Oil

10/08/2021

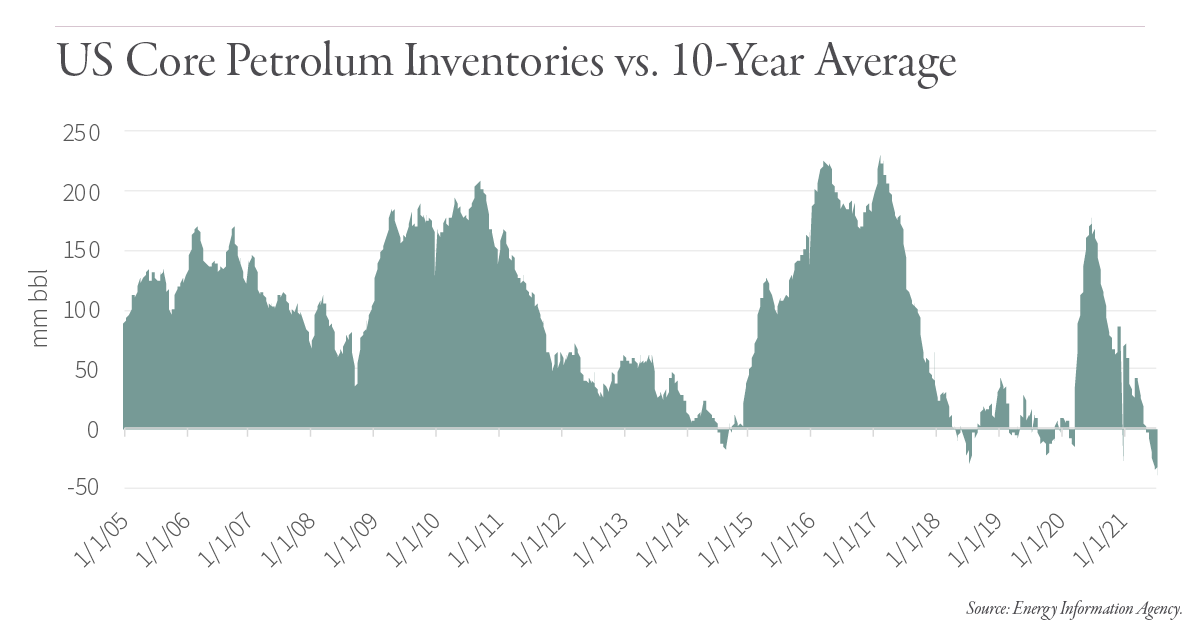

First appeared in Q2 2021 letter The foundation for the upcoming oil crisis is now firmly set in place. Despite recent hiccups related to the delta variant, the world is re-opening and global oil...

09/09/2021

Many of the most popular solutions being proposed to solve our planet’s CO2 problem will be difficult, if not impossible, to accomplish. In this video, managing partners Leigh Goehring and Adam...

08/27/2021

First appeared in 2Q letter August 5, 2021 2021 shale production has held up better than we expected. At the end of last year, we predicted shale production would experience sustained sequential...

