Goehring & Rozencwajg Team

12/02/2019

Leigh Goehring and Adam Rozencwajg were recently featured on Grant’s Current Yield Podcast, where they spoke with Grant’s Interest Rate Observer founder Jim Grant and Deputy Editor Evan Lorenz. Image...

11/20/2019

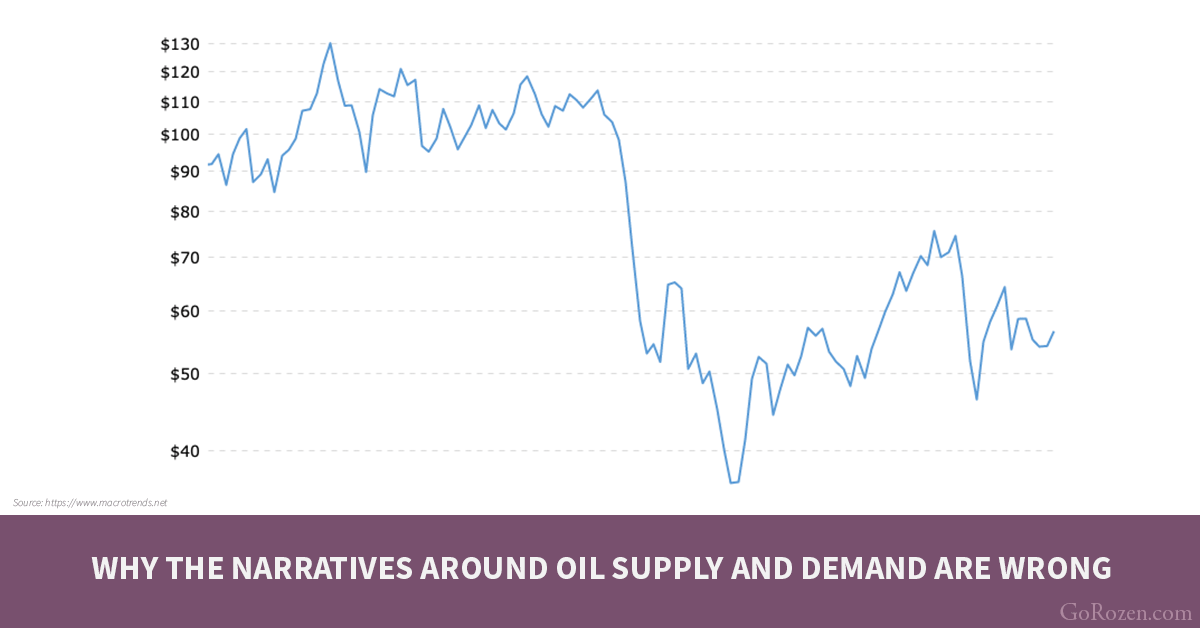

Often at the bottom of intense, grinding bear markets or the top of bull markets, investors will create a narrative to help explain the extreme price action. Today, the prevailing consensus view is...

11/13/2019

“Over the last 120 years, we estimate it took 17 barrels of oil on average to buy one unit of the S&P 500 Index. Today it requires over 53 barrels.” In the thirty years we have been investing in...

