Commodities

09/10/2021

First appeared in Q2 2021 letter While we believe a huge precious metals bull market lies in front of us, we must also be aware that challenges remain over the medium term. Since the beginning of...

09/09/2021

Many of the most popular solutions being proposed to solve our planet’s CO2 problem will be difficult, if not impossible, to accomplish. In this video, managing partners Leigh Goehring and Adam...

08/27/2021

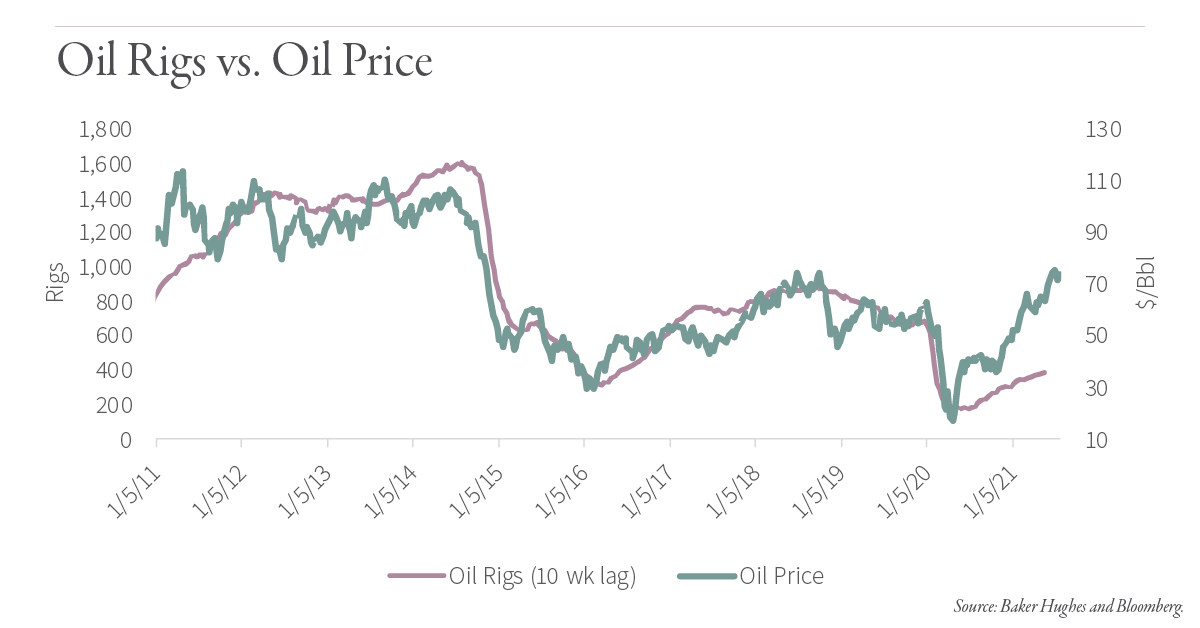

First appeared in 2Q letter August 5, 2021 2021 shale production has held up better than we expected. At the end of last year, we predicted shale production would experience sustained sequential...

08/18/2021

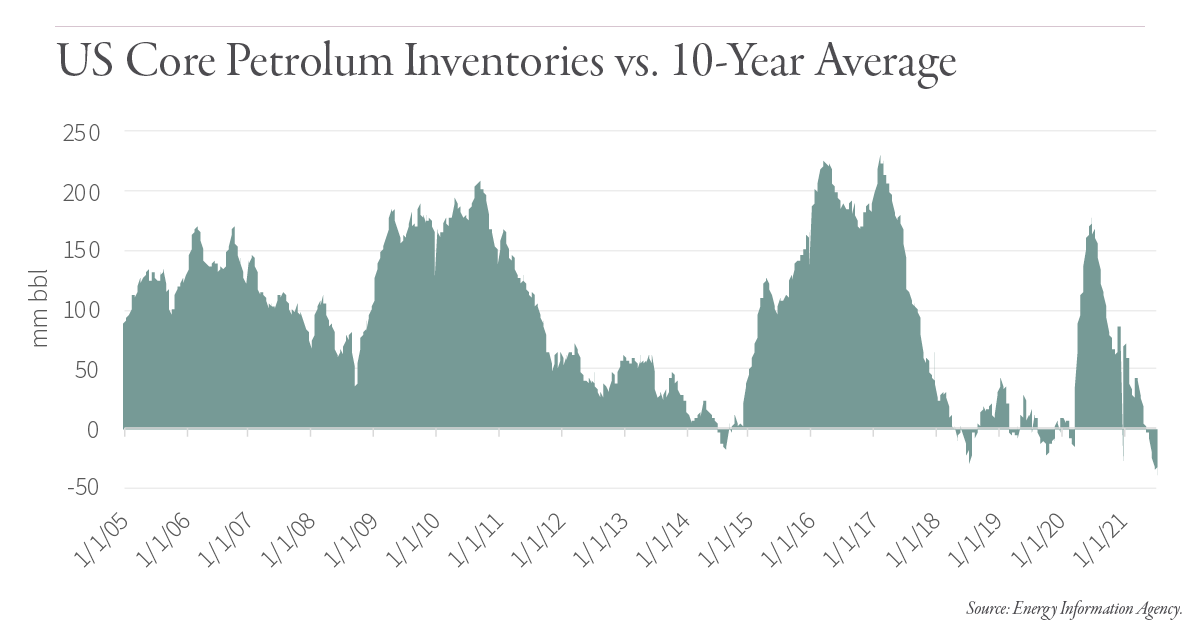

“Over the longer-term, ESG-led activist investors have all but ensured non-OPEC production will fall dramatically, leaving OPEC with increased market share and pricing power.” Over the past 18...

08/11/2021

“With Earnings Soaring, Banks See Boom Ahead” The New York Times, 4/14/2021. A vigorous debate has emerged surrounding inflation as money supply growth dramatically accelerates, deficit spending...

07/23/2021

In our Q4 2020 letter, we discussed how China had emerged seemingly overnight as one of the world’s largest corn importers. While China had become a large importer of soybeans 20 years ago, its corn...

06/24/2021

Managing Partners Leigh Goehring and Adam Rozencwajg recently hosted a video conference call along with Stacy Havener, CEO and Founder of Havener Capital Partners. During the event, they discussed...

06/17/2021

Managing partner Adam Rozencwajg was recently featured on Financial Sense Wealth Management’s popular podcast to discuss the supply and demand backdrop for copper, and why we’ll likely see higher...

01/27/2021

We believe we are on the cusp of a global energy crisis. Like most crises, the fundamental causes for this crisis have been brewing for several years but have lacked a catalyst to bring them to the...

01/13/2021

“Given silver’s huge move in the last six months, gold and precious metals could now go through a potential correction phase within a larger bull market.” In gold bull markets over the last 50...

![[Podcast with Financial Sense] Copper Has Years Left to Run](https://blog.gorozen.com/hubfs/Blog/2021.06%20GR%20Blog%20238%20LinkedIn.png)