Goehring & Rozencwajg Team

03/10/2020

Goehring and Rozencwajg have just released a Special Report regarding the severe volatility in the oil markets, including analyses around the OPEC+ developments that contributed to the worst two-day...

02/19/2020

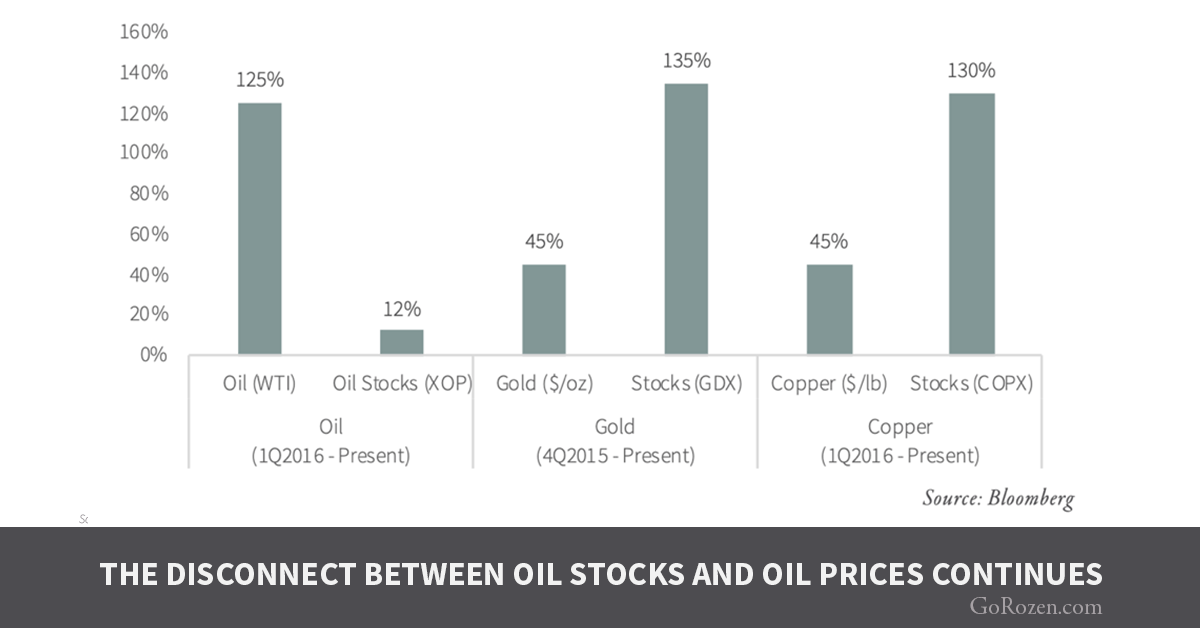

“The extreme bearishness towards energy related equities reminds us of the precious metals markets back in the late 1990s.” After extensive weakness in both Q2 and Q3, natural resources enjoyed a...

02/11/2020

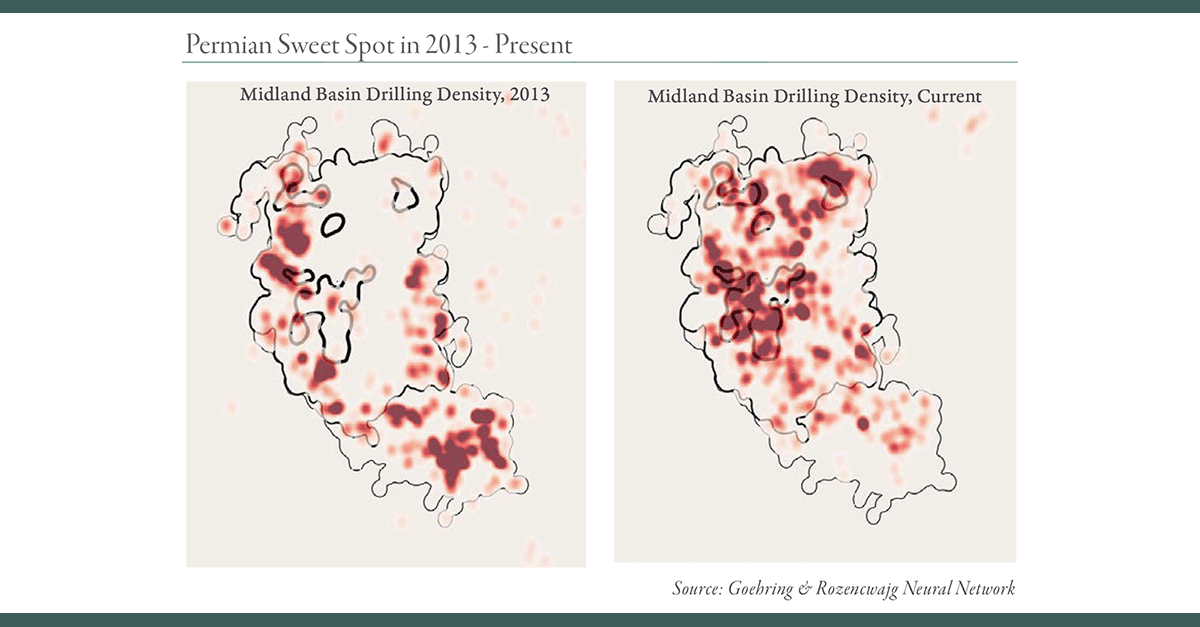

The slowing of shale oil production growth has become an accepted fact. However, we believe new forces are now at work that could produce another downward revision to US shale growth assumptions....

