Commodities

06/27/2019

As our readers know, we believe a huge bull market in precious metals sits directly in front of us. For proof, we look no further than the April 22, 2019 Bloomberg Businessweek cover. Nearly 40 years...

06/21/2019

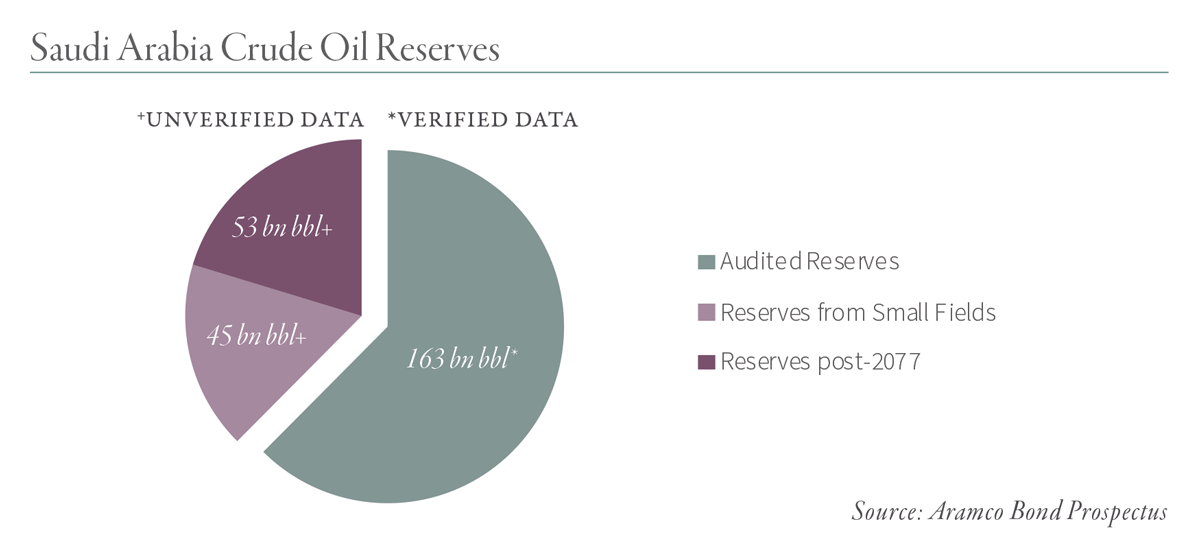

“Headlines all strongly suggested DeGolyer & MacNaughton independently verified 260 bn bbl of Saudi Arabian oil reserves, in truth they only verified 162 bn (or 60%) of that amount.” Picking up...

06/13/2019

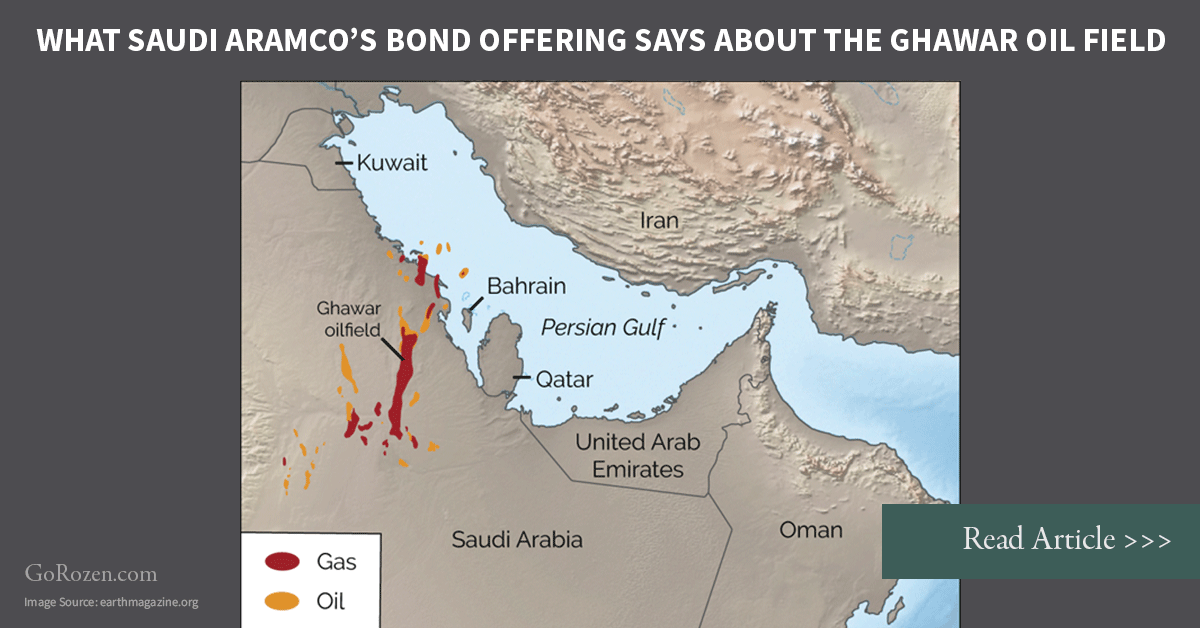

“Ghawar will not be able to increase production from here, making its 3.8 m b/d ‘maximum sustained capacity’ figure highly suspect.” Major depletion issues are now emerging in the OPEC world,...

