Natural resources

03/27/2024

The article below is an excerpt from our Q4 2023 commentary. “Saudi Aramco Abruptly Drops Plans to Expand Oil Production,” ~ The New York Times, January 30, 2024 In an unexpected move, Aramco, the...

03/21/2024

The article below is an excerpt from our Q4 2023 commentary. Commodities were mixed during the fourth quarter. The Goldman Sachs Commodity Index (GSCI), heavily weighted toward energy, fell by a...

03/07/2024

Challenge Accepted: Convince Me in 15 Minutes That Uranium is in a Bull Market. Joining the engaging podcast, Convince Me in 15 Minutes, Adam Rozencwajg makes a compelling argument for the promising...

02/28/2024

The article below is an excerpt from our Q4 2023 commentary. “Electric vehicles (EVs) are pilling up on lots across the country as the green revolution hits a speed bump, data show.” ~ USA Today,...

02/27/2024

The article below is an excerpt from our Q3 2023 commentary. There are notable similarities between the uranium market twelve months ago and today’s oil market. Almost overnight, uranium went from...

02/16/2024

"Wouldn't a recession and continued economic weakness reduce energy demand and thus be bearish for oil and gas prices?" This is a common question that frequently arises during discussions on the ...

02/09/2024

The Permian shale oil basin is very close to peaking out. When it does, everything changes for the US and the world. "Everyone thought 2019 was the all-time high for Energy and Oil demand and that...

02/02/2024

The article below is an excerpt from our Q3 2023 commentary. Real interest rates and gold have always moved in opposite directions. When real interest rates rise, gold falls, and when real rates...

01/26/2024

Looking at the next 50 years, is the threat of Peak Cheap Oil fact or overblown fear? A month has passed since energy analyst Doomberg released his controversial report titled "Peak Cheap Oil Is A...

01/19/2024

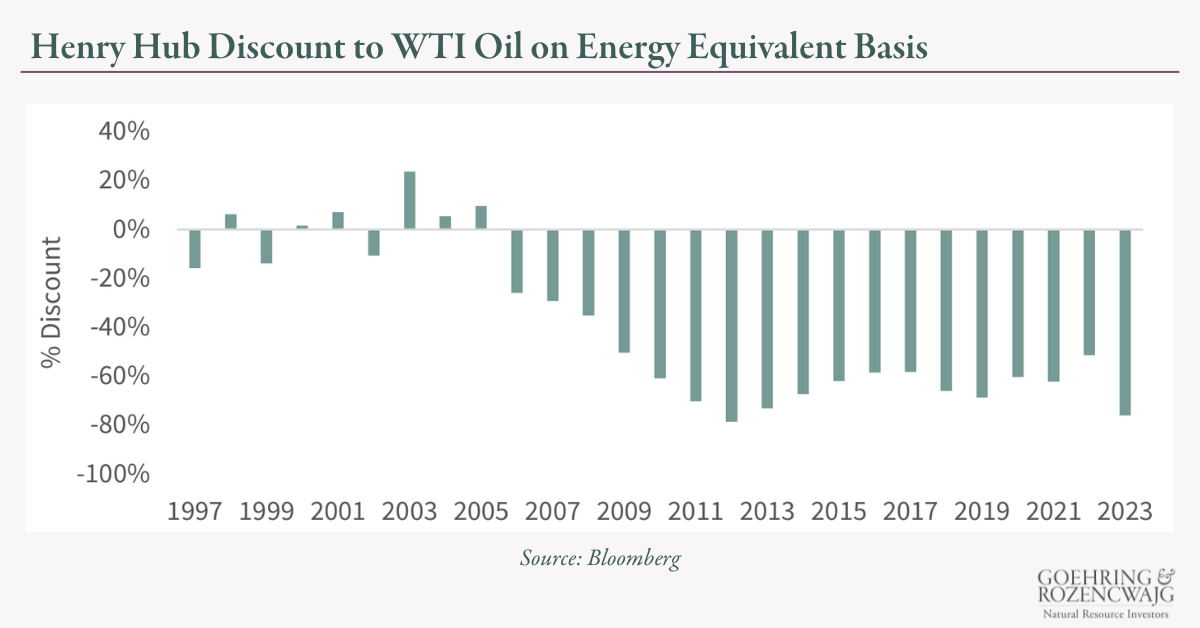

The article below is an excerpt from our Q3 2023 commentary. North American natural gas is the cheapest energy molecule on the planet by as much as 75%. Over the next twelve months, we believe this...

![[Podcast] Convince Me in 15 Minutes... That Uranium is in a Bull Market.](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.03%20GR%20Blog%20%23391-%20Convince%20Me%20in%2015%20Min%20-%20Twitter.png)

![[Podcast] Energy Demand is Massively Misunderstood, Here's Why We're Bullish](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.02%20GR%20Blog%20%23388-Commodity%20Culture%20Podcast%20-%20Twitter.png)

![[Podcast] Peak Oil is Closer Than You Think](https://blog.gorozen.com/hubfs/Blog/2024%20Blogs/2024.02%20GR%20Blog%20%23387-%20Off%20the%20Cuff%20Podcast%20-%20Twitter.png)