01/31/2020

Goehring & Rozencwajg (G&R) managing partner Adam Rozencwajg believes oil prices could rise to $80/barrel and higher this year and that natural resource equity investments are radically undervalued....

01/23/2020

“Strongly contributing to the slowdown has been the dramatic increase in the underlying base declines.” US shale oil production growth slowed dramatically in 2019. We recently turned to our...

01/17/2020

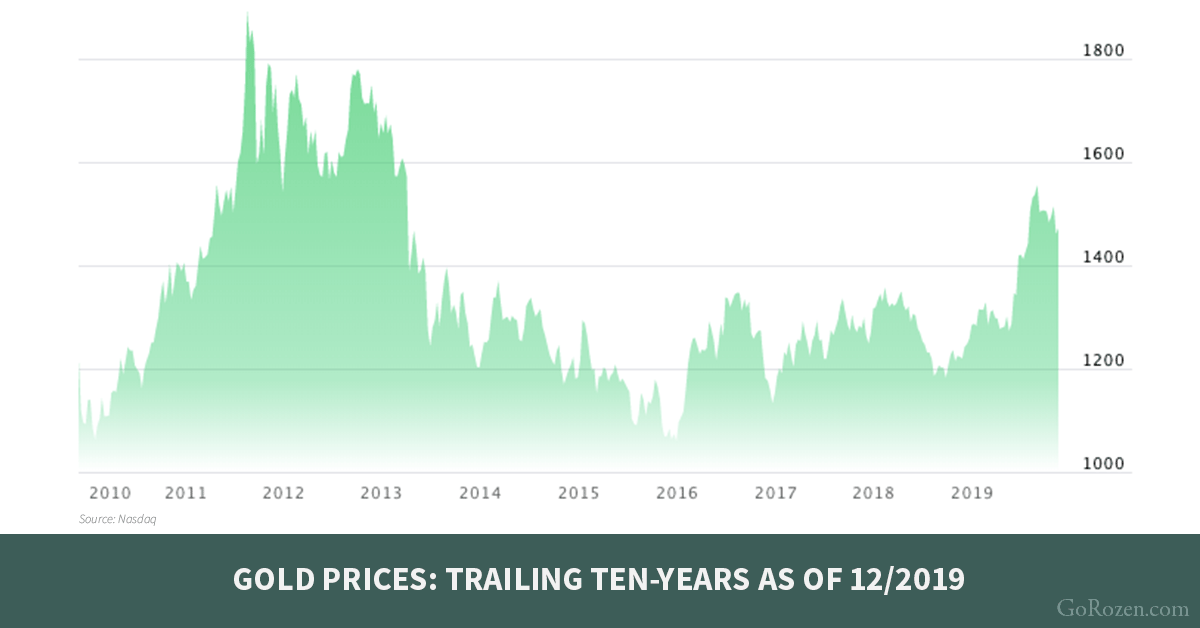

We believe that the upcoming next leg of gold’s bull market will be driven by western buyers, a subject we discussed in our 2Q 2019 Letter. Last decade’s gold bull market, which lasted 10 years and...

