As Natural Resource Investors, we aim to keep investors informed of what is happening in the commodities and natural resources sectors so that you can make informed investment decisions.

In 2023, a lot of our research was focused on why we believe we are facing a "decade of shortages" ahead. We have thousands of subscribers receiving our research on a weekly basis and even more people who just casually read our blogs. So, which insights proved the most popular? Let's revisit our three most popular blog posts of 2023.

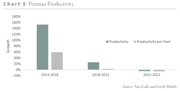

The Permian Basin Is Depleting Faster Than We Thought

The most crucial development in global oil markets is depletion in the Permian basin. We first warned about this in 2018, predicting the Permian would peak in 2025. In retrospect, our analysis was too conservative. We now believe the basin could peak within the next twelve months. The implications will be as profound as when United States oil production peaked in 1970, starting a chain of events ultimately sending prices up five-fold over ten years. If we are correct, this could not come at a worse time for oil markets: inventories are tight, production in the rest of the world is declining, and investors are incredibly complacent.

The most crucial development in global oil markets is depletion in the Permian basin. We first warned about this in 2018, predicting the Permian would peak in 2025. In retrospect, our analysis was too conservative. We now believe the basin could peak within the next twelve months. The implications will be as profound as when United States oil production peaked in 1970, starting a chain of events ultimately sending prices up five-fold over ten years. If we are correct, this could not come at a worse time for oil markets: inventories are tight, production in the rest of the world is declining, and investors are incredibly complacent.

Continue Reading >

Base Metals: A Decade of Shortages Ahead

“The Decade of Shortages” was the unofficial theme for our investor day, held on November 3rd, 2022. Our audience heard presentations from five guest speakers and the two eponymous partners, outlining fundamental trends in various commodity markets that confirm our thesis. We discussed how we believe the shortages in the first two years of this decade were destined to be repeated multiple times in different commodity markets as we progressed through the remaining years. ESG pressures have forced significant redirection of capital spending away from extraction industries to renewable projects, shifts in global power from unipolar to multipolar, war, supply-chain breakdowns, changing weather patterns, and under-appreciated shifts taking place in the geology or extractive industries — all were discussed as well their supply impacts on various commodities.

“The Decade of Shortages” was the unofficial theme for our investor day, held on November 3rd, 2022. Our audience heard presentations from five guest speakers and the two eponymous partners, outlining fundamental trends in various commodity markets that confirm our thesis. We discussed how we believe the shortages in the first two years of this decade were destined to be repeated multiple times in different commodity markets as we progressed through the remaining years. ESG pressures have forced significant redirection of capital spending away from extraction industries to renewable projects, shifts in global power from unipolar to multipolar, war, supply-chain breakdowns, changing weather patterns, and under-appreciated shifts taking place in the geology or extractive industries — all were discussed as well their supply impacts on various commodities.

What was not discussed at our conference is a great shortage we believe is in the making.

Continue Reading >

The Uranium Bull: Defying Trends and Redefining Energy Markets

Why has uranium rallied while every other energy commodity has collapsed? Over the past twelve months, spot uranium advanced 12% while oil, natural gas, and coal all fell anywhere from 30-70%. Our models suggest uranium’s strong performance has just started.

Uranium has likely reached a pivotal inflection point that could force the price higher by as much as three- to four-fold over the next several years. For the first time in history, uranium has slipped into a persistent and widening deficit. We believe the results will be dramatic. Uranium is much less transparent than other commodity markets; in this essay, we will help shed light on the forces driving uranium over the course of the decade.

From the start of the nuclear age in 1945 until 2019, the uranium industry has gone through four distinct periods. Each period has been unique in terms of supply and demand, leading to wild price swings that lasted decades. The market has now definitively entered its fifth major period, likely defined by persistent severe deficits.

Continue Reading >