08/18/2021

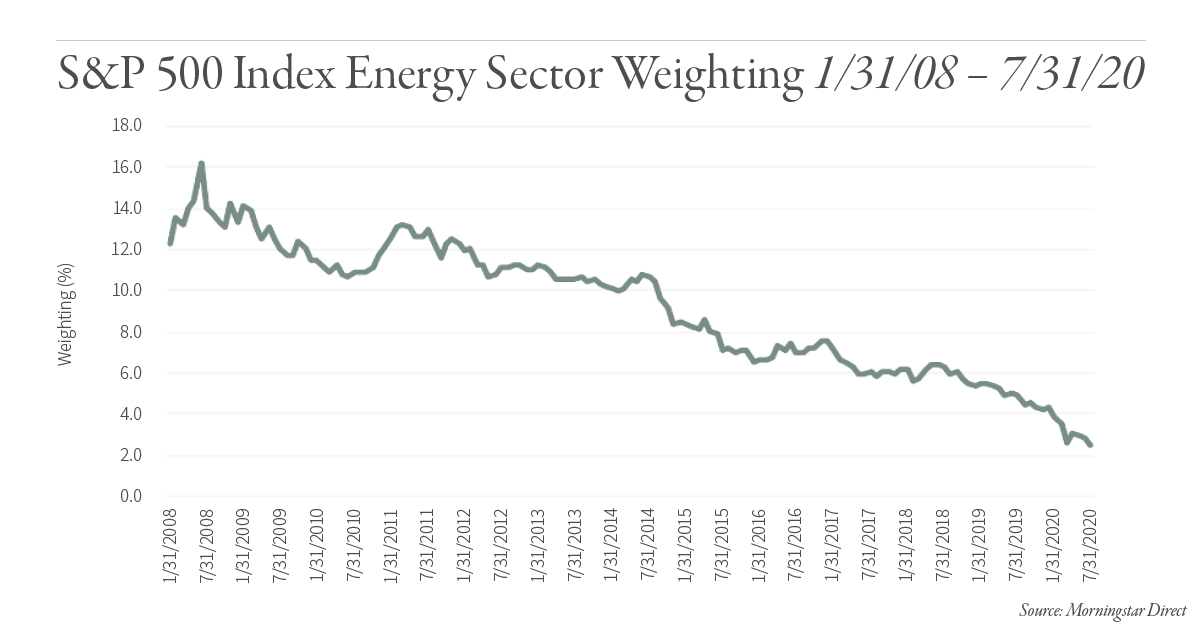

“Over the longer-term, ESG-led activist investors have all but ensured non-OPEC production will fall dramatically, leaving OPEC with increased market share and pricing power.” Over the past 18...

06/30/2021

Non-OPEC+ production outside of the US is facing challenges similar to the situation with the US shales. In their most recent report, the IEA reports that non-OPEC+ production outside of the US was...

06/24/2021

Managing Partners Leigh Goehring and Adam Rozencwajg recently hosted a video conference call along with Stacy Havener, CEO and Founder of Havener Capital Partners. During the event, they discussed...

01/27/2021

We believe we are on the cusp of a global energy crisis. Like most crises, the fundamental causes for this crisis have been brewing for several years but have lacked a catalyst to bring them to the...

01/06/2021

A return of inflation could wreak havoc on many investors’ portfolios, especially those heavy in fixed-income securities. In 2020 we wrote extensively on how the Fed’s actions and the CARES Act may...

11/23/2020

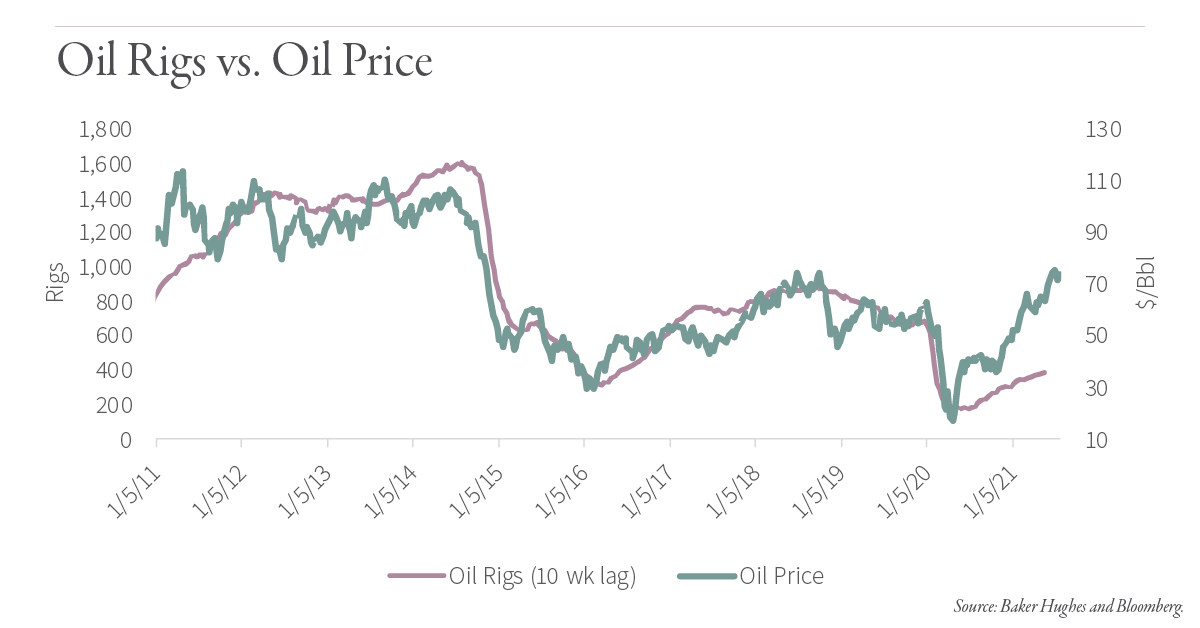

Back in 2Q 2020, amid rapidly slowing drilling activity, a significant historical development occurred in the US shale patch. In previous drilling cycles, sharp slowdowns in activity produced large...

10/29/2020

The short answer to this question is: more than index levels of 2-3%.While many institutional investors and financial advisors divide their equity exposure by market cap, style and geographic region,...