01/09/2020

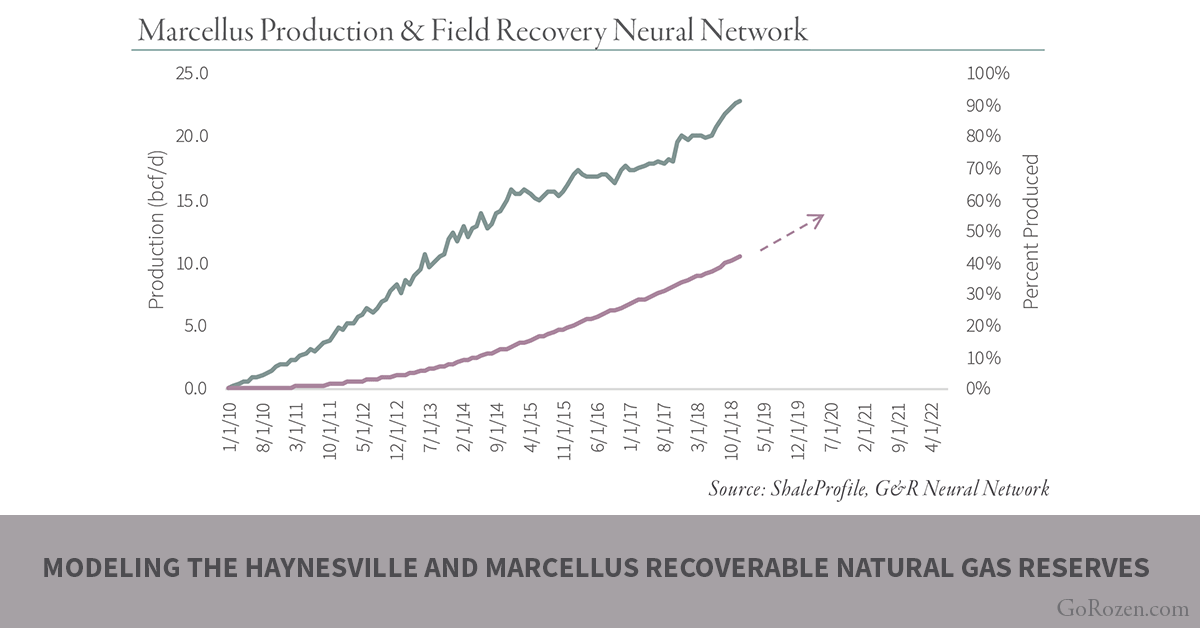

In a previous post, we talked about how over the last nine years, the largest source of U.S. natural gas supply growth has come from the Marcellus shale. The Marcellus produces 22.5 bcf/d,...

01/02/2020

Happy New Year! While we are at the end of one year and the beginning of another, we'd like to take a moment to reflect on our writings. Below we recap our 3 most popular blog posts of 2019. We...

12/16/2019

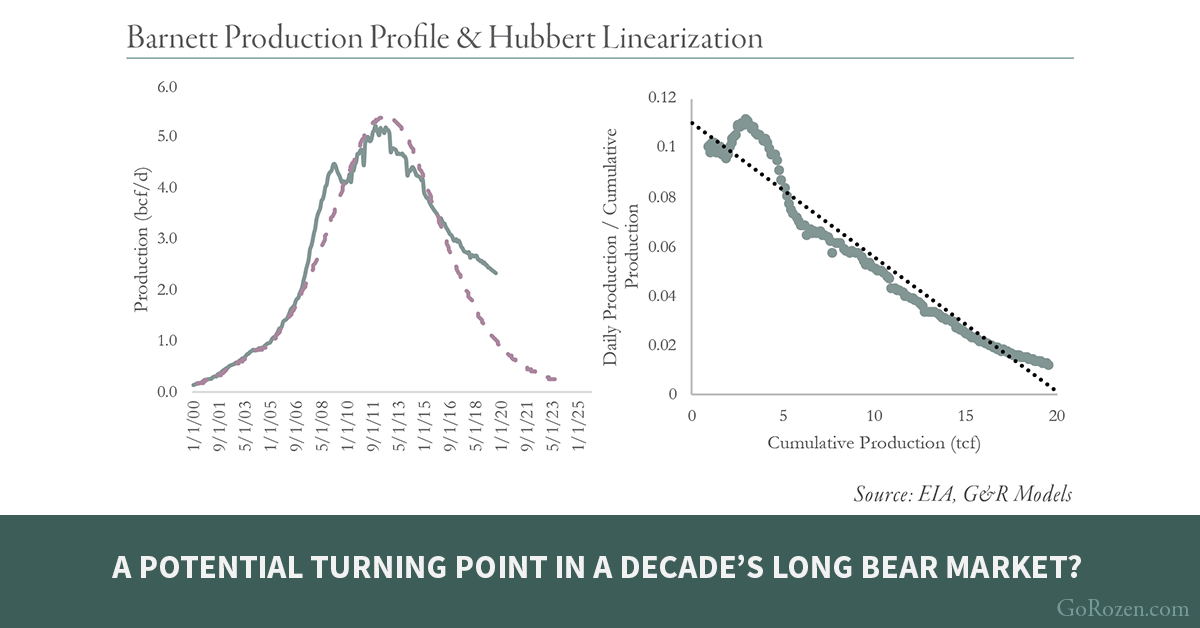

The shale gas revolution began in earnest in 2005. Even though the shales were being aggressively developed, shale gas production in 2010 still represented only 20% of US supply. Of the 21 trillion...

12/04/2019

G&R Managing Partner Adam Rozencwajg was recently featured on BNN Bloomberg’s Weekly program with Andrew McCreath. During these two segments, Adam discusses an array of energy-related topics, such as...

![[SPECIAL REPORT] Oil Market Volatility](https://blog.gorozen.com/hubfs/Blog%20Images/Special-Report-LinkedIn.png)

![[Podcast] Adam Rozencwajg Featured on Financial Sense](https://blog.gorozen.com/hubfs/Blog%20Images/G%26R%20PODCAST%20-%20Financial%20Sense.%20January%202020%20-%20LinkedIn.png)