Commodities

04/24/2019

Advisors often expect “traditional” allocations, such as large cap equities or U.S. fixed income, to provide a fair amount of exposure to commodities. For example, a small cap equity manager may have...

04/18/2019

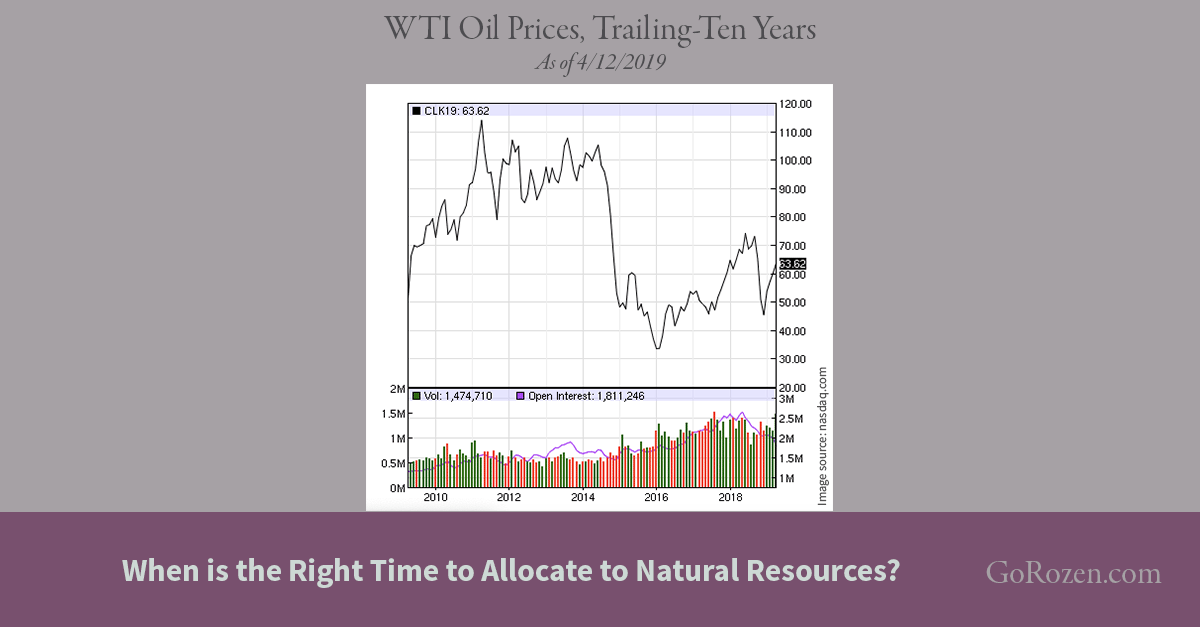

While many investors we speak with have dedicated allocations to natural resources, others believe the cyclicality of the asset class warrants a market timing approach. One opinion we’ve heard from...

04/10/2019

In the second edition of our “Yellow vests and electrical vehicles” theme (you can read the first edition here), we dive back into how the inferior energetics of electric vehicles (EVs) are leading...

04/04/2019

“There has never been an instance in the history of civilization where a new technology with inferior “energetics” has replaced an older technology with superior “energetics.” While in southern...

