Oil

10/13/2020

In case you missed it, last week Managing Partner Leigh Goehring was fortunate to spend some time with Jesse Felder on his popular podcast Super Investors and the Art of Worldly Wisdom. Mr. Felder, a...

10/08/2020

By Leigh Goehring “Bonds are so popular that $15 bn of sovereign issues trade with negative yields – a first in 4,000 years of financial history.” In part one of our story about Schlumberger, we...

09/25/2020

By Leigh GoehringThe FANG stocks are today’s investment craze. For comparison’s sake, consider Schlumberger’s odyssey from 1962-1980. From its initial public offering on the NYSE in 1962 to its peak...

09/18/2020

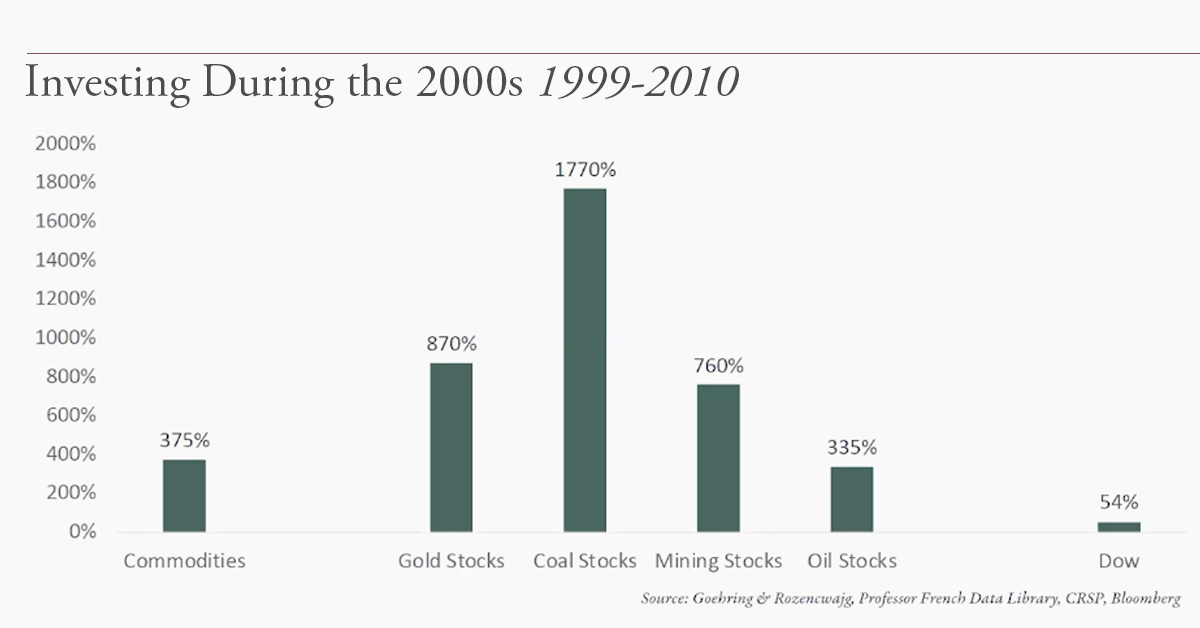

Recently, Leigh Goehring presented at the Citywire World of Boutiques virtual event. The title of his webinar was: On the Cusp of a New Commodity Cycle. In the presentation, one of the concepts he...

09/03/2020

“Over the past decade, there has been a chronic bias in the IEA estimates for non-OECD demand, and we believe this time is no different. Our models suggest that emerging market oil demand has held up...

08/12/2020

“Even adjusting the Fed’s balance sheet for excess reserves (a debate in and of itself), we believe today’s balance sheet justifies a gold price in excess of $15,000 per ounce on the low side or...

07/08/2020

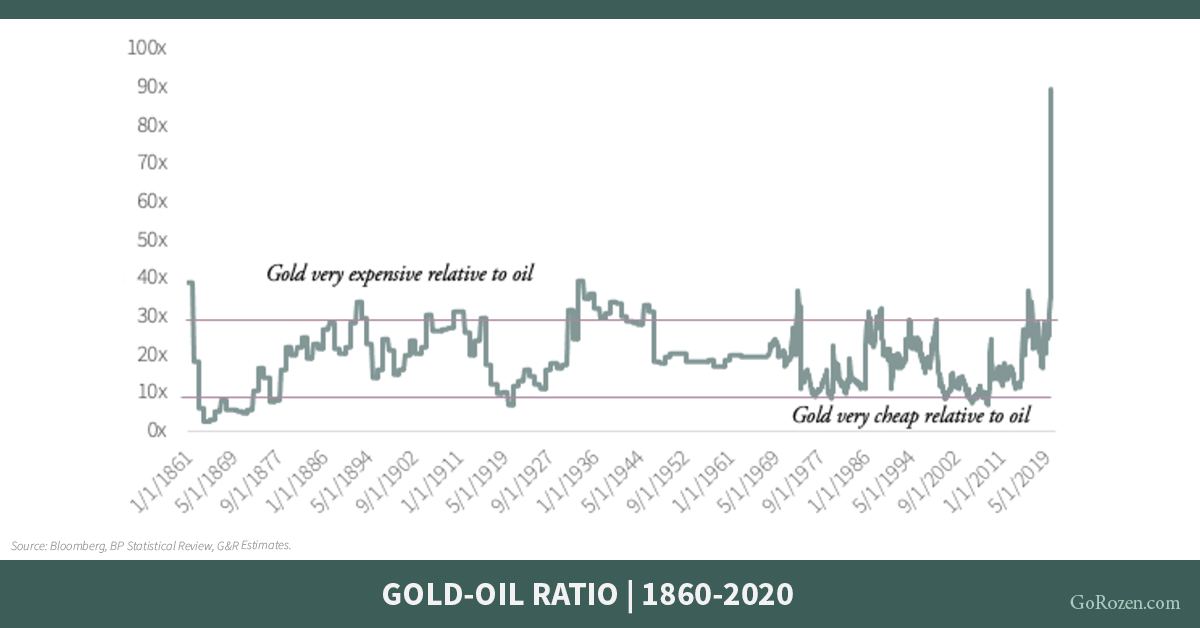

As proof we live in interesting times, just consider the gold-oil ratio over the last few months. Because of the impact of COVID-19 on the global economy, the gold-oil ratio has reached the highest...

06/24/2020

We may be near the end of the twelve-year bear market in natural gas. Although we have mostly stayed away from natural gas stocks over the last several years, we continue to follow the market...

06/17/2020

The Managing Partners here at Goehring & Rozencwajg have historically been relied on to provide perspective on an array of natural resource-related topics. For your reading interest, below is a list...

06/09/2020

During a recent client call, this question on inflation was posed to G&R Managing Partner Adam Rozencwajg, CFA: “Over the past 40 or so years, we've been in a period of declining real interest rates....

![[Podcast with Jesse Felder] The Generational Opportunity in Energy Stocks Today](https://blog.gorozen.com/hubfs/Blog%20Images/2020.10-GR220-linkedin.png)