11/07/2019

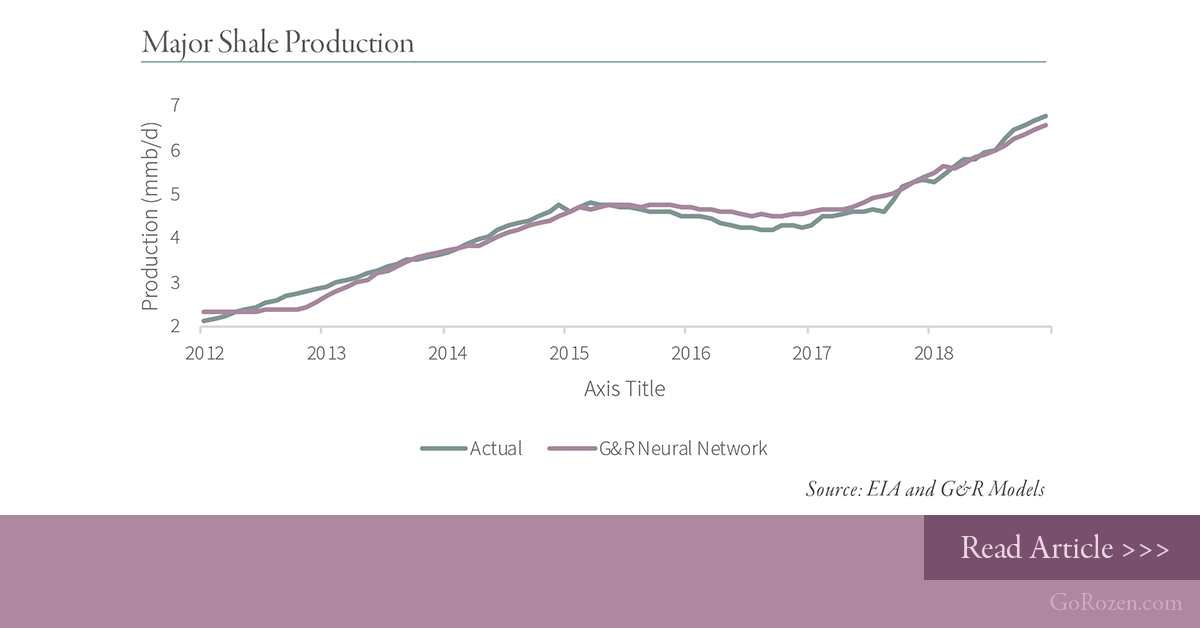

What’s happening to US shale production? After growing by a torrid 145,000 b/d per month in 2018, shale production growth has ground to a screeching near halt. Since December, shale oil production...

10/23/2019

Goehring & Rozencwajg managing partner Adam Rozencwajg is constantly on the hunt for commodity sectors that are radically undervalued. This usually involves companies that have little-to-no...

10/09/2019

“Under any scenario, future shale growth looks set to slow dramatically.” Developments in the US shale basins have never been more important for global crude fundamentals. Over the past decade, the...

10/01/2019

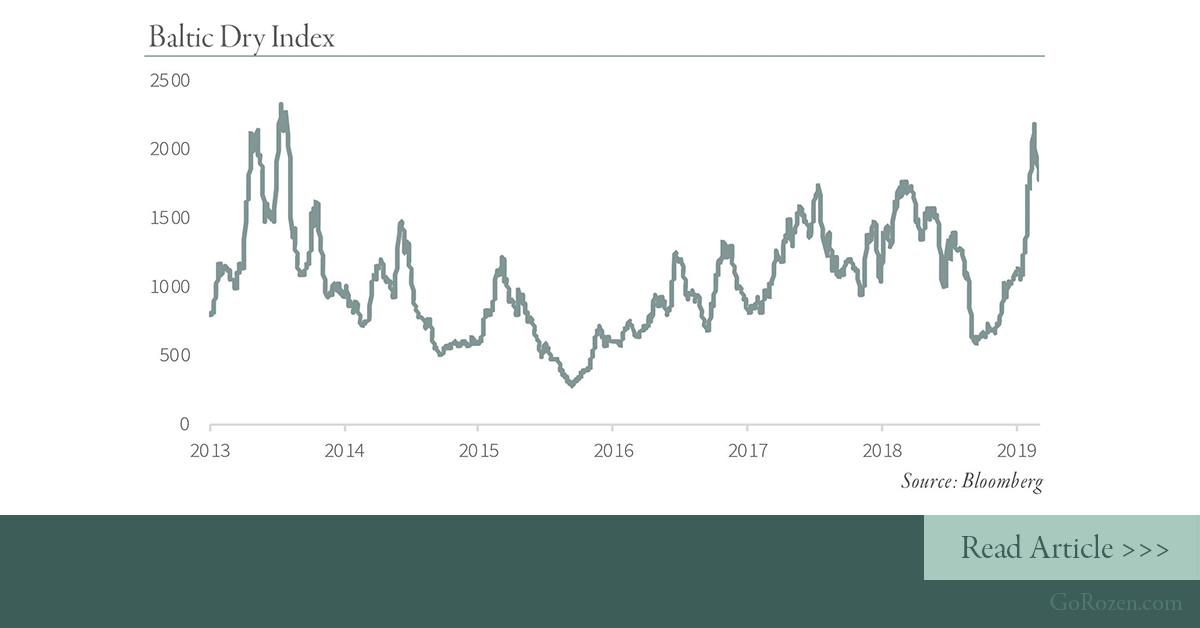

“If global commodity demand was falling sharply today, we would expect tosee the Baltic Exchange Dry Index plummeting. Instead, just theopposite is happening.” For nearly 30 years, we have been...