03/28/2019

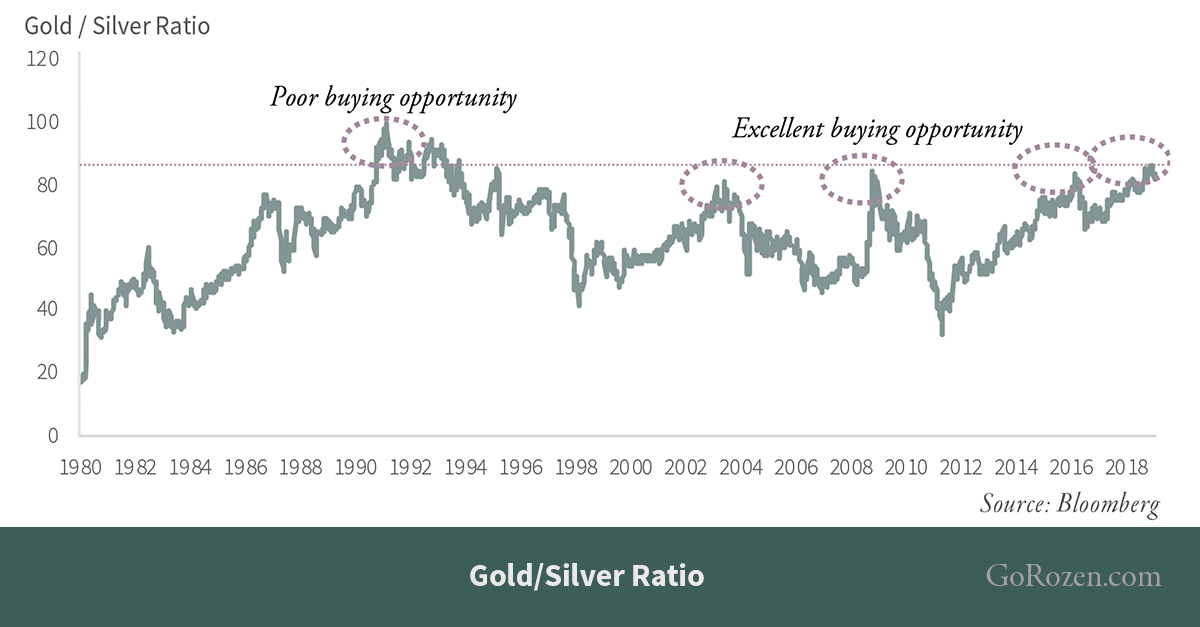

In previous quarterly letters, including Q3 2018 (Into The “Red Zone” We Go), we stated our belief that a huge new bull market would develop in gold that could take the metal to levels significantly...

03/20/2019

In January, Saudi Aramco announced they had completed a new analysis of the size of their oil reserves. This new report is significant because true size of the Saudi reserves has been a very hot...

03/13/2019

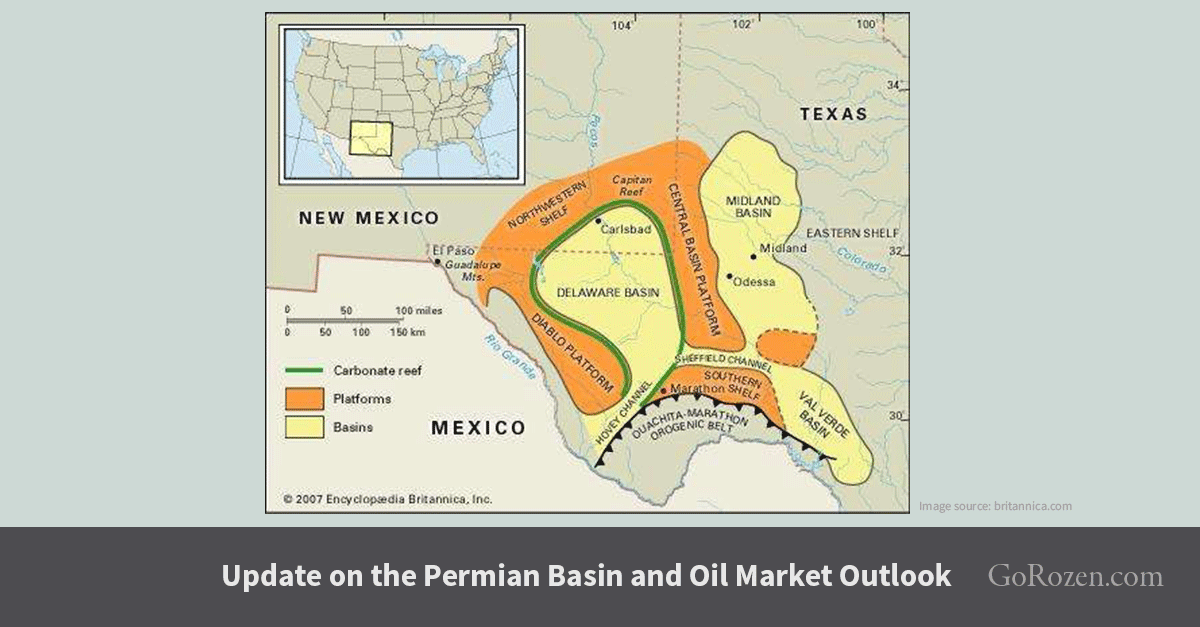

"If we are correct, this would take OECD Inventory levels to 4.2 bn bbl by the end of 2019 or 90 mm bbl below the ten-year average level – a record deficit.” Data around drilling productivity in...

03/06/2019

“While any weather-related price spike is likely to be short-lived, the risk/return now embedded in certain select natural gas securities has become more compelling” Henry Hub gas prices were...