06/11/2019

“According to the IEA, non-OPEC production outside of the U.S. and Russia peaked in June 2018 at 32.8 mm b/d and has since declined by 800,000 b/d.”

05/30/2019

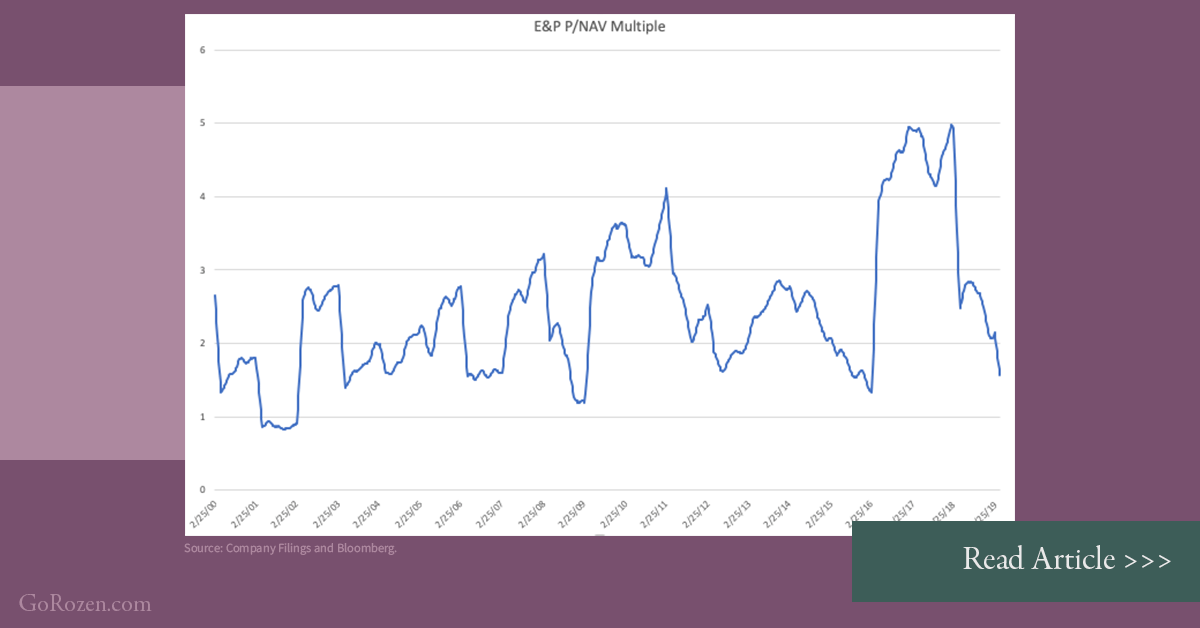

Despite 2019’s rally in oil prices, investors remain bearish towards oil-related equities. While Brent and WTI prices rallied between 25 and 30% from their Christmas Eve-lows, oil-related stocks...

