Natural resources

07/11/2025

Concerns about a global supply glut and an uncertain demand outlook continue to weigh on crude prices. Commodity experts Wasif Latif and Adam Rozencwajg share their insights on MarketWatch on what’s...

07/02/2025

The article below is an excerpt from our Q1 2025 commentary. “In just 15 years, shale companies have increased U.S. oil production by about 8 million barrels of oil a day. The boom reduced the...

06/27/2025

In a recent interview with the Investing News Network, Adam Rozencwajg, Managing Partner at Goehring & Rozencwajg, shared his latest insights into the precious metals and energy markets, including...

06/20/2025

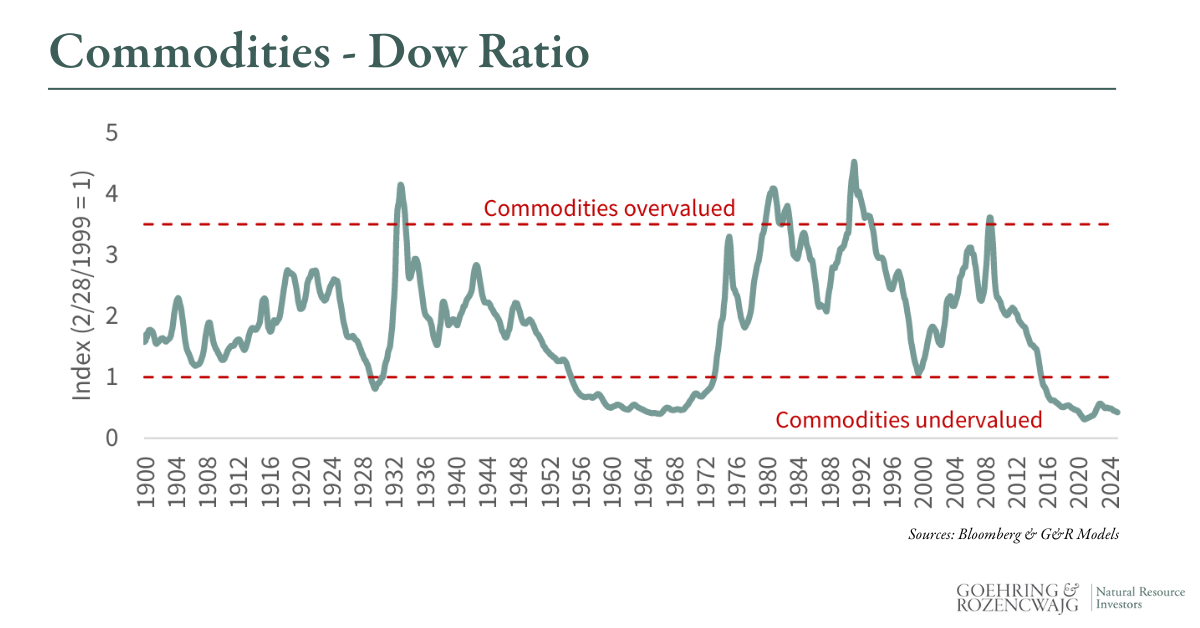

Is the next major commodities cycle already underway? Adam Rozencwajg, Co-Founder and Managing Partner at Goehring & Rozencwajg, joins Ed Coyne of Sprott Radio for a timely conversation on the...

06/13/2025

A Global Market Shake-Up: Why Rozencwajg Says Real Assets Are the FutureIs a new commodities supercycle already underway? According to Adam Rozencwajg, Managing Partner at Goehring & Rozencwajg, the...

06/04/2025

The article below is an excerpt from our Q1 2025 commentary. Has the Great Commodity Bull Market Quietly Begun? It is beginning to look that way. The signs are not yet shouted from the rooftops,...

05/29/2025

The article below is an excerpt from our Q1 2025 commentary. “Platinum Breaking Out on Surging Demand From China” ~Bloomberg, May 20th, 2025“BMW bets on petrol and sees rocky road to...

05/16/2025

We believe a global monetary reset is underway—with gold at the center. In our view, this shift is setting the stage for a commodity supercycle that could far surpass what most investors expect.We...

05/07/2025

Commodities are poised for a significant rise due to macroeconomic shifts, potential monetary regime changes, and the depletion paradox is now patrolling the US shale oil patch. In this insightful...

04/01/2025

The article below is an excerpt from our Q4 2024 commentary. We believe the time to buy natural resource equities has arrived. History, with its characteristic flair for the dramatic, has shown that...

.png)

.png)