09/13/2019

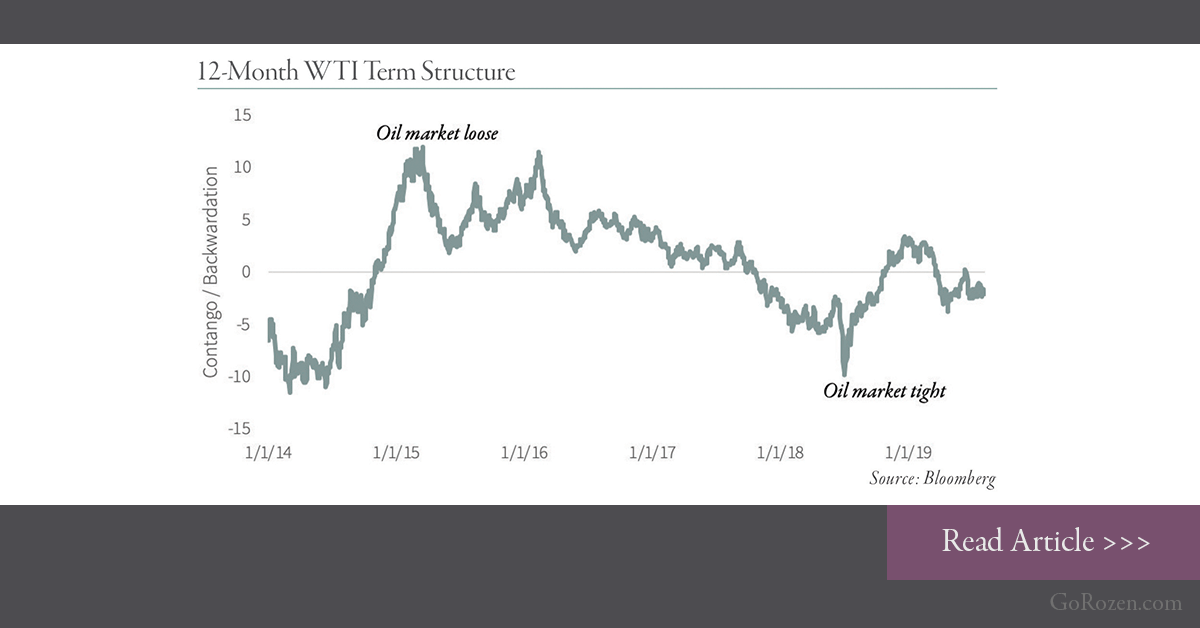

“While the conventional wisdom suggests the oil markets are in a sustained glut, the pronounced backwardization tells us that there is no truth in this belief.” For nearly 30 years, we have been...

09/06/2019

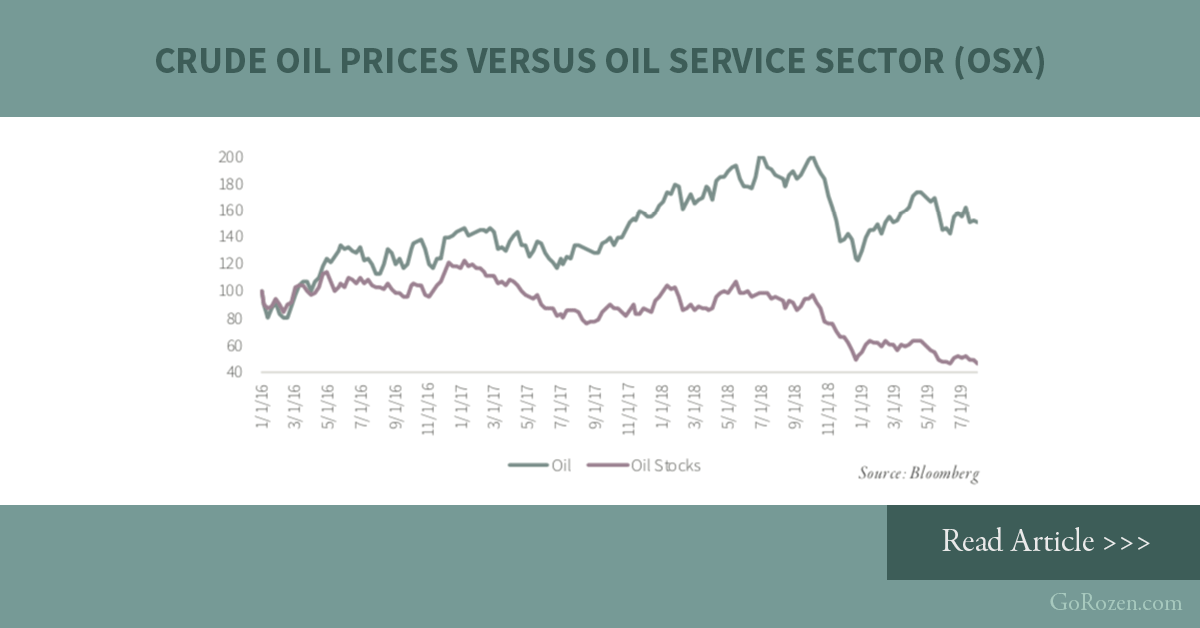

“The physical commodity markets and the natural resource equity markets are telling two drastically different stories.” At Goehring & Rozencwajg, we are deep-value, contrarian investors. For nearly...

08/29/2019

True value investors, Adam Rozencwajg and his partner Leigh Goehring believe the best time to find value in the natural resources space is when commodity prices become disproportionately depressed,...

![[New Podcast] Leigh Goehring and Adam Rozencwajg join Grant’s Current Yield Podcast](https://blog.gorozen.com/hubfs/Blog%20Images/2019-Grants-Podcast-Blog-177-LinkedIn.png)

![[New Podcast] Adam Rozencwajg Featured on Financial Sense](https://blog.gorozen.com/hubfs/Blog%20Images/G%26R%20PODCAST%20-%20Financial%20Sense%20-%20LinkedIn.png)