crisis, now gripping large swaths of the world, is about to engulf North America as well. Asian and European natural gas prices today stand at $30 per mcf versus $7.50 per mcf here in the United States. Given the underlying fundamentals that have now developed in US gas markets, we believe prices are about to surge and converge with international prices within the next 6 months. The convergence of US and international gas prices will come out of nowhere and take all investors by surprise.

A sudden and unexpected event is about to take place: the global natural gas crisis, now gripping large swaths of the world, is about to engulf North America as well. Asian and European natural gas prices today stand at $30 per mcf versus $7.50 per mcf here in the United States. Given the underlying fundamentals that have now developed in US gas markets, we believe prices are about to surge and converge with international prices within the next 6 months. The convergence of US and international gas prices will come out of nowhere and take all investors by surprise.

Running Out of Spare Oil Capacity - What's Next?

Between 2010 and 2020 the world grew accustomed to cheap, abundant conventional energy. Global energy markets were so well supplied for so long that neither investors nor consumers gave energy markets much thought. We were one of the few warning that an impending energy shortage and crisis would emerge in the next several years. The calm of the past decade has been turned upside down seemingly overnight.

Between 2010 and 2020 the world grew accustomed to cheap, abundant conventional energy. Global energy markets were so well supplied for so long that neither investors nor consumers gave energy markets much thought. We were one of the few warning that an impending energy shortage and crisis would emerge in the next several years. The calm of the past decade has been turned upside down seemingly overnight.

Continue Reading >

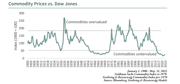

The Commodity Bull Market Has Only Just Begun

One of the most frequent questions we get asked regarding this commodity bull market is: “Have I missed it? Is it too late to make an investment in natural resources?” From our base of younger investors, we frequently get questions such as this: “I have been reading your material for the last two years and I started getting heavily involved in the commodity markets and I have made a lot of money. Is the top near? Should I sell out? Is this commodity bull market over?” Given the big moves in various commodity markets since the summer of 2020, it is logical to ask these questions. But our response to all these questions is going to be a real shocker. Not only is the commodity bull market not over, it has hardly begun.