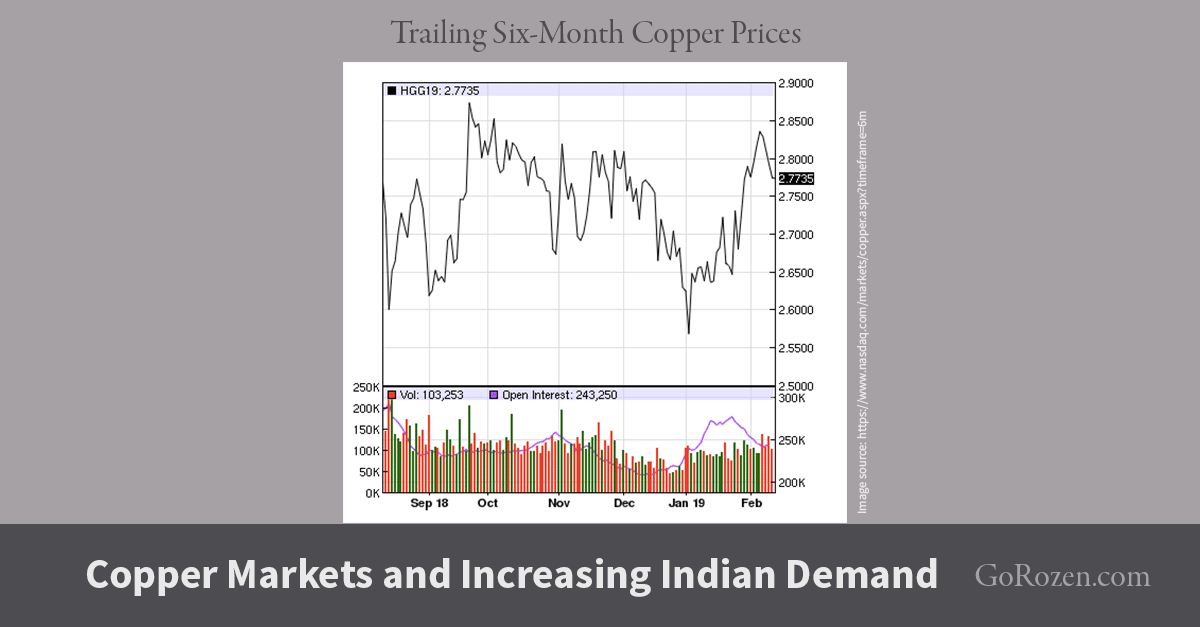

02/28/2019

“Indian refined copper demand surged by 13,000 tonnes or 33% on a year-over-year basis to reach 50,000 tonnes per month.” Copper prices were weak toward the end of 2018 but have rebounded this...

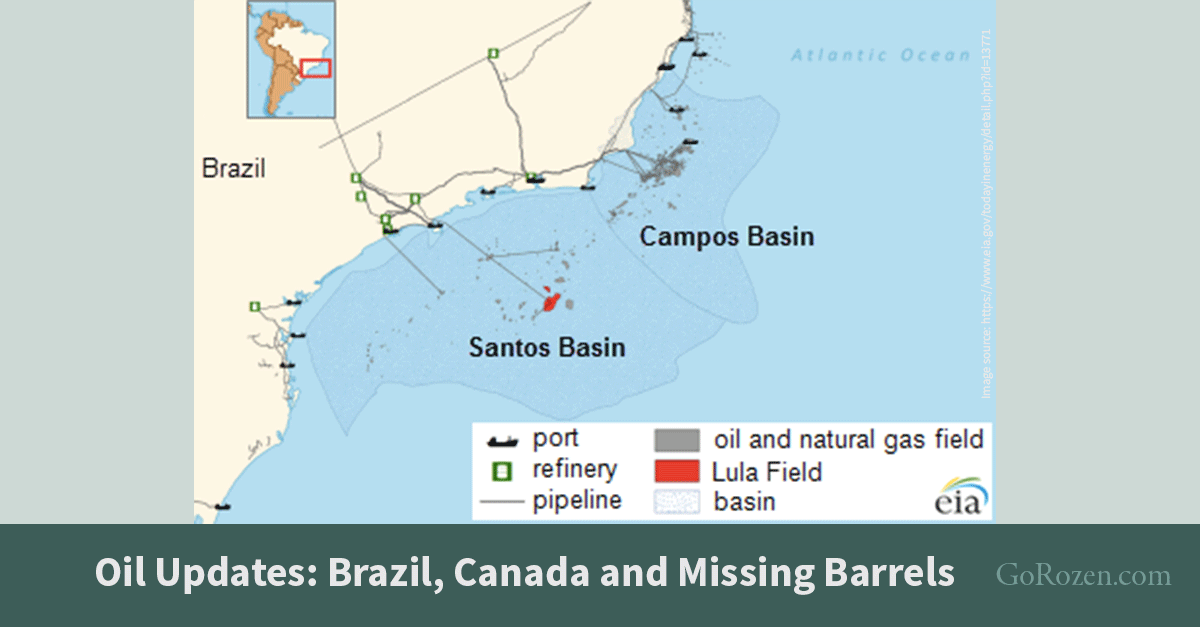

02/21/2019

“Looking forward, we still think the IEA is once again far too optimistic regarding its 2019 estimates for non-OPEC production outside of the US and Russia. Instead of growing by 120,000 b/d, our...