Contrarian

03/09/2023

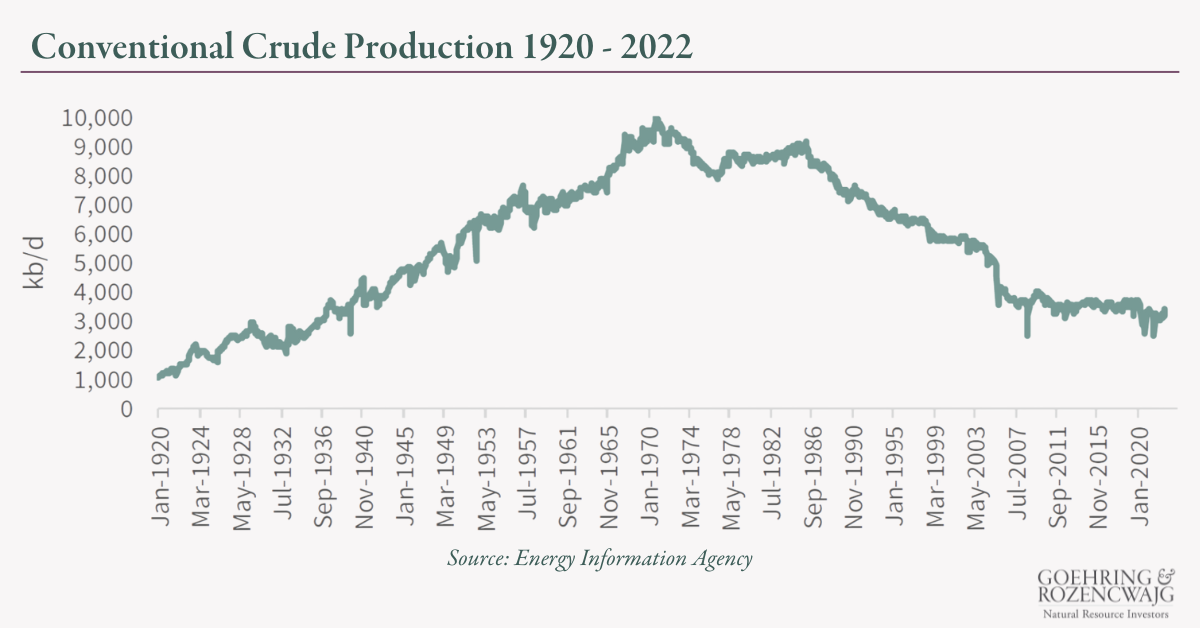

The article below is an excerpt from our Q4 2022 commentary.Crude oil fundamentals are very tight and risk getting considerably tighter. Investors continue to starve energy companies of much-needed...

12/20/2022

The article below is an excerpt from our Q3 2022 commentary.Inflation continued to surprise to the upside in Q3. Aggressive central bank tightening and ongoing worries over China’s “COVID-zero”...

12/07/2022

The article below is an excerpt from our Q3 2022 commentary.The most pressing question facing oil markets is why US shale drilling remains so muted despite high prices. A simple question whose answer...

11/18/2022

Goehring & Rozencwajg hosted afascinating one-day live eventto discusshow to prepare for the coming decade of shortages in everything from energy to materials and agriculture,on Thursday,...

11/09/2022

“I do think that things have really fundamentally changed here, and I think the next number of years will be a little bit different. I think we have to let the dust settle to really understand the...

10/27/2022

The article below is an excerpt from our Q2 2022 commentary.Ever since silver staged a furious catch-up rally back in the summer of 2020 -- something that has always signaled a long corrective phase...

10/14/2022

The article below is an excerpt from our Q2 2022 commentary.Our Q4 2021 commentary was entitled “The Distortions of Cheap Energy.” In our lead essay, we explained how extremely low energy prices...

09/30/2022

“We have an energy crisis, we don’t have enough energy today. And yet people are saying that the answer is that we have to get away from oil and gas and invest more in renewables. It will only make...

09/09/2022

The article below is an excerpt from our Q2 2022 commentary. The pendulum continued to swing in favor of nuclear power during Q2. The Russian invasion of Ukraine has put national energy security...

08/11/2022

Adam Rozencwajg, CFA, Managing Partner at Goehring & Rozencwajg, joined MacroVoices hosts Erik Townsend and Patrick Ceresna to discuss how the world has entered the early stages of a global energy...

![[REPLAY] 2022 Investor Day - The Coming Decade of Shortages](https://blog.gorozen.com/hubfs/Calls,%20Webinars%20and%20Investor%20Day/2022.11%20Investor%20Day%202022/2022.11%20Investor%20Day%202022%20-%20Access%20Replay.png)

![[PODCAST] Out with the FED Put & In with the OIL Put ft. Adam Rozencwajg](https://blog.gorozen.com/hubfs/Blog/2022.11%20GR%20Blog%20%23335%20-%20Podcast%20%20-%20LinkedIn.png)

![[Podcast] The Real Reason Behind the Current Energy Crisis ft. Adam Rozencwajg](https://blog.gorozen.com/hubfs/Blog/2022.09%20GR%20Blog%20%23331%20-%20Podcast%20Top%20Traders%20Unplugged%20-%20LinkedIn.png)

![[Podcast] MacroVoices: Understanding the Global Energy Crisis ft. Adam Rozencwajg](https://blog.gorozen.com/hubfs/Blog/2022.08%20GR%20Blog%20%23325%20-%20MacroVoices%20-%20LinkedIn.png)