Natural resources

06/22/2022

The article below is an excerpt from our Q1 2022 commentary. On April 20th, 2019, Bloomberg/BusinessWeek magazine published an issue entitled “Is Inflation Dead?” with a dead dinosaur prominently...

06/16/2022

The article below is an excerpt from our Q1 2022 commentary. One of the most frequent questions we get asked regarding this commodity bull market is: “Have I missed it? Is it too late to make an...

06/09/2022

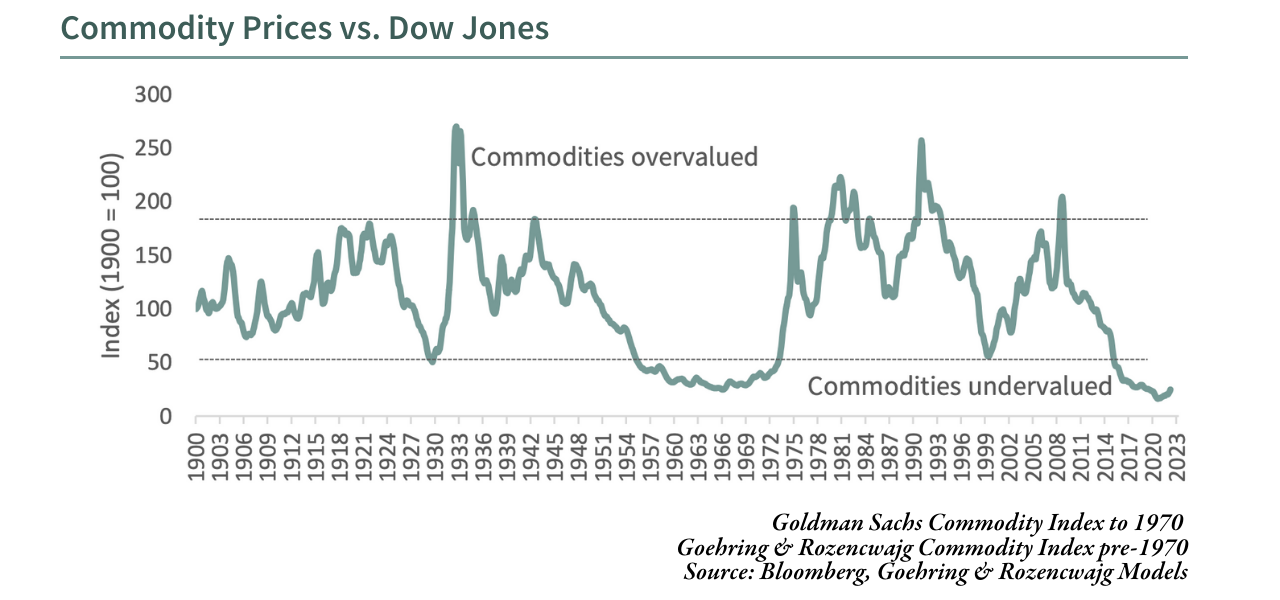

Charts of the Quarter Top Chart: Not only is the commodity bull market not over, it has hardly begun. This chart shows the returns of the Goldman Sachs commodity index versus the level of the US...

05/13/2022

Adam Rozencwajg, CFA, Managing Partner at Goehring & Rozencwajg, joined the "Top Traders Unplugged" podcast as part of their Global Macro series. In this episode, The Dark Side of Renewable Energy,...

04/21/2022

A sudden and unexpected event is about to take place: the global natural gas crisis, now gripping large swaths of the world, is about to engulf North America as well.Asian and European natural gas...

04/13/2022

Tensions between Russia and Ukraine have thrown oil and gas prices into focus, but an energy crisis has been brewing for much longer than the war has been going on.In an interview with Investing News...

04/05/2022

Massive price spikes are occurring in a number of critical commodities after Russia's invasion of Ukraine.In this Financial Sense Newshour Podcast (recorded March 8, 2022), Adam Rozencwajg shares an...

03/31/2022

The article below is an excerpt from our Q4 2021 commentary. Without US liquefied natural gas (LNG), Europe may well have frozen literally to death this winter. We believe what is happening with...

03/24/2022

The article below is an excerpt from our Q4 2021 commentary. “The world has already passed ‘peak oil’ demand, according to Carbon Brief analysis of the latest energy outlook from oil major BP.” ...

03/18/2022

Managing Partners Leigh Goehring and Adam Rozencwajg recently hosted a video webinar that was viewed live by over 1,300 people.

![[Podcast] The Dark Side of Renewable Energy ft. Adam Rozencwajg](https://blog.gorozen.com/hubfs/Blog/2022.05%20GR%20Blog%20%23315%20-%20LinkedIn.png)

![[Podcast] Financial Sense: Adam Rozencwajg on the Post-Invasion Outlook for Energy and Commodities](https://blog.gorozen.com/hubfs/Blog/Meet%20the%20Team/2022.04%20GR%20Blog%20%23312%20-%20Financial%20Sense%20Podcast%20-%20LinkedIn.png)

![[Webinar Replay] G&R's Outlook on Energy and Inflation](https://blog.gorozen.com/hubfs/Calls%20(Live)%20and%20Webinars/2022.03%20Webinar%20Live/2022.03%20Replay%20-%20Webinar%20.png)