10/17/2025

The article below is an excerpt from our Q2 2025 commentary. In the second quarter, the commodity complex split neatly into two camps. On one side: uranium, platinum group metals, and...

10/10/2025

Gold continues to set new all-time highs, but according to Adam Rozencwajg, Managing Partner of Goehring & Rozencwajg, the story is far from over.In a recent interview with Investing News Network’s...

10/03/2025

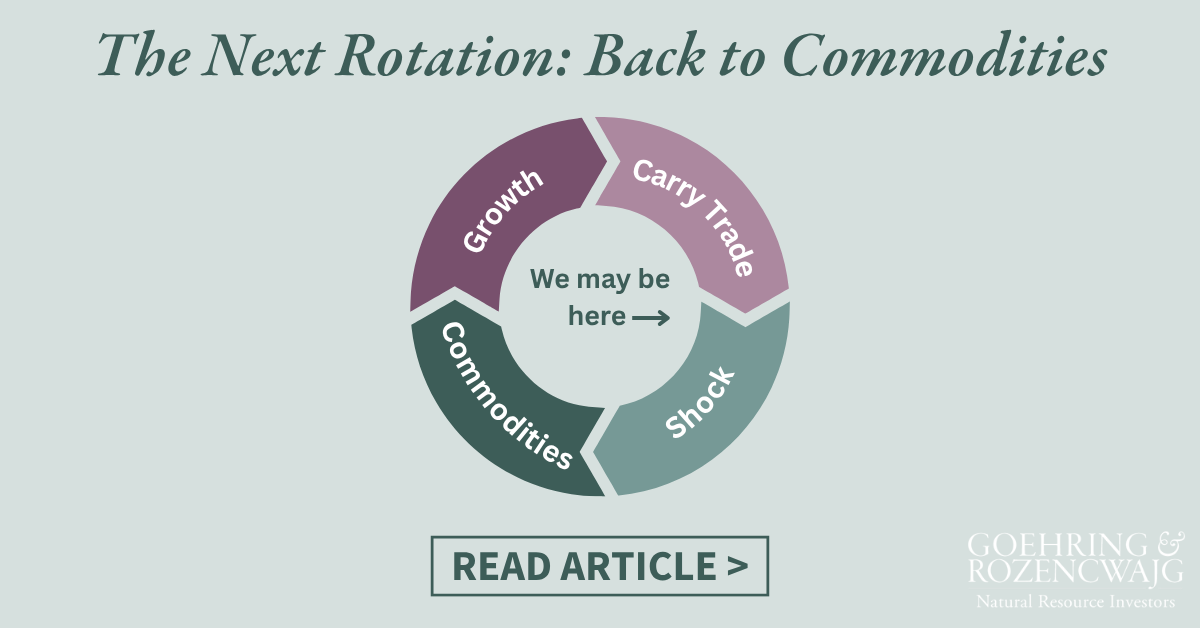

The article below is an excerpt from our Q2 2025 commentary. The financial world, like the social world, has its fashions. At cocktail parties, there are seasons of martinis and seasons of...

09/25/2025

At Goehring & Rozencwajg, we take a contrarian, research-driven approach to natural resources investing. In a recent conversation on Money Life with Chuck Jaffe, Adam Rozencwajg, Managing Partner at...

09/16/2025

Why investors should pay attention now.Leigh Goehring and Adam Rozencwajg have spent decades in the natural resources sector. Right now, they see a setup for gold, uranium, oil, natural gas, and...