05/28/2019

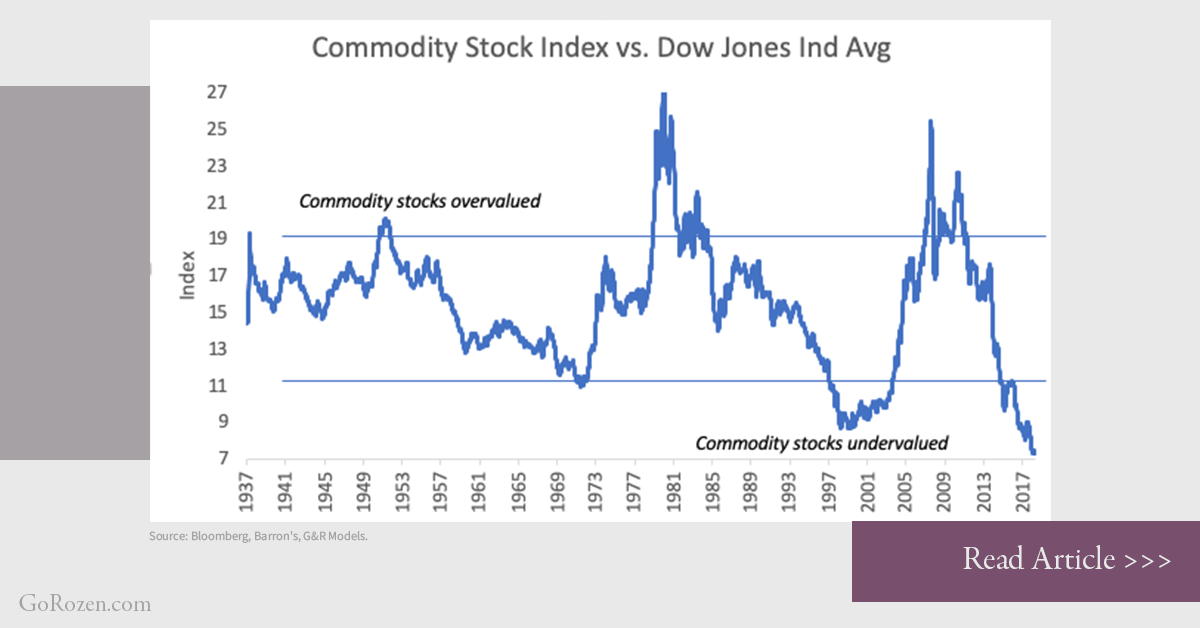

In a recent blog, we wrote about Commodities Undervalued vs Broad Market, the value of commodities and natural resource-related equities relative to financial assets has grown more and more depressed...

05/15/2019

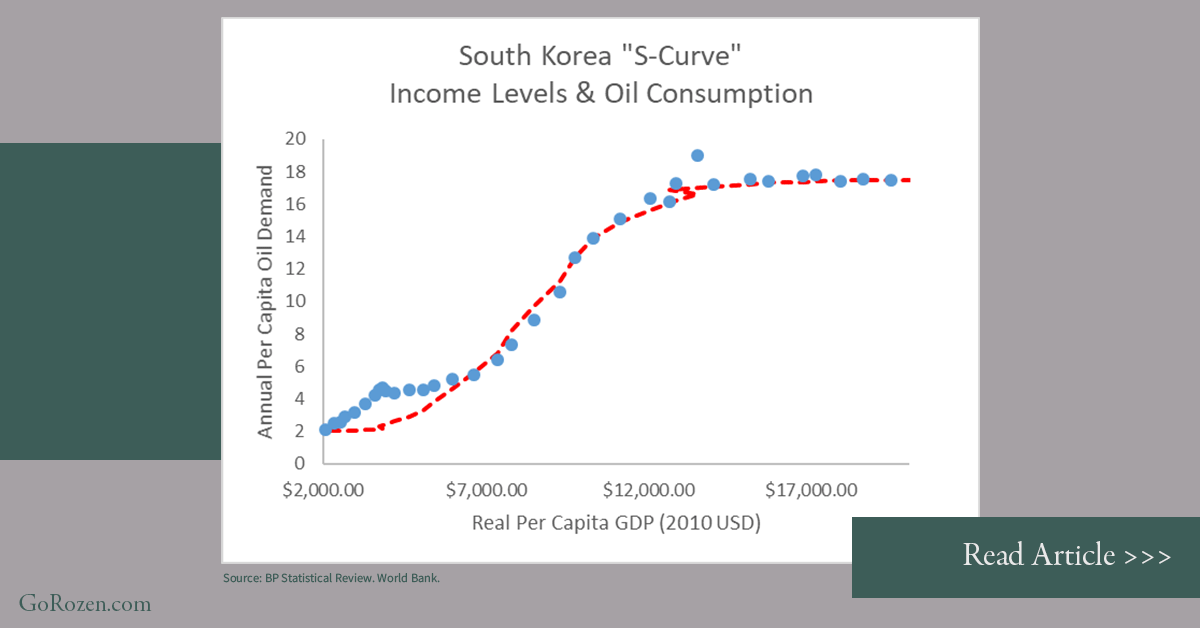

As mentioned last week in our blog, Investors Bearish but Demand Has Never Been Stronger, we believe we are entering a prolonged period of strong commodity demand, yet the value of commodities...

05/10/2019

“We have seen an extraordinary increase in global energy demand in 2018, growing at its fastest pace this decade.” Dr. Fatih Birol, Executive Director of the International Energy Agency (IEA) ...

05/02/2019

Tempted to invest in natural resource private deals? The past 18 months has seen one of the more curious divergences we have ever seen: natural resource public equity has seen large liquidations...

05/01/2019

On Tuesday, April 30th, 2019, our very own Leigh Goehring was featured on the popular Money Life podcast, hosted by Chuck Jaffe. In Leigh’s 12-minute segment, he makes the case that the commodities...