Contrarian

01/21/2022

“Chevron Girds for Activist Challenge After Exxon’s Proxy Battle Defeat” Wall Street Journal, September 3, 2021“Exxon Debates Abandoning Some of Its Biggest Oil and Gas Projects” Wall Street Journal,...

01/14/2022

We are currently in Riyadh, Saudi Arabia attending the inaugural Future Minerals Forum. This is our first dedicated research trip since COVID-19 and it has not disappointed. While most investors...

12/10/2021

“Food Supply Chains Are Buckling as World Runs Short of Workers” Bloomberg, September 2, 2021“Ruined Brazil Harvest Sparks Food Inflation Everywhere” Bloomberg, September 28, 2021 First appeared in...

06/24/2021

Managing Partners Leigh Goehring and Adam Rozencwajg recently hosted a video conference call along with Stacy Havener, CEO and Founder of Havener Capital Partners. During the event, they discussed...

06/17/2021

Managing partner Adam Rozencwajg was recently featured on Financial Sense Wealth Management’s popular podcast to discuss the supply and demand backdrop for copper, and why we’ll likely see higher...

01/27/2021

We believe we are on the cusp of a global energy crisis. Like most crises, the fundamental causes for this crisis have been brewing for several years but have lacked a catalyst to bring them to the...

11/23/2020

Back in 2Q 2020, amid rapidly slowing drilling activity, a significant historical development occurred in the US shale patch. In previous drilling cycles, sharp slowdowns in activity produced large...

10/29/2020

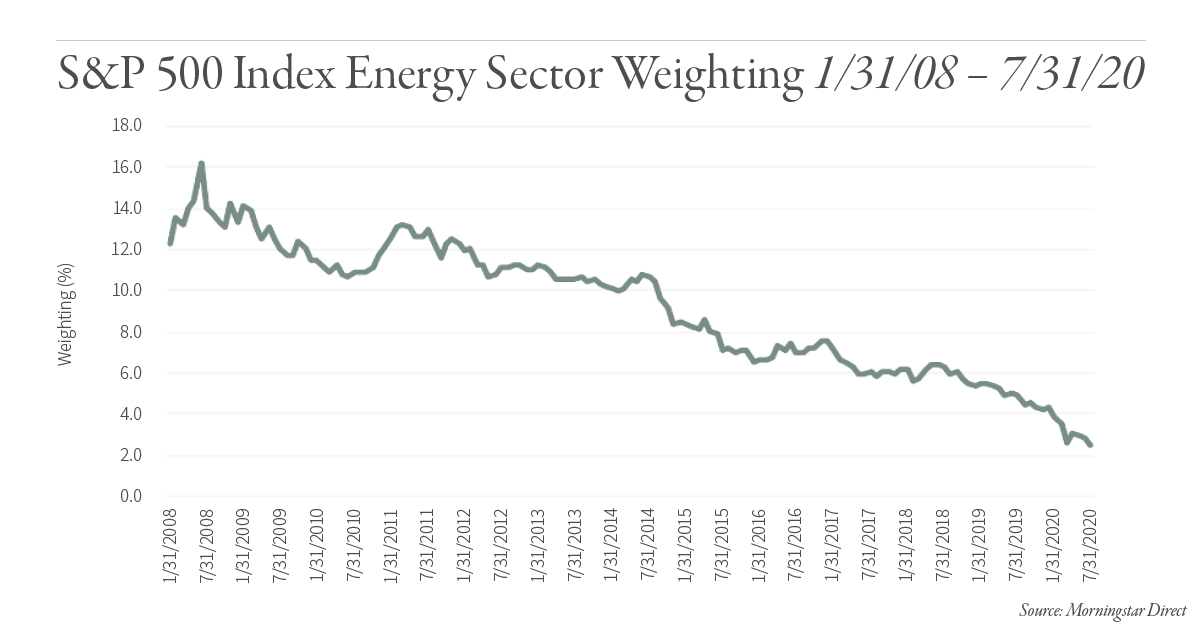

The short answer to this question is: more than index levels of 2-3%.While many institutional investors and financial advisors divide their equity exposure by market cap, style and geographic region,...

10/13/2020

In case you missed it, last week Managing Partner Leigh Goehring was fortunate to spend some time with Jesse Felder on his popular podcast Super Investors and the Art of Worldly Wisdom. Mr. Felder, a...

10/08/2020

By Leigh Goehring “Bonds are so popular that $15 bn of sovereign issues trade with negative yields – a first in 4,000 years of financial history.” In part one of our story about Schlumberger, we...

![[Podcast with Financial Sense] Copper Has Years Left to Run](https://blog.gorozen.com/hubfs/Blog/2021.06%20GR%20Blog%20238%20LinkedIn.png)

![[Podcast with Jesse Felder] The Generational Opportunity in Energy Stocks Today](https://blog.gorozen.com/hubfs/Blog%20Images/2020.10-GR220-linkedin.png)