09/04/2025

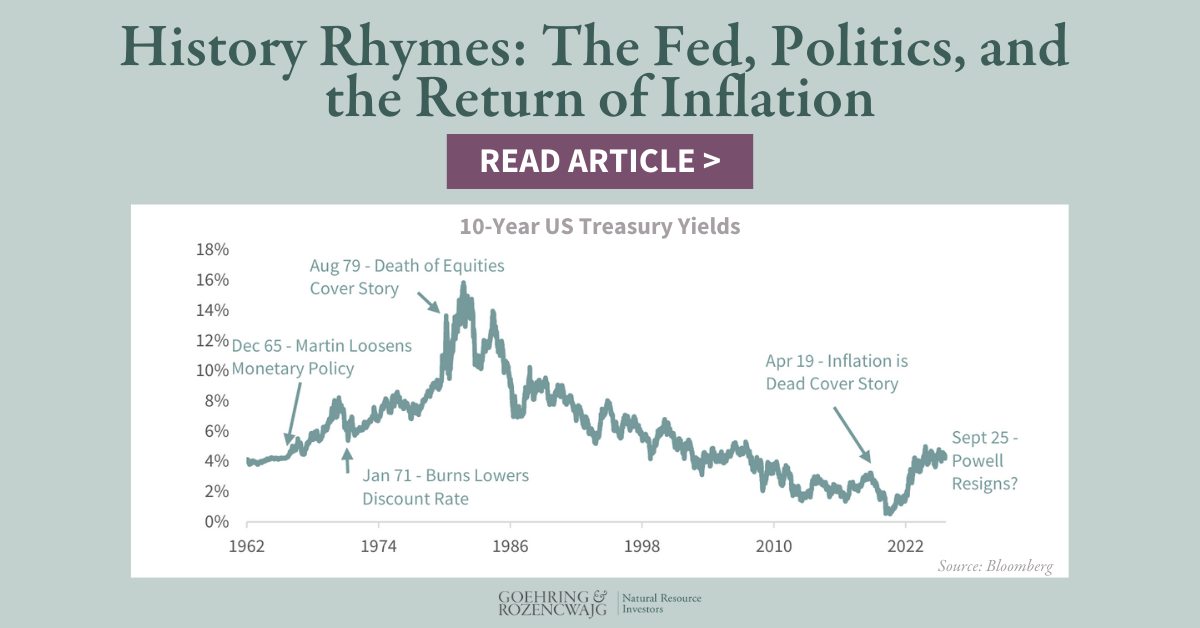

The article below is an excerpt from our Q2 2025 commentary. “Few challenges to the Federal Reserve independence have ever matched the drama of Dec. 5, 1965. Fed Chairman William McChesney Martin...

08/22/2025

The article below is an excerpt from our Q1 2025 commentary. In previous letters, we’ve written at length about our conviction that North American natural gas might well prove to be the...

08/13/2025

The article below is an excerpt from our Q1 2025 commentary. Back in 2018, we posited that financial players—ever alert to overlooked corners of the commodity world—would emerge as a dominant force...

08/04/2025

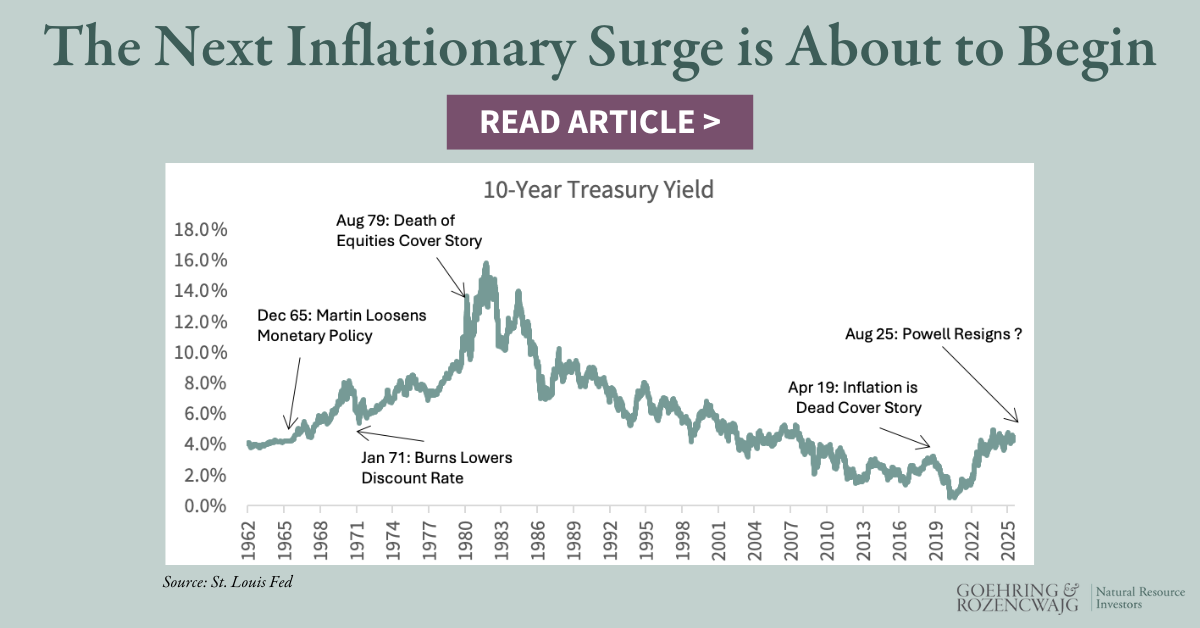

“Few challenges to the Federal Reserve independence have ever matched the drama of Dec. 5, 1965. Fed Chaiman William McChesney Martin Jr. had just convinced the Board of Governors to raise the...

08/01/2025

You could say that natural resources run in Leigh Goehring’s blood. The son of two oil and gas engineers, Leigh has spent nearly his entire life studying markets and investments related to...